A backdoor Roth IRA is a strategy that allows high-income earners to bypass the ordinary income limits on Roth contributions and get money into a Roth IRA account.

The strategy is called a “backdoor” Roth because it involves contributing money that has already been taxed to a Traditional IRA. A few days later, the account holder converts the money to a Roth IRA. Because the money has earned no money, it can be converted without tax consequences aside from a requirement to fill out IRS Form 8606.

For high-income earners, the backdoor Roth may sound like a tax strategy that’s too good to be true. After all, a few button clicks and one tax form allow high-income individuals to bypass the normal income limits on Roth contributions.

However, this strategy is a reasonable way for high-income earners to protect some money from future taxation. Here’s what you need to know about it.

Understanding IRA Contribution Limits

A Roth IRA is an account where people contribute money that has already been taxed to a retirement account. Once the money is inside the account, it grows tax-free and is not taxed when the account holder withdraws the funds. The Roth is an amazing (and legal) tax shelter for everyday investors.

However, the IRS places limits on who can contribute to a Roth IRA. It does not allow high-income earners to contribute directly to the account. For 2024, a married couple filing jointly is excluded from a Roth contribution limit if their Adjusted Gross Income is more than $240,000 annually (phase-outs begin at $230,000). For single people, the income limit is $161,000 with phaseouts starting at $146,000.

Traditional IRAs are also a form of individual retirement accounts. Typical account holders can receive a tax deduction when they contribute to a Traditional IRA. The tax deduction for traditional contributions phases out as income rises. However, individuals can still contribute already taxed money to the Traditional IRA regardless of their income.

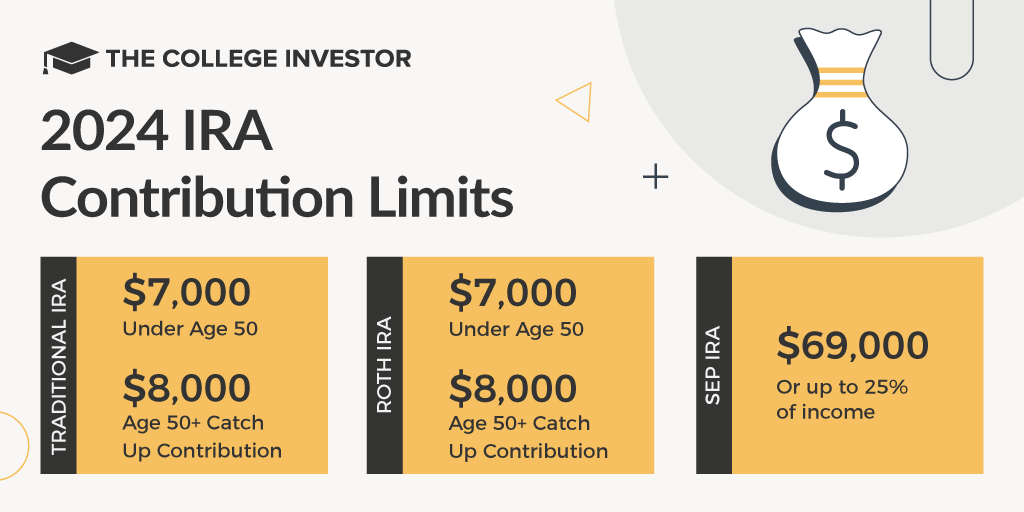

Individuals may contribute no more than $7,000 per year to a Traditional IRA or a Roth IRA (combined). The limit is bumped to $8,000 per year for people over age 50.

The Backdoor Roth IRA Strategy

Anyone earning an income above the limits sets by the IRS are excluded from contributing directly to a Roth IRA. However, they can still contribute pre-tax money to a Traditional IRA. And that opens up the option for using the backdoor Roth strategy.

Once a person puts money into a Traditional IRA account, they may convert it to a Roth account at any time. Assuming the money placed into the account is the only money in a Traditional IRA, SIMPLE IRA, or SEP IRA, the individual will pay no additional taxes on the conversion. The only additional step is to fill out Form 8606 at tax time.

One wrinkle to the backdoor strategy is that it's subject to the pro-rata rule. That means that the IRS doesn’t let you pick and choose which money you want to convert. So if you have a mixture of non-deductible IRA contributions (post-tax) and pre-tax contributions in your IRAs this is something to consider.

For example, let's say you have $60,000 in total between your various IRA accounts (SEP, SIMPLE, and Traditional). Next, we'll say that 90% of those funds ($54,000) were contributed pre-tax and 10% ($6,000) were contributed post-tax. You decide to only convert $6,000 of your funds into your Roth IRA because you assume that none of those dollars will be taxable.

But due to the pro-rata rule, that's not how things work. In this example, 90% of your conversion will be taxed at your ordinary income tax rate. Only 10% can escape of your conversion can escape taxation regardless of how much money you convert.

Because of this rule, we recommend that people who want to use the backdoor strategy moving forward should first move all funds from SIMPLE, SEP, and Traditional IRAs into 401(k) or Solo 401(k) accounts.

How To Complete A Backdoor Roth IRA

Aside from the pro-rata wrinkle, a backdoor Roth is a relatively straightforward process that involves some fancy paperwork. The first step is to roll any existing “pre-tax” IRA accounts into an individual 401(k) or your workplace 401(k).

If you are self-employed and using a SEP IRA or a SIMPLE IRA, you'll need to start a 401(k) plan and then roll your funds into that account. The backdoor Roth doesn’t work as well if you have pre-tax money in SEP, SIMPLE or Traditional IRAs. Only attempt a backdoor Roth once you have $0 in SEP, SIMPLE or Traditional IRAs.

Next, contribute $7,000 ($8,000 if you’re older than 50) to a Traditional IRA. We recommend using a brokerage that has both Traditional and Roth IRA accounts. After the money is settled in the Traditional IRA, convert it to a Roth IRA (this is as simple as making a transfer if they're located at the same firm).

Finally, at tax time, you'll need to fill out Form 8606. Tax software such as TurboTax makes this easy. But you need to be careful to enter the information correctly.

Pitfalls To Avoid When Attempting A Backdoor Roth

Although the backdoor Roth is a simple strategy, the execution can get bungled. These are a few pitfalls to avoid when using the backdoor Roth strategy.

Using The Backdoor Roth When You Don’t Have To

The backdoor Roth strategy is only a strategy for high-income earners who want to bypass the ordinary rules for Roth contributions. Only use the strategy if your annual income is above the limits set by the IRS for contributing to a Roth IRA.

Not Maxing Out Your Basic Retirement Buckets First

Most high-income earners can afford to fully fund a 401(k), a health savings account (HSA), and a backdoor Roth. However, if cash is tight, focus on the straightforward contributions before messing with the fancy paperwork.

Having Pre-Tax Funds In Your Converted IRAs

If you have previously-contributed IRA funds, you'll have to pay the ordinary income tax rate on a portion of the funds you plan to convert to a Roth IRA. To avoid that, first move the money to a 401(k) to achieve a $0 balance before initiating a backdoor IRA.

Crossing Calendar Years With Contributions And Conversions

The backdoor Roth is much easier when you contribute to a Traditional account and complete the conversion in the same calendar year. Ideally, your 2024 backdoor Roth will be started and completed in 2024. If you can't do that, you should probably hire an accountant to help you file your taxes, so you can get the tax benefit you expect.

Opening A SEP Or SIMPLE IRA After The Backdoor Roth Is Complete

Form 8606 asks about the total value of your SEP, SIMPLE, and Traditional IRAs at the end of the tax year. You want that number to be $0. If it isn’t, you may face tax consequences. To avoid unintended taxation, don’t open a Traditional, SEP, or SIMPLE IRA after you complete the backdoor Roth until the next tax year.

Forgetting Form 8606

The backdoor Roth is all about fancy paperwork. Be sure that you’ve completed Form 8606 before filing your taxes. Most of the major tax software packages support Form 8606, but you'll want to double-check before using the software.

Dealing With Too Many Transactions

The backdoor Roth should involve exactly two transactions: (1) placing money into a traditional IRA and (2) converting it to the Roth. It doesn’t make sense to slowly contribute to the account throughout the year and risk earning too much appreciation. The longer you wait, the more potential there is for the money inside the traditional IRA to grow, in which case you may face tax issues with the conversion.

Final Thoughts

The backdoor Roth IRA is only a strategy for high-income earners. But it's a useful strategy to understand if your income is rapidly rising and you may be above the income limits for Roth contributions.

If you fit that description, the backdoor Roth could make a lot of sense. While it requires a bit of paperwork, it allows you to avoid further taxation for the long term. As long as you’re careful to keep records and file Form 8606 with your taxes, the strategy should work out well.

Also, keep in mind that you have a Solo 401k, you might be able to contribute up to $46,000 to your Roth IRA per year by completing a mega backdoor Roth conversion. To learn more about who might want to consider a mega backdoor Roth and how to do it, check out this guide.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak