Commercial real estate investing was once the investment domain of well-capitalized individuals, hedge funds, and opaque private non-traded REITs. However, the once inaccessible market became more penetrable with the April 2012 JOBS Act. This opened up investment opportunities in emerging growth companies including through non-traded REITS.

Today, many crowdfunded real estate companies are vying for investor dollars as each tries to outperform the others. Modiv, a seeming newcomer (but not really) to the crowdfunding space, is aiming to differentiate itself as a more stable and conservative option.

As a brand, Modiv was launched in February 2021 but the underlying company started in 2015. Through strategic mergers and acquisitions, it's working hard to build a solid foundation for growth. Here’s what you need to know about it.

Quick Summary

- Non-traded REIT specializing in corporate rentals

- More than $400 million in assets under management

- Now open to both accredited and non-accredited investors

- Past legal problems may be concerning

Modiv Details | |

|---|---|

Product Name | Modiv |

Min Invesment | $1,000 |

Annual Costs | ~3% |

Open To Non-Accredited Investors | Yes |

Promotions | None |

What Is Modiv?

Modiv, formerly known as NNN REIT and Rich Uncles, is a non-traded Real Estate Investment Trust (REIT). The company has over $400 million in assets under management, with shares owned by more than 10,000 individual investors. Most of the assets under management include office buildings, retail space, and other commercial investments.

While Modiv is marketing itself as a conservatively-managed private REIT, it’s history has not always been squeaky clean. In 2019, Rich Uncles paid $300,000 in fines to the SEC related to acting as an unregistered broker dealer and illegal radio advertising practices which took place in 2017.

Modiv is also facing an ongoing whistleblower retaliation lawsuit from a former employee whose information helped lead to the original 2019 suit. The past and ongoing legal issues may be important for investors to consider before buying into Modiv, as sponsor risk is one of the critical factors when investing in a non-public REIT.

In 2020, Modiv bought BuildingBits which offered investments to all investors regardless of income status. And in August 2021, Modiv announced that it had updated its registration to Registration A so that all investors could participate in its offerings (not just accredited investors).

What Does It Offer?

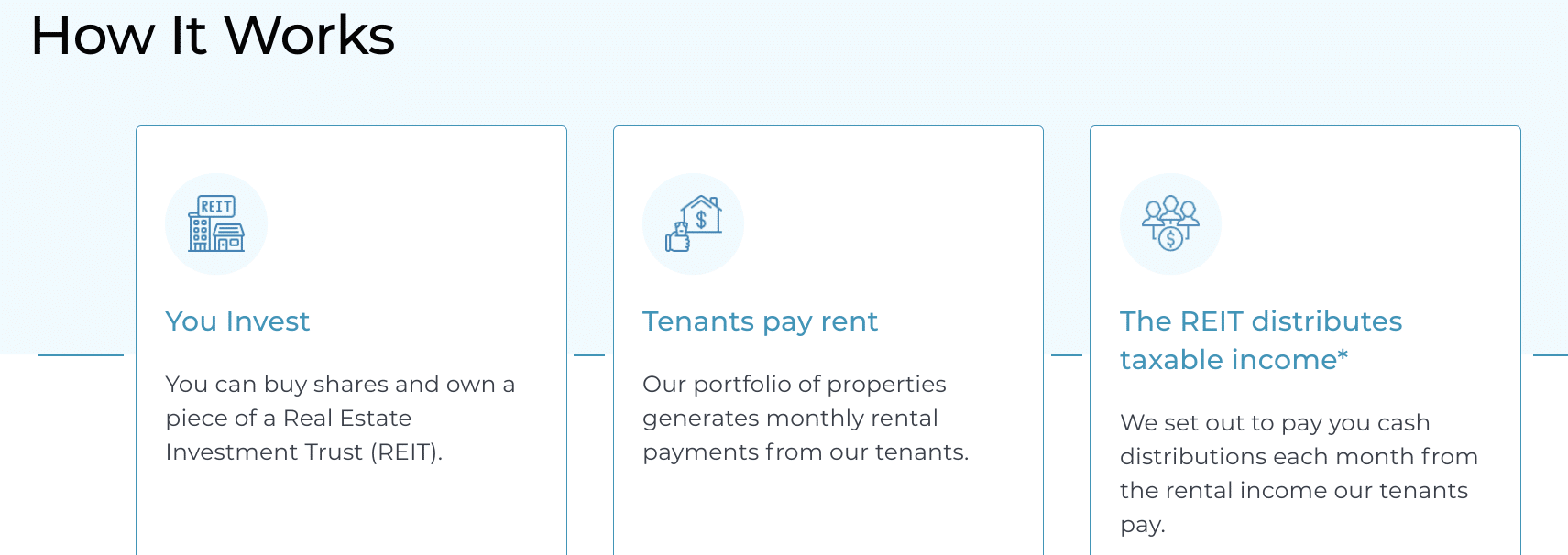

Modiv allows individual investors to buy shares of a non-traded REIT. This gives access to a corporate real estate investment that could be a valuable alternative in the investor’s portfolio.

Modiv’s share price is driven by the company’s Net Asset Value per issued share. Because of that pricing methodology, it can keep the price of a share relatively stable over time. As of May 5, 2021, a share of Modiv was $24.61. Investors must invest a minimum of $1,000 when buying initial shares.

Buy Shares Of A Non-Traded REIT

Investors can buy shares of a non-traded REIT. The REIT returns at least 90% of its annual income to investors in the form of a dividend. Shares of the REIT cannot be re-sold, but Modiv may buy back shares through a repurchase agreement.

Investors who buy shares of Modiv buy into the entire portfolio. Tenants pay Modiv monthly rent. Modiv manages the properties, pays the bills on the property, and ultimately passes along the remaining profits to investors.

As a REIT, Modiv must distribute at least 90% of its net income annually. It does this through 12 monthly dividends and a potential “13th dividend” when the fund exceeds its business targets.

Industry Insiders Manage A Commercial Real Estate Portfolio

All the assets owned by Modiv are selected and managed by commercial real estate experts. The company employs banking, finance, and real estate experts to ensure the assets selected are likely to perform in the long term.

Investors do not get a say in which assets Modiv purchases for its portfolio. However, the financials of all deals are readily available to investors.

Selling Shares Subject To Repurchase Agreements

Shares of Modiv are very illiquid assets. Investors can't sell them for at least 6 months of holding. After the six-month window, investors can't sell to other investors. Instead, they can only re-sell to Modiv through a repurchase agreement.

The repurchase agreement outlines the price investors may be able to receive through Modiv. However, it's important to note that Modiv isn't obligated to repurchase shares.

Ability To Invest Through Self-Directed IRAs

Investors can buy shares of Modiv through a self-directed IRA. However, Modiv doesn’t specifically support self-directed IRAs. That means investors need to set up a self-directed account on their own before investing in Modiv.

Some crowdfunding companies have established partnerships that make it easier for investors to open self-directed IRAs. But that kind of convenience isn't yet available with Modiv.

Automatic Investing Options

Modiv recently launched two different options for investing automatically. Those who have already invested at least $1,000 on the platform can enroll in the Automatic Investment Program (AIP) to set up monthly transfers of at least $100 per month with the ability to cancel at any time.

Even if you haven't yet invested any money on the platform yet, you can still enroll in the AIP program. However, in this case, you'd need to agree to continue using AIP (and investing at least $100/mo) for at least 12 months. So you're actual minimum investment before you'd be able to back out the program would be $1,200.

Are There Any Fees?

Modiv estimates that 3% of all investment dollars go towards organizational costs. These costs aren’t formal fees, since all formal fees are paid by the trust. However, the overhead costs are effectively the same as a 3% annual management fee. In the long run, Modiv is looking to lower its cost to 1.88% of all investment dollars.

Modiv’s 3% fees are a bit higher than other real estate crowdfunding sites which charge fees ranging from 1-2% in most cases. And compared to mutual funds or publicly-traded REITs, the costs of owning Modiv are very high. Mutual funds and public REITs typically have investment management fees under 1% per year.

How Do I Contact Modiv?

Modiv’s street address is 120 Newport Center Drive, Newport Beach, CA 92660. Investors interested in contacting customer service can call 888-686-6348. The customer service email address is info@modiv.com. Potential investors can also use the online contact form to ask Modiv specific questions.

How Does Modiv Compare?

Non-traded REITs are older investment tools. But the JOBS Act breathed new life into an old framework. There's now quite a bit of competition in the commercial real estate crowdfunding space. Some platforms are open to all investors, while others require accreditaion. Here's a quick look at how Modiv compares:

Header |  | ||

|---|---|---|---|

Rating | |||

Annual Costs | ~3% | 1% to 1.25% | 1% |

Min Investment | $1,000 | $5,000 | $500 |

Open To Non-Accredited Investors? | |||

Cell | Cell |

How Do I Open An Account?

Opening an account at Modiv starts by creating an online profile. Prospective investors must prove that they meet the investment qualifications set by Modiv and the SEC. All “human” investors must be a resident of the United States. And all “company” investors (such as trusts or partnerships) must be based in the United States.

An investor support team member may request documentation to prove your accreditation status which will determine the maximum amount that you can invest per year. Once Modiv verifies your status, you can officially open and fund an online account. The minimum investment is $1,000.

Is It Safe And Secure?

Modiv takes security and privacy seriously, but they can't eliminate the risk of a data breach or another hack. The privacy of investor’s information is governed by SEC and US privacy laws.

However, the biggest risk that most Modiv investors face is the risk of poor performance. Unexpected events or unusually high costs could lead to lower or negative returns.

For example, during the throes of the pandemic, Modiv (still called Rich Uncles at that time), was receiving little to no payments from many of its largest commercial tenants. In May 2020, the company announced that it was nearing insolvency. As a result, its per-share value was reduced by 30%.

While it's unlikely that we'll see a commercial-real-estate-killing event like a pandemic again in the near future, other risks will always present with non-traded REITs. And if Modiv's REIT doesn't meet its performance expectations, it's unlikely that the company would be willing to repurchase shares to allow investors to exit.

Is It Worth It?

Asset allocation drives over 90% of portfolio performance, and many investors only carry stocks and bonds in their portfolios. Adding commercial real estate as an alternative investment may be a wise choice. But should you make that investment in Modiv's REIT?

For now, we feel like the answer is probably no. On the surface, Modiv looks like a non-traded REIT that is well-positioned in the marketplace. However, it's recent legal and financial troubles makes us hesitate to recommend it.

We'll b monitoring the company's progress. And if Modiv is able to build a stronger track record over the coming years, we'll update this review to let you know.

Until then, you can compare all our favorite real estate crowdfunding sites here.

Modiv Features

Account Types | Individual U.S. Entity U.S. Trust Self-Directed IRA |

Minimum Investment | $1,000 |

Management Fees | ~3% per year |

Target IRR | 7% to 12% |

Open to Non-Accredited Investors | Yes |

Investment Options | One commercial real estate REIT |

Fund Transparency | High -- fund financials are filed publicly with the SEC |

Investment Term | At least 6 months |

Dividend Payout Schedule | Monthly, with a potential 13th dividend paid out at the end of year. |

Share Redemption Program | Yes, but redemption is not guaranteed |

Secondary Market | None |

Customer Service Phone Number | 888-686-6348 |

Customer Service Email Address | info@modiv.com |

Mobile App Availability | No |

Promotions | None |

Modiv Review

-

Pricing & Fees

-

Ease of Use

-

Customer Service

-

Diversification

-

Liquidity

-

Investor Accessibility

Overall

Summary

Modiv allows both accredited and non-accredited investors to invest in a non-traded REIT that specializes in corporate rentals.

Pros

- Passive income (monthly dividends)

- Modest minimum investment

- Now open to non-accredited investors

Cons

- 3% effective fee is relatively high

- Must open separate self-directed IRA to invest through a retirement account

- Legal issues with Rich Uncles brand

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller