Doorvest allows you to invest in single-family rental real estate.

Today’s competitive real estate market means that buying real estate for a rental property is a real challenge for many would-be investors. Doorvest, a turnkey rental property and management company, makes investing in single-family rental properties easier. The company’s personalized marketplace helps investors find a property that matches their investment criteria. For a fee, Doorvest manages the property, going so far as monitoring rehab work before renters enter their new home.

Besides Doorvest, there are ways to invest in real estate using crowdfunding or syndication, which makes this kind of investing more accessible and easier for everyday people. While real estate investment trusts (REITs) offer a great way to gain exposure to real estate, many prospective real estate investors want to own a tangible asset. They want control over whether to rent the property or sell it and what repairs to do.

Doorvest Details | |

|---|---|

Product Name | Doorvest |

Property Types | Single-family |

Fee | 10% Management fee for first year (minimum one year required) |

Offering Types | Direct Ownership |

Promotions | None |

What Is Doorvest?

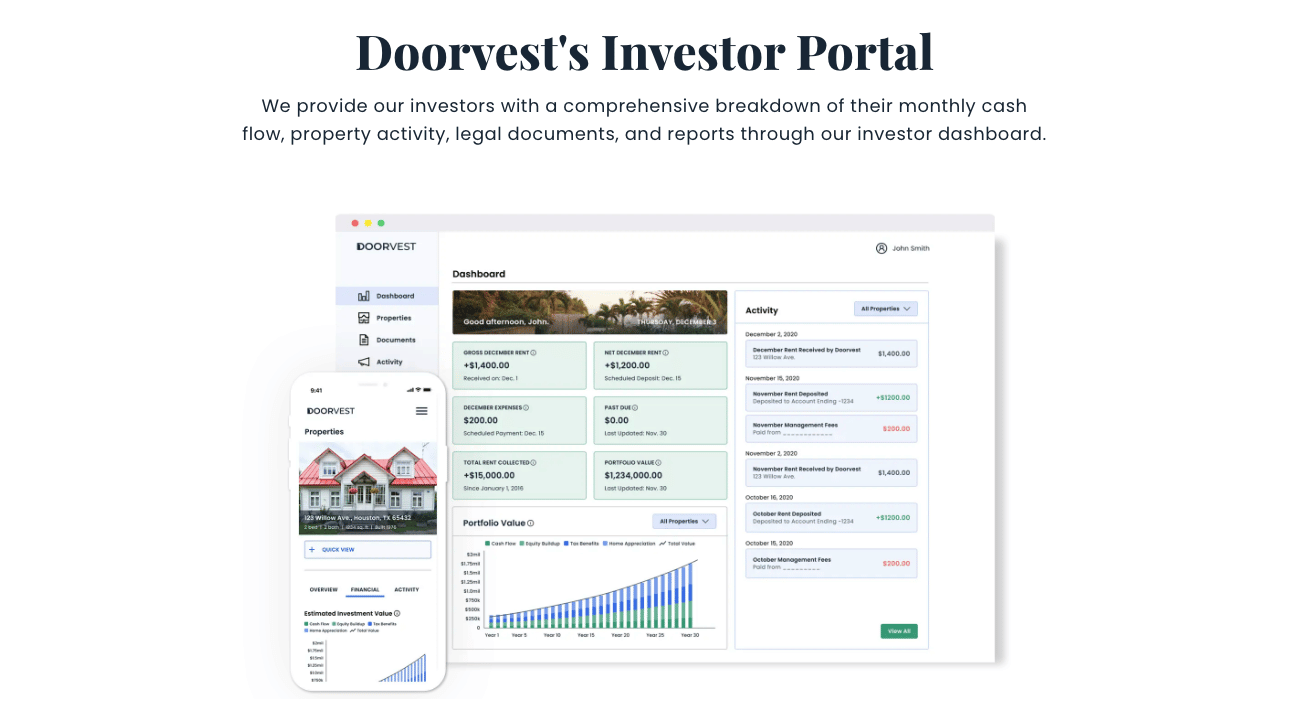

Launched in 2018, Doorvest is a San Francisco-based real estate investing platform dedicated to helping everyday people buy residential real estate (single family homes) online. The company specifically focuses on matching prospective investors with homes in high-growth markets that offer opportunities for both cash flow and appreciation.

Unlike many online real estate marketplaces, Doorvest matches you with specific houses that you buy and own for the long term. Doorvest also provides long-term property management for customers who want to retain its services after purchasing the property.

When buying through Doorvest, you have to use the management service for the first year. But after the first year, you’re free to make any decisions you want regarding the property you purchased.

What Does It Offer?

Doorvest is making real estate investing easier for the everyday person. Here’s how it lowers barriers to investments.

Use Doorvest’s Matching Algorithms to Find Rental Properties

Doorvest uses algorithms and human intervention to help you find a rental property that meets your goals. The company can’t find “purple unicorns” of high cash flow in perfect neighborhoods, but it can help you find a property inside your budget that meets most of your preferences.

If you’re serious about finding a rental property, Doorvest’s approach can help you find the right property quickly. Even though you’ll buy a rental property from a long distance, Doorvest’s approach can help you feel confident that you’re buying a great home to help you move towards greater wealth.

You can reach out to Doorvest by emailing hello@doorvest.com. People who create a profile on Doorvest are invited to book a free consultation with Doorvest’s client partner team. You can book this through the website once you have a profile.

Buy Turnkey Rental Properties

Before you buy a house, Doorvest creates a renovation plan that will get the house rent-ready. Doorvest manages the entire renovation, so your investment is entirely passive. Once the house is rental-ready, Doorvest places the first tenant, and you can start collecting rent checks.

Doorvest Places Your First Tenant

Doorvest’s houses aren’t merely rental-ready, the company places your first resident in the home when you buy it. As an investor, you get all the benefits of owning rental real estate, but the investment is truly passive at first. Doorvest will continue to find tenants for you as long as you retain the company as your property management company.

Invest in Real Estate Markets With High Expected Returns

Doorvest manages properties in Oklahoma City, Columbus, Ohio, Atlanta, and several Texas-based cities. Each of these markets has seen rapid population growth, but home prices remain moderate. Compared to cities with extremely expensive real estate, investors in these markets can expect to see more appreciation and better cash flow.

Doorvest Manages Your Property For One or More Years

Doorvest charges a 10% property management fee, but it only charges the fee when you have a tenant who is paying rent. As an investor, you’re locked into a management relationship with Doorvest for one year. After that, you can keep Doorvest as your property manager, or you can find a manager on your own.

Are There Any Fees?

Doorvest charges a $100 refundable fee to gain access to the company’s off-market listings. The prices for Doorvest’s homes are not negotiable, and you must pay the company’s 10% management fee for the first year you own the home.

After the first year, you are free from any obligations to Doorvest and can manage the property yourself or hire a different property management company.

As a property owner, you are responsible to pay the mortgage, insurance, and taxes along with any maintenance fees.

How Do I Contact Doorvest?

Doorvest isn’t an investment company that’s hiding behind an internet firewall. It makes it easy to get in touch with representatives who can guide you as you make decisions about buying your first property. The company is headquartered at 564 Market St, Suite 450, San Francisco, CA 94104.

However, there have been a number of complaints in recent months about poor and non-responsive customer service issues.

How Does Doorvest Compare?

Typically, turnkey investing is a local game. Many major cities have one or more turnkey companies with a local focus. These local companies may have connections that Doorvest cannot match. However, Doorvest has the advantage of focusing on the nation’s most lucrative rental markets. It is expanding by creating local relationships.

When it comes to nationwide turnkey investing, Roofstock is Doorvest’s major competitor. While Doorvest is an end-to-end service provider (including property management), Roofstock is primarily a turnkey marketplace. Roofstock operates in more markets than Doorvest and it doesn’t come with property management requirements.

Doorvest’s “hand holding” approach may be better for new investors who are apprehensive about buying a rental property. Roofstock may be better for people simply looking for a deal on turnkey investment properties.

There’s also Fundrise, which is a real estate crowdfunding platform that lets you invest in commercial or residential real estate. Fundrise allows you to invest in either professionally managed residential real estate called eFunds or a diversified portfolio of commercial real estate called eREITs.

Header |  |  | |

|---|---|---|---|

Rating | |||

Investment Options | Single-family properties | Individual single-family properties REITs of single-family properties | REITs that include a blend of residential and commercial properties |

Min Investment | $45,000 | $5,000 | $10 |

Open To Non-Accredited Investors? | Yes | Non-accredited investors can buy individual properties on the marketplace, but can't invest in Roofstock One shares | Yes |

Cell |

How Do I Open An Account?

To get started, choose go to Doorvest's home page. Provide your name, email, and phone number along with an address and create a password.

During the account creation process, you’ll be asked about your investing preferences to align your expectations with Doorvest’s offerings. If you’re unsure about the investment options, you can meet with a Doorvest’s client partner specialist to learn more before you put down a refundable $100 deposit to view Doorvest’s listings.

Is It Safe And Secure?

Doorvest collects minimal information from you such as your legal name, email address, and phone number. This allows you to set up multi-factor authentication.

The company stores certain personal information, but it does not clarify whether this information is encrypted at rest. Given the company’s tech focus, it seems likely that the company follows best practices when collecting and storing personal information. You can opt-out of certain types of tracking (the use of cookies for example) if you want.

When buying rental properties, Doorvest handles the large amounts of money for you. They facilitate these transactions through the website, but the actual transfer of money is done through escrow accounts. Attorneys and title companies ensure that all property is transferred legally and appropriately.

However, at the end of the day you are relying on this third party to both handle the deal and handle the property management. Gaps in property management of a rental property can significantly reduce returns. And there have been a number of customer service complaints about poor handling of property management issues - such as slow to evict non-paying tenants, failure to list vacant properties timely, and more.

Why Should You Trust Us?

We have been writing about and reviewing investment firms and covering real estate investments for 10 years. I have personally owned single family real estate and more. I'm well versed in both the investment aspect and tax aspect of these products and services.

Furthermore, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Is It Worth It?

Right now, it is difficult to find any rental property that yields positive cash flow and is expected to appreciate. This is more of a long-term investment. Even Doorvest’s example math shows negative cash flow for two or more years before investors start seeing positive yields. If you’re interested in Doorvest, keep in mind you may need to take on a property where you’ll lose money for several years before you start making a profit.

If you’re enthusiastic about owning rental properties, consider Doorvest one option for finding a rental property. The company offers excellent services to help new real estate investors gain their footing in the single-family investing space.

Remember that buying physical property isn’t the only way to invest in real estate. Purchasing real estate syndications or house hacking may be a better way to dip your toes into real estate investing.

Doorvest Features

Offering Types | Direct ownership |

Minimum Investment | Varies depending on investment type |

Management Fee | 10% maintenance fee for the first year (one year minimum required, only if there are renters in the property) |

Other Fees | |

Do Investors Need to Be Accredited? | No |

Guarantees |

|

Customer Service Email | hello@doorvest.com |

Mobile App Availability | None |

Promotions | None |

Doorvest Review: An Easier Way For You To Buy Rental Properties

-

Fees and Commissions

-

Ease of Use

-

Diversification

-

Property Management

-

Customer Service

Overall

Summary

Doorvest, a turnkey rental property and management company, makes investing in single-family rental properties more simple.

Pros

- Option to passively invest in turnkey rental properties

- A wide variety of support is available to Doorvest buyers

- 3-month rental income guarantee

- Only pay the management fee when you’re collecting income from a renter

Cons

- Investors can expect negative cash flow for their first year or two on most properties

- No ability to negotiate the purchase price

- You must pay Doorvest for at least one year of management

- Customer service concerns around property management

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington