The Form 10-K is an annual report filed by publicly traded companies, and you can learn a lot by reading it.

There are plenty of financial websites to read about how a company is performing. But if that is all the analysis you do, you’re always reading about someone else’s view. Serious investors go to the source and develop their own bias about a company.

In this article, we’ll describe what a Form 10-K is and how you can start using it in your analysis.

If you're looking to start trading stocks, check out this list of places to trade stocks for free.

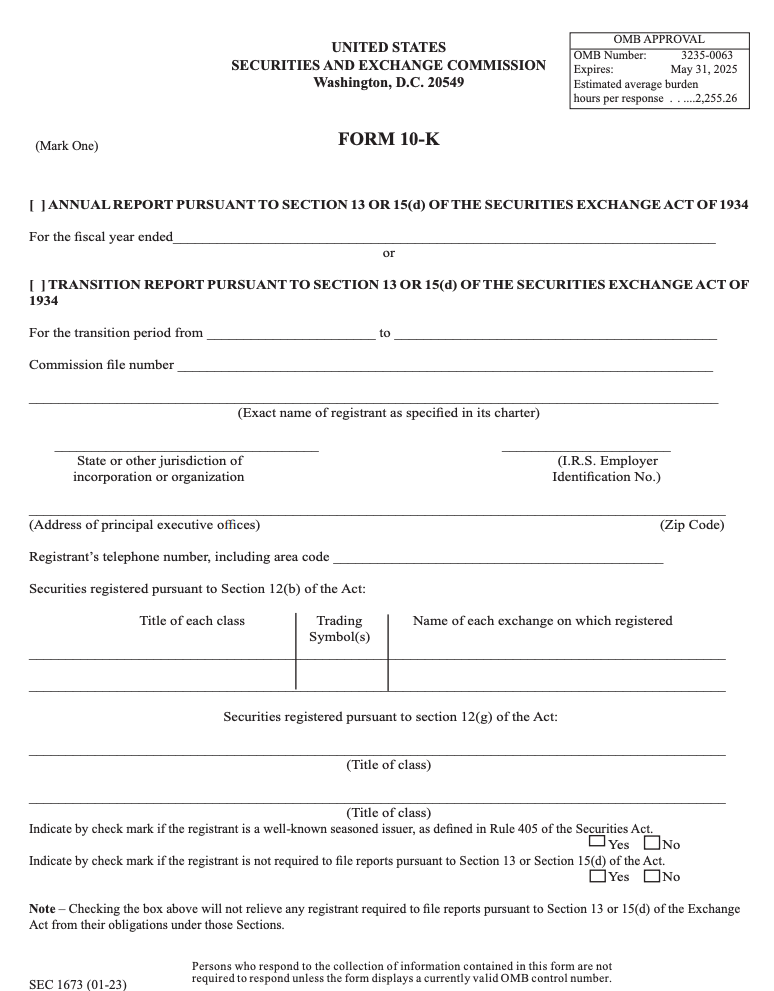

Introduction to Form 10-K

Form 10-K is an annual report that must be filed by publicly traded companies, as required by the SEC. Form 10-K reports contain everything you’d want to know about a company, including audited financial statements. Some of what you’ll find on a Form 10-K report includes:

- Executive compensation

- Audited financial statements

- Risk factors

- Owned properties

- Organization structure

And, lots more. The document is extremely in-depth, although it is also very dry as well. However, for serious investors, Form 10-K is an essential piece of investment research material — it’s unfiltered information about a company and not biased by analysts’ perspectives.

Understanding Form 10-K

The SEC breaks the Form 10-K down into four parts:

Part I

- Item 1: “Business”

- Item 1A: “Risk Factors”

- Item 1B: “Unresolved Staff Comments”

- Item 2: “Properties”

- Item 3: “Legal Proceedings”

- Item 4: This item has no required information, but is reserved by the SEC for future rule-making.

Part II

- Item 5: “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities”

- Item 6: “Selected Financial Data”

- Item 7: “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

- Item 7A: “Quantitative and Qualitative Disclosures about Market Risk”

- Item 8: “Financial Statements and Supplementary Data”

- Item 9: “Changes in and Disagreements with Accountants on Accounting and Financial Disclosure”

- Item 9A: “Controls and Procedures”

- Item 9B: “Other Information”

Part III

- Item 10: “Directors, Executive Officers and Corporate Governance”

- Item 11: “Executive Compensation”

- Item 12: “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters”

- Item 13: “Certain Relationships and Related Transactions, and Director Independence”

- Item 14: “Principal Accountant Fees and Services”

Part IV

- Item 15: “Exhibits, Financial Statement Schedules”

To analyze a company using Form 10-K, always check “Item 1,” which is an overview of business operations. As an example, we’ll look at TSLA. The overview lists all of the car models, potential new models, and other developments within the company, such as potential factories. This gives you a good idea of what’s in store for the company’s future production.

Moving down to Item 7, you can see where the company is planning to invest capital. The “Trends in Cash Flow, Capital Expenditures and Operating Expenses” section shows the company invested most of its capital in the production of the Model 3 and Model Y. In this same section, you can also read about Gigafactory developments.

Next, take a look at Item 8, which includes a number of audited financial statements, revealing the financial performance of the company.

While those are just three sections, they might be considered some of the most important on Form 10-K.

Where to Find 10-Ks

The best place to download Form 10-K reports is directly from the SEC’s EDGAR website. EDGAR stands for Electronic Data Gathering, Analysis, and Retrieval.

To access the EDGAR search, visit https://www.sec.gov/edgar/searchedgar/companysearch.html. Put in the company stock symbol or name to find all publicly filed documents, including Form 10-Ks.

There are two versions for most documents — static and interactive. The static version is a listing of related documents. Interactive versions are broken down a little more and allow you to click into other sections of the document. The interactive version also includes clickable definitions for terms.

For some companies, such as TSLA, they file lots of documents. Form 10-K may not be listed on the first page of search results or even the second or third. Rather than clicking through pages of search results, put “10-K” into the “Filing Type” box to quickly find only Form 10-K documents.

How Does Form 10-K Differ From Form 8-K and Form 10-Q?

There are two other documents that must be filed by publicly traded companies. These are Form 8-K and Form 10-Q. Let’s look at the differences between these two documents and Form 10-K.

Form 8-K

This document may be filed multiple times throughout the year and even during a quarter. It reflects any material events within the company. It is also called the “current report.” Material events include:

- Bankruptcy

- Plant closure

- Acquisition

- Delisting

- Unregistered sales of equity securities

- Amendments to articles of incorporation or bylaws; change in fiscal year

Rather than waiting for important announcements at the end of the year through a Form 10-K, which may be outdated by then, Form 8-K allows investors to make timely decisions based on current events.

Form 10-Q

This filing is a quarterly report of unaudited financial statements, which is in contrast to Form 10-K’s audited financial statements.

Analyzing a Form 10-K takes time. Once you understand how it is structured, have a goal for what you want to find rather than just reading the entire document. You’re more likely to get value from the document if you are looking for specific things.

Some parts of the document should always be part of your reading, including “Item 1” and the financial statements.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett