Robinhood has become a dominant force in the investing industry - offering commission free trades to its users, the ability to trade stocks, ETFs, options cryptocurrency, and more.

It's also gained a lot of negative press as well for people "betting it all" on hot stocks and options. And it was recently ordered by FINRA to pay a record $70 million fine for a variety of "systemic supervisory failures,"

Robinhood bills itself as the future of money (both investing and banking) - with $0 trades, a well-designed mobile app, and a bunch of fancy investment-backers that would make it the envy of any Wall Street firm.

But as a customer and investor, is it's commission-free trading platform worth it? Should you give it a try as an investor?

Here are my honest thoughts on Robinhood. If you want to skip the Robinhood review, the bottom line is that there are better free alternatives for long term investors.

We recommend Fidelity and Charles Schwab because they both offer $0 commission-free trades, $0 minimum IRAs and are full-service. They're a better solution because they offer many more tools and resources for the long term. And they both have great apps.

Quick Summary

- Free investing app that allows stocks, options, and crypto trading

- Premium features include margin and after-hours trading

- Lacks a lot of support, and doesn't have a full set of features and accounts

- Now offers an IRA with a 1% match for every dollar you contribute

Robinhood Details | |

|---|---|

Product Name | Robinhood Investing App |

Min Investment | $0 |

Stock and ETF Trades | Free |

Option Trades | Free |

Crypto Trades | Free |

Robinhood Retirement | IRA with a 1% match for every dollar contributed (employer not necessary) |

Promotions | Free stock for opening an account |

What Is Robinhood?

Robinhood is an app-based investing platform (it also has banking options) that is commission-free. It is a tech-based start-up that has been focused on changing the investment game.

And, honestly, it's been working. Robinhood made a name for itself by offering $0 commissions on stock, ETF, and options trading. When it first was launched, this was unheard of. However, today, almost every major stock broker offer $0 commissions and no fees.

So, how do they compare today? Honestly, most users will likely be better served elsewhere. But if you're interested in Robinhood, here's what you need to know.

Robinhood offers the following main options:

- Commission-free investing for stocks, ETFs, and options

- Commission-free limited cryptocurrency trading

- Fractional Share Investing

- They offer a premium subscription called Robinhood Gold that offers margin trading

- Robinhood Cash Management - which is a cash management account with a debit card

Notably, Robinhood does not support mutual fund trades. You also can't buy bonds or other fixed-income securities on Robinhood's platform.

In 2024, Robinhood was also named our top pick for online brokerages in our annual reader survey, specifically because of their app and commission-free trading. See our full list of the best stock brokers here.

They were also named a Top investing App.

Let's dive in more in this Robinhood review.

Setting Up The Robinhood App

Once I signed up for Robinhood on the website, I received an email with a link to download the Robinhood app. I followed the link and got started.

Once I downloaded the Robinhood App for my iPhone, I opened it up. After you login with your information, it asks you to create a Watchlist.

I didn't really understand what was even happening at this point. I seriously just entered my login information and it started populating a Watchlist. I wish it didn't do that (and you don't have a choice to skip it that I saw).

The next screen asks if you want Smart Notifications for the app. I opted out of this because I hate notifications on my iPhone. I'm sure others will find this feature useful though:

The next screen asks you to fund your account. Out of every app I have ever used, this has been the most intuitive part of the process. I find linking bank accounts can be a challenge, even on a desktop computer, but Robinhood made this easy.

Once your account is funded, you'll receive a confirmation email and an alert on the iPhone app. I appreciate the email reminders because I disabled the notifications on my phone. Here's what your account screen looks like:

However, before I could do anything else, Robinhood once again asked me to setup a bunch of investment objectives. I didn't really understand the purpose of these, as they don't seem to have any software or help to customize a portfolio or trade.

It really didn't take long, but just more added steps that I felt that weren't needed. It was all pretty standard stuff, but seemed like a robo-advisor:

How To Use The Robinhood App

Now that you have your account funded, you can start using the Robinhood App to look up and trade stocks.

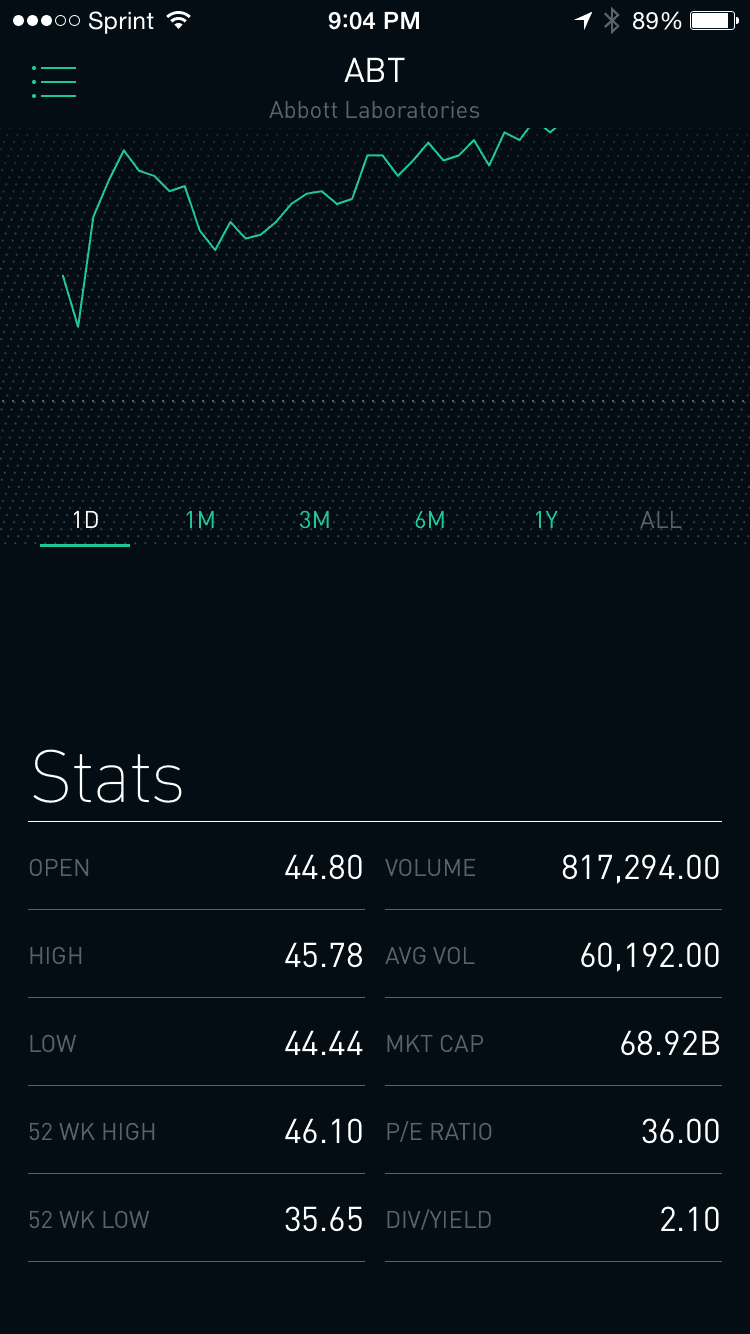

They have some very elegant ways to look up stock information. Here's what I started with, looking up Abbott Labs (ABT). Once you look up the stock symbol, it gives you a quote, basic chart, and other basic information about the stock.

This is all trading information - they don't have any fundamental information about the company:

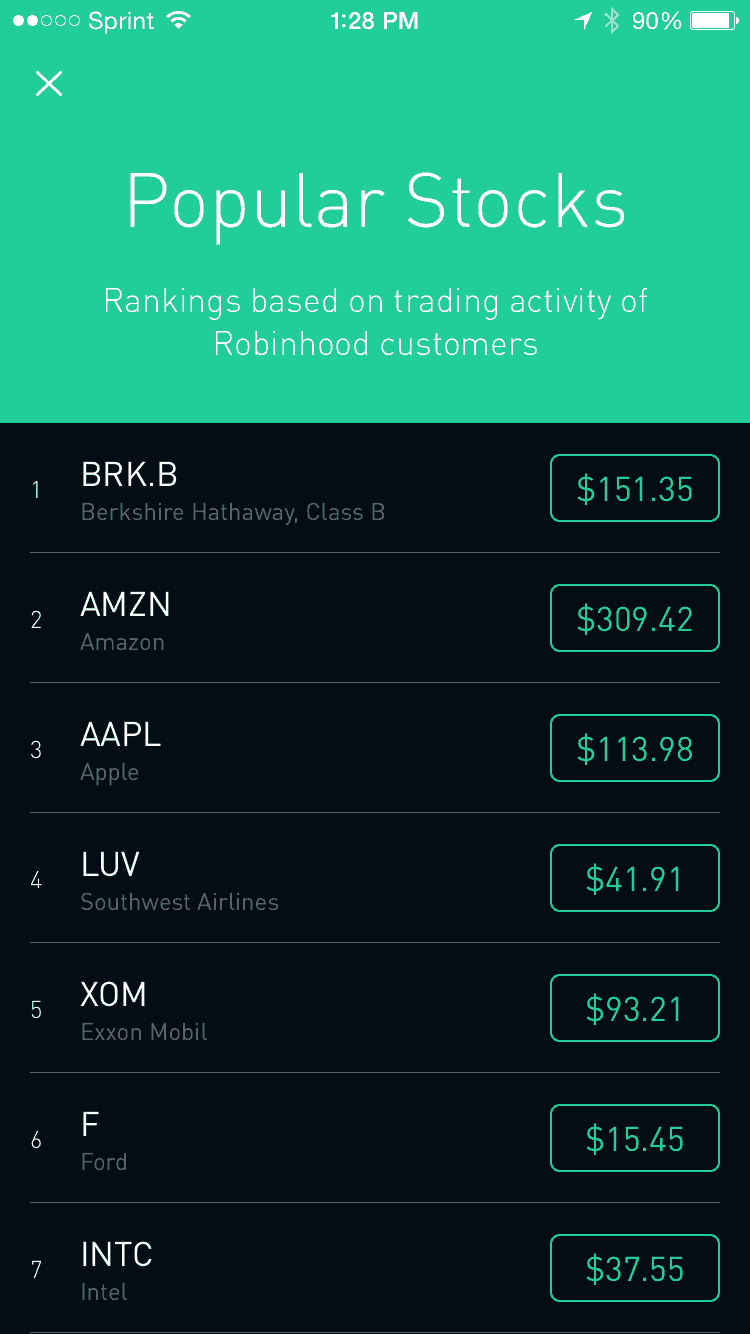

Before you can make a trade, Robinhood does have this cool feature that lets you look at "Popular Stocks" based on what others are doing on their app.

While I don't like to base my investment decision on what others are doing, a little voyeurism is always fun:

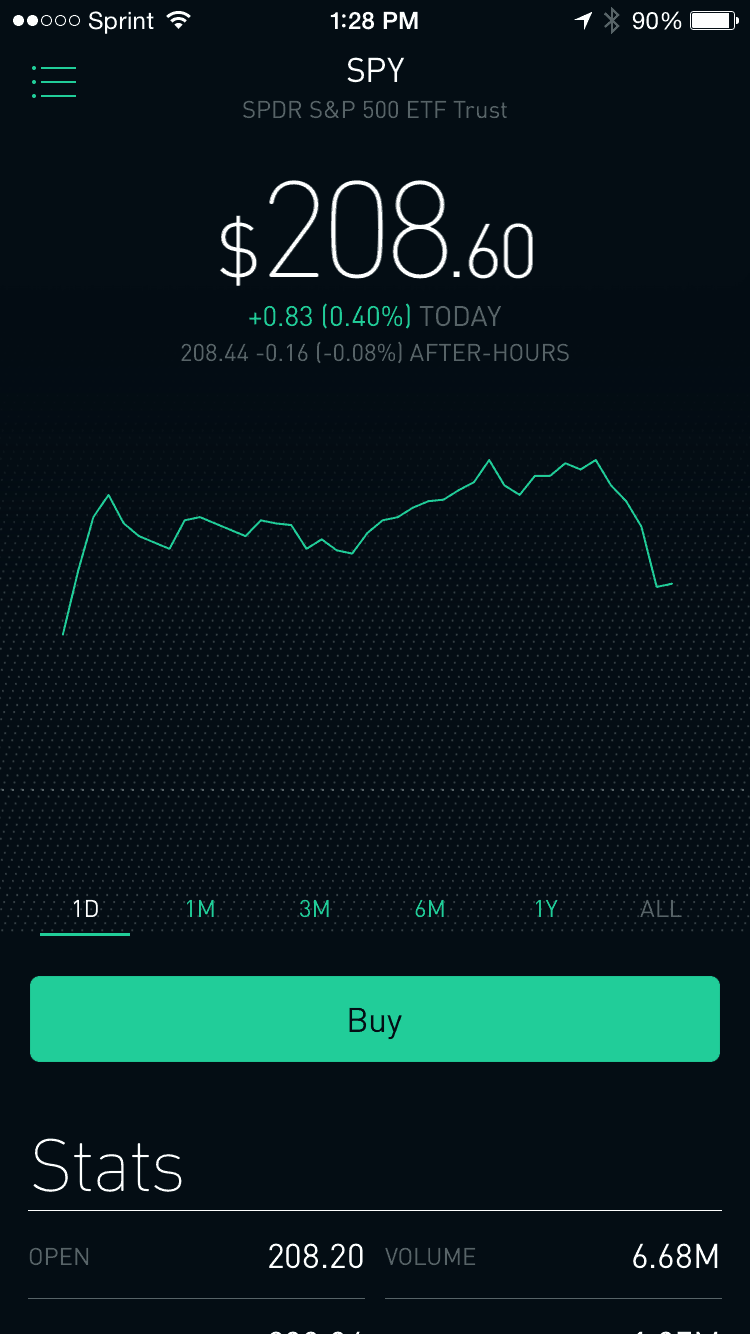

When I went to make my first trade, I thought I'd keep it simple and just invest in SPY. So, I typed in the symbol for SPY and got a quote.

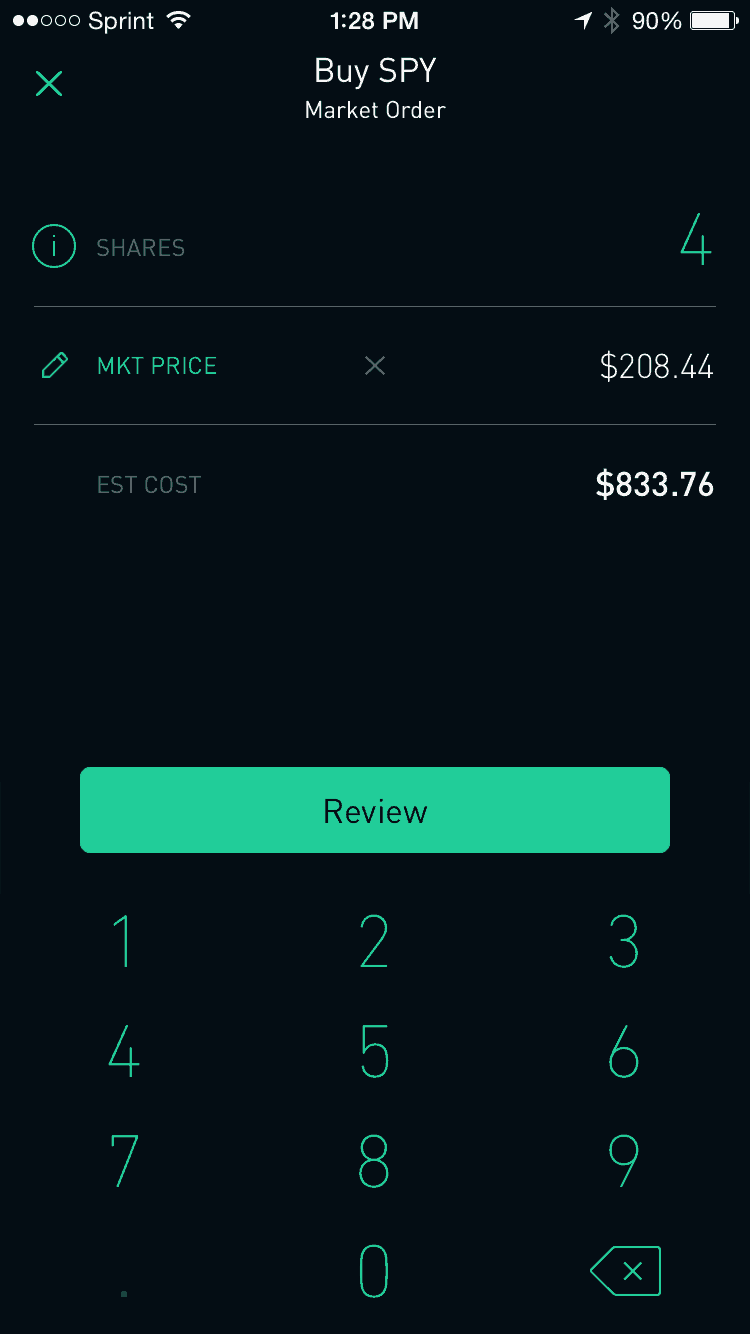

I then clicked the big Buy button on the screen and it brought me to the order screen. It's very intuitive and easy to use to place an order. You simply type in the shares you want to buy and the price. If you don't want a market order, you can tap the "Market" and switch it to a limit order.

After that, you review your order. Then, you just swipe up to submit. Personally, I hate having to swipe to access features on a phone. Just let me push a button.

Robinhood Stock Screeners

Robinhood recently introduced a stock screening tool to their platform. Stock screeners allow you to use filters to narrow your search for new investments.

Robinhood has pre-set screeners you can use, or you can create your own custom screeners. There are over 20 filters in total, including 52-week high/low, price change, volume, implied volatility, market cap, sector, analyst ratings, and dividend yield. There's no limit to the number of filters you can use in your research.

They offer advanced charts an allow you to track indicators such as moving average, moving average convergence divergence, and relative strength index.

Robinhood Crypto

Robinhood is one of the few companies to offer commission-free crypto trading. However, it currently only supports seven coins:

That's one of the smallest lists of supported currencies that you'll find which is the primary reason that Robinhood has yet to make it on to our list of best crypto exchanges. It's also important to understand that even though Robinhood doesn't charge a direct fee for crypto trades, you're still being charged indirectly through the spread.

Robinhood Gold

Robinhood Gold is their premium product. You can get access to gold starting at $5 per month, first 30 days free.

Robinhood Gold gives you:

- Margin Trading: They call this feature "Gold Buying Power", but honestly it's just 2x margin on your account. However, unlike other margin accounts, you don't pay interest. Your margin power is based on the flat monthly fee you'll pay

- Pre & After Hours Trading: You can get access to pre market and after hours trading

- Bigger Instant Deposits: You can get instant access to your money, including when you sell a security, you don't have to wait the few days for the settlement(they call this "Instant Reinvestment")

- Level II Market Data and Pro Research: In addition to Level II data, you'll get access to professional research from Morningstar.

- Earn more interest on your cash: Robinhood Gold members earn a higher interest rate on their Robinhood Cash account and it's FDIC insured up to $2.25 million.

Right now, you can also get on a waiting list for the Robinhood Gold Card. This is a credit card that earns 5% cash back on travel booked through the Robinhood travel portal and 3% cash back on everything else. That's a lot of cash back and there is no annual fee.

Margin Rates

Robinhood has some of the lowest margin rates among leading brokerages. The rates will vary based on a customer's margin balance.

Right now, you can see the following rates:

Balance | Up To $50k | $50k to $100k | $100k to $1M | $1M to $10M | $10M to $50M | $50M+ |

|---|---|---|---|---|---|---|

Margin Rate | 6.75% | 6.55% | 6.25% | 6.00% | 5.95% | 5.70 |

Robinhood Cash

After stumbling to launch their cash account, Robinhood now offers a cash management account with a solid APY that's competitive to the top high yield savings accounts out there.

The account currently pays you 1.50% APY. Like all variable rates, this could go up or down over time. However, if you're Robinhood Gold, you can earn 5.00% APY on your deposits.

The account has no minimum requirements, no monthly fee, no overdraft fee, and comes with a Mastercard debit card to easily access your money at their huge network (75,000+) of fee-free ATMs.

The only drawbacks with this account are that they don't reimburse other ATM fees. And you do have to use their app. However, if you're good with those conditions, enjoy a great cash management product.

Side Note: While 5.00% APY seems good, because of the $5/mo subscription fee, you would need to have $1,200 in your account to break even...

How They Make Money

I'm always leery when I see a company offering something for nothing. This company isn't a non-profit. It's venture backed and will be looking to go public and make people rich. But, in order to do so, they need to make money, so how do they do it? They break it down here.

They have two models. First, they sell your stock trade information to third-party companies (this is called payment for order flow). This is a big revenue generator for them, but it does have the potential to cost individual investors money on trades. You can read more about it in this article.

Second, they have their Robinhood Gold account, which you do pay a subscription for to have access to things like margin trading.

For the long term investor, these don't really matter. Paying $0.01 more (potentially) per share shouldn't impact a long-term buy and hold investor. However, if you're a trader (which Robinhood's platform is geared towards), this could be costly.

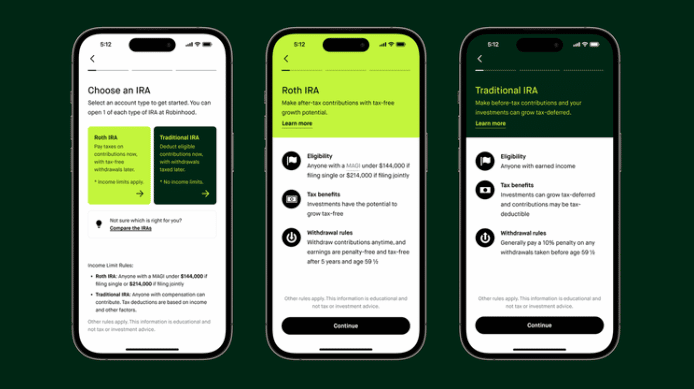

Robinhood IRA: Earn a 1% Match

Robinhood opened the company's first retirement product, Robinhood Retirement. It's the first and only IRA with a 1% match for every contribution dollar. It allows access to stocks and ETFs with zero commissions or account minimums (other fees may apply).

The best part? No employer necessary. According to Pew Research, 40% of America's total workforce is made up of gig workers, who don't have access to employer matched funds.

Robinhood is providing a path to retirement savings for people who don’t have access to traditional retirement accounts or corporate matching programs.

Here's how Robinhood Retirement works:

- Diversify your portfolio: You can choose to invest in stocks and ETFs through either a traditional IRA or Roth IRA.

- Invest the way you want: Build a custom portfolio through Robinhood's tailored in-app recommendations, by choosing your own investments, or a mix of both.

- IRA Instant Deposit: Once you contribute, you have instant access instantly to your funds to start investing, up to $1,000.

Note, there is a "catch" to the 1% match. You must make IRA contributions from a linked external bank account only. Contributions from your Robinhood brokerage or spending accounts don’t earn the IRA Match.

You must also keep the funds that earned the match in the account for at least 5 years to avoid a clawback fee of the match.

Robinhood Bonus And Promotional Offers

Robinhood currently has three different promotional offers going on:

Free Share When You Sign Up

Robinhood is known for their sign-up bonus: you can get a free share of stock when you sign up. The value of the share could technically be anywhere between $5 and $200, but Robinhood says that there's a 98% chance that it will be between $2.50 and $10.

How Does Robinhood Compare?

Remember, when Robinhood launched, they changed the game of investing by offer $0 commissions on trades. That was revolutionary at the time.

However, today, they aren't doing anything better than anyone else - and in may ways, they are starting to lag behind the competition.

Every major investment firm offer $0 commissions, and many offer a lot more features and account types. Check out our list of the best free investing apps here.

Here's a breakdown of some of the competitors to Robinhood:

Robinhood vs. Fidelity

Fidelity is the one of the largest traditional investment firms in the United States. They offer the ability to invest in almost everything (except cryptocurrency). They also allow investors to have every type of account imaginable.

Read our full Fidelity review here for more.

Header | Robinhood | Fidelity |

|---|---|---|

Trading Commission | $0 | $0 |

Minimum Investment | $0 | $100 |

Monthly Fee | $0 | $0 |

Account Types | Taxable | Taxable, IRA, 401k, Trust, and More |

Tradeable Assets | Stocks, ETFs, Options, Crypto | Everything but Crypto |

Robinhood vs. Vanguard

Vanguard is the leader in mutual funds and low-cost investing. They changed the game in lowing mutual fund expense ratios and management fees - saving investors billions. As a result, they have a cult-like following of low cost index fund investors.

Read our full Vanguard review here for more.

Header | Robinhood | Vanguard |

|---|---|---|

Trading Commission | $0 | $0 |

Minimum Investment | $0 | $0 |

Monthly Fee | $0 | $0 |

Account Types | Taxable | Taxable, IRA, 401k, Trust, and More |

Tradeable Assets | Stocks, ETFs, Options, Crypto | Everything but Crypto |

Robinhood vs. M1 Finance

M1 Finance is another tech-based investment firm that is another revolutionary force for long-term investors. M1 Finance is commission-free investing - but has a unique feature that allows investors to build their portfolio allocation, automatically rebalance it, and contribute new money directly into the right places.

Read our full M1 Finance review for more.

Header | Robinhood | M1 Finance |

|---|---|---|

Trading Commission | $0 | $0 |

Minimum Investment | $0 | $0 |

Monthly Fee | $0 | $0 |

Account Types | Taxable | Taxable, IRA |

Tradeable Assets | Stocks, ETFs, Options, Crypto | Stocks, ETFs, Options, |

Robinhood vs. Webull

Webull is a direct competitor to Robinhood in the app-based investing game. Webull is almost like the more "adult" version of Robinhood, offering a lot more of the robust features in terms of trading and analytics that are missing from Robinhood.

Read our full Webull review here.

Header | Robinhood | Webull |

|---|---|---|

Trading Commission | $0 | $0 |

Minimum Investment | $0 | $0 |

Monthly Fee | $0 | $0 |

Account Types | Taxable | Taxable |

Tradeable Assets | Stocks, ETFs, Options, Crypto | Stocks, ETFs, Options |

Robinhood vs. Public

Public is another direct competitor Robinhood with their own investment app. We view Public as the happier, friendlier app-based investing tool. Public seeks to combine the best aspects of free trading, fractional share investing, and more - with a unique community feel.

Read our full Public review here.

Header | Robinhood | Public |

|---|---|---|

Trading Commission | $0 | $0 |

Minimum Investment | $0 | $0 |

Monthly Fee | $0 | $0 |

Account Types | Taxable | Taxable |

Tradeable Assets | Stocks, ETFs, Options, Crypto | Stocks, ETFs |

How Do I Contact Robinhood?

This is another area where Robinhood falls short. Under mounting pressure, Robinhood has finally unveiled 24/7 phone and chat support - but you still need to access it via the app. You can learn more about phone support here.

It's "Support" page is simply a collection of FAQs. And its "Contact" page only contains one sentence: "Sign in so we can provide better and more personalized support."

Is It Safe And Secure?

Robinhood does take strong security measures such as using Transport Layer Security (TLS) protocol to protect data and offering safer login options including TouchID, FaceID, custom PIN code, and two-factor authentication.

Still, some of Robinhood's data servers were hacked in October 2020. Nearly 2,000 accounts were compromised during the breach and Robinhood has already been sued by at least one affected customer.

When it comes to financial protection, all brokerage accounts receive up to $500,000 of SIPC protection. And cash accounts get up to $1.25 million of FDIC protection through Robinhood's partner banks.

Robinhood Pros And Cons

Pros:

- Commission-Free Trades

- Fractional Shares and Dividend Reinvestment

- Pretty App for iPhone & Android

- Security: the app uses Apple Touch to login, which makes it feel secure

- Stock screener tool with over 20 filters

Cons:

- Fewer investment choices than other platform

- Not easy for managing your holdings (couldn't see holding 5-10 positions with the app)

- Charts and data are too basic, especially if you aren't a Gold member

- Limited customer service

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have been following Robinhood since it's private beta, when I had a personal conversation with Robinhood co-founder Baiju Bhatt who walked me through their entire idea around the platform.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Final Thoughts

If you're looking to get started investing in stocks and ETFs inside a taxable account with a small amount of cash, then Robinhood should be a broker you check out. Just know that you won't be able to invest in mutual funds or open an IRA. And don't expect fast and attentive customer service.

If you need something a little more robust, I'd honestly recommend opening an IRA or brokerage account at a mainstream brokerage like Schwab or Fidelity. With every platform being commission-free now, why not get full service for the same price? Check out our list of the best brokerages and learn more.

But don't just take my word for it with this review. You can try Robinhood for free right here: Signup for Robinhood

Robinhood FAQs

These are a few of the most common questions we receive about Robinhood:

Is there a catch with Robinhood?

While it might not be technically considered a "catch," one of the primary ways that Robinhood makes money is through "payment for order flow" which many contend is a conflict of interest.

How do I get my money out of Robinhood?

Clients can withdraw up to $50,000 of cash from their accounts per day. However, it's important to note that Robinhood doesn't currently allow withdrawals of cryptocurrency that has been purchased on its platform.

Does Robinhood support Dogecoin?

Yes, Robinhood clients can buy or sell Dogecoin commission-free and at any day or time.

Does Robinhood charge a per-contract fee on options trades?

No, Robinhood is one of the few brokers that has eliminated the per-contract fee on options in addition to charging no commissions.

Does Robinhood have any bonus offers or incentives?

Yes, you'll receive one share of free stock when you open a new account with Robinhood. The value of the share could technically be anywhere between $5 and $200, but Robinhood says that there's a 98% chance that it will be between $2.50 and $10.

Robinhood Features

Account Types | Taxable |

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | N/A |

Options Costs |

|

Account Fee |

|

Margin Rates | 7.75% to 11.75% |

Wealth Management | No |

Robinhood Retirement | Earn 1% match for every dollar you contribute Get on the waiting list. |

Banking Services | Yes |

APY On Cash Deposits | Up to 5.00% APY (subscription fee applies) |

Customer Service Number | Via the App |

Customer Service Email | None listed |

Web Platform | Yes |

Mobile App Availability | iOS and Android |

Promotions | Free stock for opening an account |

Robinhood Review

-

Commissions & Fees

-

Ease Of Use

-

Customer Service

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Robinhood is a commission-free brokerage that is app-based, where you can trade stocks, options, and even cryptocurrency. They recently announced an IRA, which matches 1% match for every dollar and access to stocks, ETFs, and zero commissions or account minimums.

Pros

- Commission-free investing in stocks, ETFs, options

- Limited cryptocurrency trading

- Access to margin accounts

- IRA with 1% match for every dollar you contribute

Cons

- Lack of investment options, including mutual funds and bonds

- Reliability – the app has been known to fail and have excessive downtime

- Lack of account types

- Limited customer service options

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett