Betterment is a robo-advisor, human advisor, and banking service all mixed into one solid offering for investors.

If you're looking for an easy way to save and invest, Betterment may be a top choice for you. This is especially true if you're looking for ways to save for retirement, earn some extra income on your cash, or just want some human advice.

We break down what Betterment is, and what it has to offer, below.

For those of you who have yet to open a retirement account let me tell you why we think it's a top choice for a robo-advisor to help you manage your investments. Check it out in our Betterment review.

Betterment Details | |

|---|---|

Product Name | Betterment |

Min Invesment | $10 |

Annual Fee | $4 per month or 0.25% to 0.65% |

Account Type | Taxable, IRA, SEP, Checking, Savings, And More |

Promotions | None |

What Is Betterment?

Betterment was one of the first robo-advisor services. A robo-advisor is a hybrid of both a traditional brokerage account and a traditional financial advisor. It uses tools and automation to automatically setup and rebalance your portfolio.

Betterment was founded in 2008 by Jon Stein and and Eli Broverman. As of 2023, it had over 800,000 users and $40 Billion in assets.

We have named Betterment one of the best robo-advisors in our annual survey.

In 2024, it acquired Marcus Invest by Goldman Sachs.

How Does Betterment Work?

When you create an account Betterment will ask you some basic questions about yourself in order to determine your risk tolerance.

They use these questions as well as your age to determine this.

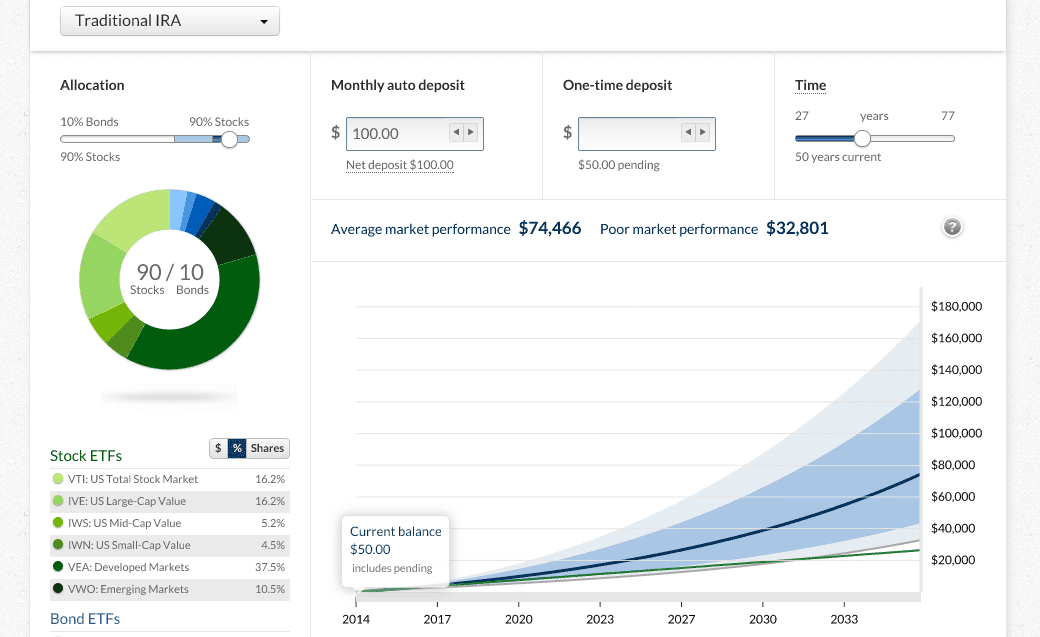

After answering my set of questions they determined my risk allocation to be 90 percent stocks and 10 percent bonds. Yep, sounds about right to me!

After determining your risk allocation you can then set up your chosen an account (which takes about a minute) and create a goal.

The accounts you can set up are:

- Roth IRA

- Traditional IRA

- SEP IRA

- Trusts

- House Down Payment Savings

- Education Savings (not to be confused for a 529 college savings account, Betterment's Education Savings is not tax advantaged.)

- General Savings (Feel free to name this what you want.)

- Crypto Investing

After setting up your account and linking up your bank info you simply choose a goal and Betterment will give you advice.

How Is Your Money Invested?

The next thing you’re probably wondering is how will your money be invested?

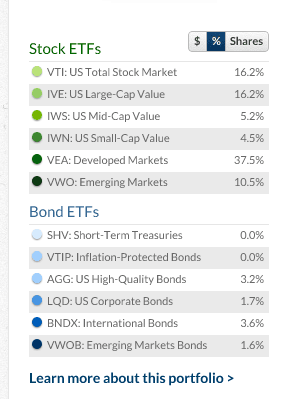

Well it works like this: Based on your allocation, Betterment will automatically invest your money in a diverse group of Index Funds. (Read: What are index funds?)

Here is an example:

You do no work at all here. You simply deposit your money and Betterment invests it for you. And you can adjust your allocation ratio at any time.

If you feel the allocation they give you is either too risky or too boring simply adjust it to what you prefer!

What Are The Minimums, Deposits, and Fees?

My favorite part about Betterment?

There is only a $10 minimum to open an account (but no ongoing minimums) and no required automatic deposits. This is perfect news for beginner investors with little money to put down!

With that being said, they have two different plans:

Digital Plan - $4/mo or 0.25% AUM

A “digital” plan costs a straightforward $4 per month for balances under $20,000, and then a 0.25% fee of the account balance for higher balances. However, customers with $250 or more in monthly recurring deposits pay a 0.25% annual fee regardless of account balance. That's a nice savings in exchange for automatically investing.

That means if you deposit $10,000 into a Betterment account, the annual fee will be $48. But if you deposit a $20,000 balance, you'll only pay $50 per year.

It's also important to note that the $4 per month fees are accrued daily and calculated based on your average daily account balance. If your average daily balance drops below $20,000, you will accrue the daily portion of the $4/month fee for that day.

What you get in exchange for that fee (straight from their website):

- Personalized financial advice

- Low-cost, globally diversified investment portfolios

- Automatic rebalanced

- Advanced tax-saving strategies

- Your entire financial picture in one place (you can sync external accounts)

- Reliable customer service

Premium Plan - 0.65% AUM

Betterment also offers a “premium” plan, which costs 0.65% annually and requires a $100k minimum balance. Included in this price is what you would expect, much more hands-on and personal advice regarding your financial situation. For example, the premium service includes:

- All the benefits listed as part of digital plan

- A Cash Reserve preferred rate - an additional 0.25% APY on top of the existing rate

- 20% off estate planning with Trust & Will

- In-depth advice on investments outside of Betterment (such as 401(k)s, real estate, etc.)

- Unlimited access to Betterment’s team of CFPsᵀᴹ. These are real humans that can advise you on planning for a child, buying a home, retiring, etc.

Crypto Plan - 1.00% AUM

Crypto investing will cost 1.00% regardless of your plan.

Betterment Financial Advice

What if you have the digital plan but still want to actually talk to someone and get some real help or advice? Betterment has that too.

Customers at any balance can purchase individual financial advice packages to receive in-depth guidance around various life events. These packages include a personalized action plan and educational content related to the life event or financial goal they are seeking guidance on. All calls will be handled by a CFPᵀᴹ or licensed financial expert.

The currently have 5 different packages, ranging in price from $299 to $399. Unlike their management fee for your portfolio, this is a one-time fee. The packages are:

These are great deals because you likely won't be able to speak to a financial planner for less. It can be especially good if you just want to talk about one specific goal or plan.

Betterment Checking

Betterment has launched the Betterment Checking account, which is a free checking account that works seamlessly with Betterment's other products - Cash Reserve and their robo-advisor.

This account has a lot of great features:

- Get ATM fees reimbursed directly to your account worldwide, where Visa is accepted.

- Visa foreign transaction fees reimbursed

- Mobile check deposit

- No monthly maintenance fees, no minimum balances, and no overdraft fees

- Checking is FDIC insured up to $250,000 (through NBKC Bank)

This account is promising, and will likely compete well with the best free checking accounts currently out there.

Betterment Cash Reserve

Betterment Cash Reserve is Betterment's cash account. The Cash Reserve account is a cash management savings account that has a top yielding account with no fees. In fact, this account is "outside" the management product, so you get the full APY on your money.

Right now, you can earn 5.50% APY. And deposits are insured by the FDIC up to $1 million.

See how it compares on our list of the best high yield savings accounts.

Are There Any Additional Features And Perks?

Betterment has a ton of additional features that may be of interest to some - especially if you want to at least know what's going on with your investments even if you maintain a hands-off approach.

Some of the key ones include:

Crypto Investing

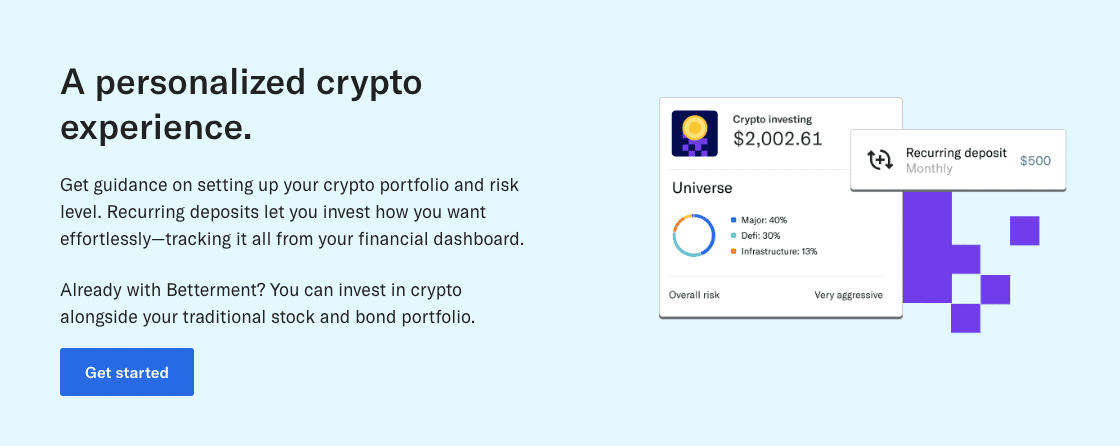

In order to guide investors through a sometimes-confusing crypto investing journey, the company launched Crypto Investing by Betterment.

Remember, crypto investing costs 1.00% AUM.

The product consists of four crypto-based portfolios. Think of these as curated selections of crypto assets which sits alongside Betterment's more traditional portfolios. They're intended to give you the ability to invest in crypto for the long-term with expert guidance for better decisions, diversification to help mitigate volatility, and automated features to make investing easier.

Universe: Broadly invest in the crypto landscape with one portfolio. Get diversification across decentralized finance, payments, the metaverse, and more.

Sustainable: Focus on crypto assets that either use less energy to validate transactions or are on a clear path to sustainable energy usage.

Metaverse: A mix of crypto assets focused on the creation of new digital communities. You can invest in virtual reality, non-fungible tokens (NFTs), and more.

Decentralized Finance: Emphasizes crypto assets that are disrupting traditional financial systems through peer-to-peer banking and financial services using blockchain technology.

Betterment's Crypto Investing may be an option to get involved, especially if you're new to crypto investing or want to expand your crypto portfolio.

Tax-Loss Harvesting

This was one of the early features of Betterment that set it apart from other companies. If you have a taxable account, you can leverage tax loss harvesting to potentially boost your returns over the long run. What happens is when your investments lose value, Betterment can sell them to help offset the taxes that come with income and capital gains.

This strategy is usually employed by sophisticated investors, but Betterment's technology enables it for everyone.

Retirement Goals

Betterment's software is designed around goals - with one of the biggest being retirement. Their retirement tools are easy to understand and helpful for calculating both what you'll have and what you'll need.

One thing we noticed is that their tools actually factor in an early retirement, unlike other tools on the market. This is great for those looking to FIRE.

Cash Analysis

One of the great things about Betterment is that it's set and forget - but one thing you typically have to set is at least a deposit into your Betterment account. Now, with their Betterment Everyday program, you can setup a minimum amount to keep in your checking account, and Betterment will sweep the rest into your Betterment account.

Then, of you just want to keep cash on hand, Betterment has an Everyday account that could earn you more than 20x the average savings account. This is a great way to keep cash without worrying about having to open another account at another bank.

Read our full Betterment Smart Saver review here.

Socially Responsible Investing

If investing in companies that align with your values is important to you, Betterment also offers a Socially Responsible Investing (SRI) portfolio. It's not a perfect fit for SRI investors. But it's a good mix of SRI and performance.

Betterment's SRI portfolio aims to maintain the diversified, low-fee approach of Betterment's portfolio while increasing exposure to companies that meet SRI criteria.The great thing here is that you can get SRI investing at the same pricing you'd normally pay Betterment.

Charitable Giving

Finally, for individuals interested in giving, Betterment has a charitable giving program where you can donate shares from your taxable accounts to a charity that Betterment has partnered with.

Betterment will calculate and recommend donating shares that you’ve held longer than one year so that the gift can be deducted up to the maximum amount come tax time. This can be a great way to contribute to a charity and maximize your tax benefits.

How Does Betterment Compare?

While Betterment has a lot going for it, but it's not the only robo-advisor in town. While it does rank on our list of the Best Robo-Advisors, it does have some close competition.

Check out this quick comparison:

Header |  | ||

|---|---|---|---|

Rating | |||

Annual Fee | $4/mo or 0.25% to 0.65% | 0.25% | 0.15% to 0.30% |

Min Investment | $10 | $500 | $3,000 to $50,000 |

Advice Options | Auto and Human | Auto | Auto and Human |

Banking | |||

Crypto | |||

Cell |

How Do I Contact Betterment?

There's a reason why Betterment calls itself a robo-advisor. It tries to automate as many services as possible. And that means it will try to push customers towards non-personal support options as often as possible.

If you're on the Premium plan, you'll obviously have unlimited access to CFPsᵀᴹ. But if you're a Checking, Cash Reserve, or Digital Plan client who's just looking to get general account help, you'll have a hard time accessing human support.

When you visit Betterment's "Contact" page, you'll find several Help articles and a live chat service. But you won't find a customer service phone number.

However, we were able to find Betterment's contact info by digging through their privacy policy. You can contact their customer support team over the phone at 646-600-8263 over by email at support@betterment.com.

You can also view other ratings and reviews of Betterment, as well as what others had to say, here: The platform earned 4.5 out of 5 stars in the Google Play Store and 4.7 out of 5 stars in the Apple App Store. The platform has a "Poor" rating wth just 8 reviews on Trustpilot, and 1/5 rating with 12 reviews on BBB.

Is It Safe And Secure?

Yes, Betterment's website is secured by HTTPS encryption. It's servers are monitored 24 hours a day and are frequently subjected to internal and external security audits. It also offers two-factor authentication and safer connections to finance services through "App Passwords."

That covers Betterment's data security. But what about financial protection? Investment accounts are protected by SIPC insurance up to $250,000. And Betterment is able to offer up to $250,000 of FDIC insurance on Checking deposits and up to $1 million of FDIC insurance on Cash Reserve deposits through its program banks.

Why Should You Trust Us?

I've been writing about investing and have reviewed brokerage firms since 2009. When Betterment launched in 2009, we were one of the first platforms that covered the "new" space of robo-advisors. And since then, we've reviewed most robo-advisor platforms in the United States.

Since then, I've regularly updated and tested the new features that Betterment has launched. Betterment is also consistently voted on by our readers each year when we survey the best robo-advisors.

Finally, our compliance team regularly checks and updates the rates in this review as needed.

Who Is This For And Is It Worth It?

I love Betterment for the fact that it’s so easy. Every single part of the process is simple.

You don’t get charged any transaction fees, you start investing with practically nothing, and your money is invested based on your risk profile.

This is exactly what a beginner needs. Check out Betterment here.

Betterment FAQs

Let's answer a few of the most commonly-asked questions about Betterment:

Can Betterment clients invest in individual stocks?

No, Betterment only offers ETF portfolios that are customized to your risk tolerance and goals.

Can the weightings of Betterment portfolios be adjusted?

Yes, with Betterment's Flexible Portfolio options, you can modify the weights of each asset class or choose not to invest in certain classes.

What happens if Betterment goes out of business?

Betterment is an SIPC member broker, which means that client assets would be protected up to $500,000 ($250,000 maximum for cash) if it were to file for bankruptcy.

Does Betterment offer any fee-free accounts?

Yes, Betterment's Checking and Cash Reserve accounts do not come with any annual advisory fees or monthly maintenance fees. Its advice and planning tools are also accessible to everyone free of charge.

Does Betterment have any bonus offers or incentives?

You can find bonus offers for Betterment - which are typically having some of your portfolio managed for free for a certain period of time.

Betterment Features

Account Types |

|

Minimum Investment |

|

Expense Ratios |

|

AUM Fees |

|

Advice Packages |

|

Socially Responsible Investments | Yes |

Access to Human Advisor | Yes, for clients on the Premium plan and through advice package |

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | Yes |

Cash Reserve APY | 5.50% |

Customer Service Number | 646-600-8263 |

Customer Service Email | support@betterment.com |

Other Customer Support Options | Live chat CFPᵀᴹ Advice Packages |

Web/Desktop Platform | Yes |

Mobile App Availability | iOS and Android |

Promotions | None |

DISCLOSURES

Annual percentage yield (variable) is as of 09/05/2024. Cash Reserve is only available to clients of Betterment LLC, which is not a bank, and cash transfers to program banks are conducted through the clients’ brokerage accounts at Betterment Securities. {add hyperlink https://www.betterment.com/cash-reserve.

For Cash Reserve, Betterment LLC only receives compensation from our program banks; Betterment LLC and Betterment Securities do not charge fees on your Cash Reserve balance.

Checking accounts and the Betterment Visa Debit Card provided and issued by nbkc bank, Member FDIC. Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNER™ certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Betterment Review

-

Commissions And Fees

-

Ease Of Use

-

Customer Service

-

Portfolio Options

-

Features And Tools

Overall

Summary

Betterment is a robo-advisor that offers low-cost investing and advice, as well as cash management products and fee-only financial advice from a CFPᵀᴹ. It’s a strong contender if you want low-cost, managed help with your finances.

Pros

- Only $10 to get started

- Automatically invest based on your goals

- Checking and a Cash Management Account

- Pay for additional help from a CFPᵀᴹ

Cons

- Limited options for experienced investors

- Cannot setup allocations to include external accounts (like a 401k)

- Doesn’t offer investments in all asset classes

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett