Banking

Find A Fee-Free Checking Account And Earn More Interest On Your Savings.

Banking is the fundamental feature of the modern financial system. Every person interacts with the banking system in some way or another. You need a checking account. You need a savings account. You might want to find a certificate of deposit. Maybe you need business banking options?

For too long, bank accounts have been complicated - charging high fees, or requiring a certain number of transactions, or making sure you have a minimum balance. It made banking challenging, especially for young adults.

No matter what your banking needs are, we have the comparisons and information to help you make the best financial decision possible. Here are our most popular articles:

Banking Facts

Before we dive in to everything about banking, let's cover some basic facts about banks in the United States:

- Average savings account balance: $8,000

- Median savings account balance: $1,200

- Average American monthly expenses: $5,577

- Percentage of Americans with a Checking Account: 98%

- Average age of first savings account: 17

- Average age of first checking account: 18

Checking Accounts

A checking account is the most essential bank account for most Americans. This is your "transaction" account. This is the account you will use to receive your paycheck, pay your bills, and handle your day to day expenses.

Many Americans open their first checking account at 18, and this is the same checking account they keep forever. But you should just keep an account because it's been open forever. You should keep a checking account that meets your needs: no-fees, no account minimums, allows transactions how you want them (ATM, check, wire, etc.).

We regularly compare the best checking accounts - for adults, students, and more. See our main guides here:

Some people struggle to have a normal checking account due to a poor banking score. In this case, people should look at Second-Chance Checking Accounts.

Savings Accounts

After a checking account, a savings account is key. This is where you need to store your short term emergency savings (hint: emergency fund). Savings accounts are a little less liquid than checking accounts, but more liquid than investment accounts. That's why it's great to park money here for short term goals.

The downside is that savings accounts, while earning more interest than a checking account, don't typically earn what the stock market earns. However, as long as your savings account is FDIC or NCUA insured, you can't lose money. That's a big plus!

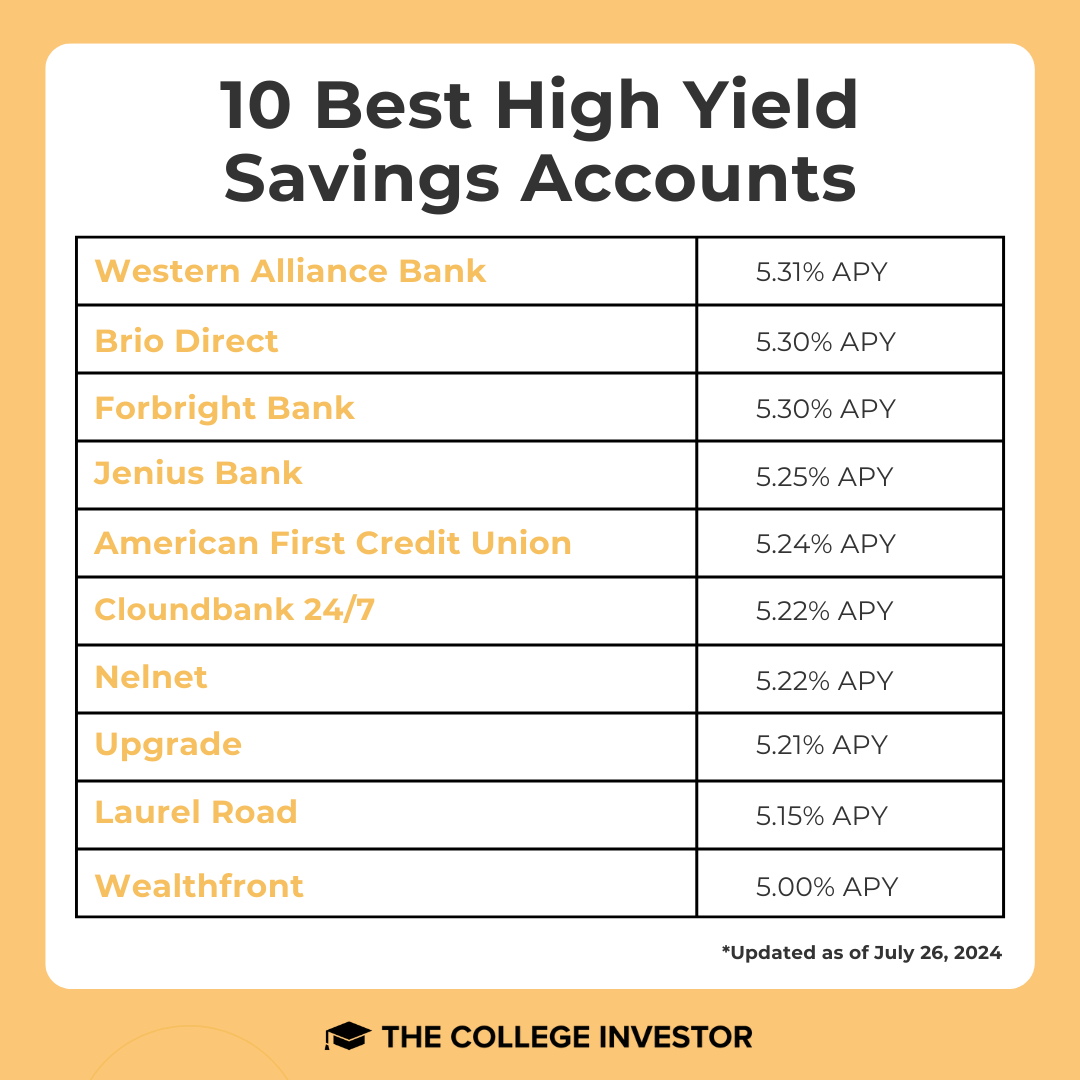

The number one factor in a savings account is finding the highest interest rate. Our lists and rankings always focus on the highest interest rates first. We don't play gimmicks like some other big websites where we have "featured" partners or other ads that skew the list. You'll find the highest earning savings accounts here:

Certificates Of Deposit

Certificates of Deposit (or CDs) are a great in-between savings product. They typically over slightly better interest rates than savings accounts, but they require you to "lock-up" your money for a certain period of time in order to earn that rate.

For example, a 12-month (or one-year) CD requires you to keep your money in the account for one year in order to earn the interest advertised. If you pull your money out early, you never lose principal, but you can lose some (or all) the interest.

If you really need access to the funds, a savings account is a better choice. But if you know that your savings won't be needed for a little bit, you can look at CDs.

Business Banking

Business banking is a very different world than consumer banking. In general, most banks make most of their money off business customers. That's why it's rare to find low-fee business bankings.

But for side hustlers and small businesses, no-fee business banking is essential. It's why we created these guides - we had a need to find a business checking and savings account that matched our needs.

>> Don't forget to check out our Business Bank Account Bonus and Promotional Offer page.

We've also looked at a variety of business bank accounts for specific needs. See these guides:

Bank And Credit Union Reviews

There are over 4,000 banks in the United States, and we strive to review as many nationwide banking options as possible for our readers. We're always reviewing new banks and credit unions. We have a focus - banks and credit unions that offer free checking or compelling high yield savings accounts.

Here's a selection of our most popular bank reviews:

- Ally Bank

- American Express Bank

- Axos

- Bank of America

- Barclays Bank

- Bask Bank

- BMO

- Bread Savings

- Capital One

- Cash App

- Chase Bank

- Chime

- CIBC

- CIT Bank

- Citibank

- Citizens Access

- Consumers Credit Union

- Crescent Bank

- Current

- Discover Bank

- Fifth Third Bank

- FNBO Bank

- Found Business Banking

- GO2bank

- Hanover Bank

- HSBC

- Huntington Bank

- Juno

Read More Banking Content

We have hundreds of articles related to student loans. Check out our full student loan archive here:

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Banking Terms And Definitions

Learn more about what these banking terms mean, from A to Z:

A

- Account Balance

- Account Number

- Annual Fee

- Annual Percentage Rate (APR)

- Annual Percentage Yield (APY)

- Anti-Money Laundering (AML)

- Auto Loan

- Automated Teller Machine (ATM)

B

C

- Cash Advance

- Cashiers Check

- Certificate of Deposit (CD)

- Check

- Check Cashing

- Checking Account

- Collateral

- Compliance

- Commercial Bank

- Compound Interest

- Corporate Bank Account

- Credit Card

- Credit Limit

- Credit Union

- Currency Exchange

D

- Debit Card

- Depositors Insurance Fund (DIF)

- Digital Banking

- Direct Deposit

- Dividends

- Doing Business As (DBA)

E

- Electronic Funds Transfer (EFT)

- Emergency Fund

- Employer Identification Number (EIN)

- Exchange Rate

F

- Federal Deposit Insurance Corporation (FDIC)

- Federal Reserve Fed Funds Rate

- Financial Intelligence Unit (FIU)

- Forex Market

H

I

J

K

L

M

N

- National Credit Union Administration (NCUA)

- Net Worth

- Not-For-Profit

O

- Overdraft

- Overdraft Protection

P

R

S

- SWIFT Code

- Savings Account

- Savings Bond

- Service Charge

- Share Account

- Statement Cycle

T

- Term Deposit

- Transaction

- Transfer

- Trust

- Two-Factor Authentication

U

- Underwriting

- Unsecured Loan

V

- Vault

W

- Wire Transfer

- Withdrawal

Z

- Zelle

Editor: Ashley Barnett Reviewed by: Colin Graves