With home prices reaching new highs, entering into real estate investing could seem out of grasp. Even online real estate syndications often require a high net worth, income, or large upfront investments.

Concreit, a digital investing app, is making real estate investing more accessible for everyday people. Anyone with a dollar can start investing in real estate through Concreit. Here’s how the app works.Concreit Details | |

|---|---|

Product Name | Concreit |

Min Investment | $1 |

Monthly Fee | $5 per month for investments under $5,000 1% fee for investments over $5,000 |

Accredited Investor? | Open to Both Accredited & Non-accredited Investors |

Promotions | None |

What Is Concreit?

Concreit is a technology-enabled fractional real estate investment company. Based out of Seattle, the company allows everyday investors to buy shares of a non-traded, real estate investment trust. Investors can invest as little as $1 in Concreit’s REITs.

Real Estate Investment Trusts operate a lot like mutual funds for real estate. In a REIT, investor money is pooled together, and a manager makes investments and manages cash flow on behalf of investors.

What Does It Offer?

Fully Managed Real Estate Portfolio

Concreit is a non-traded Real Estate Investment Trust (Concreit Fund 1) that invests across a broad array of commercial real estate. The real estate assets owned by the fund are purchased, maintained, and managed by the trust.

Investors cannot select which real estate deals they want to participate in.

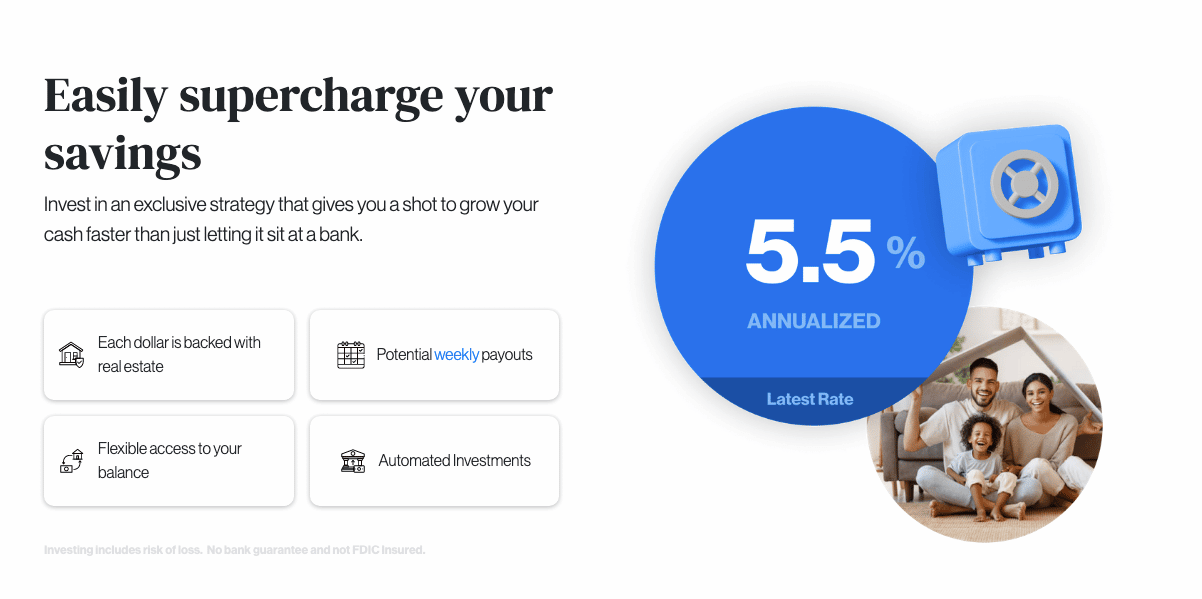

Historic 5.5% Yield Paid Weekly

Concreit differentiates itself by typically giving investors weekly payouts. Investors have historically earned a 5.5% annual yield on their investment assets. This payout isn’t guaranteed by Concreit but has been paid steadily since 2021.

Option to Reinvest Dividends

Investors who are serious about compounding their growth can choose to reinvest their weekly dividend payouts into more Concreit shares. Investors who choose to reinvest, get the benefit of truly passive real estate investments.

Set Up Automatic Investments

Investors can choose whether to invest a single lump sum into Concreit or continuously invest over time. Investors who are accustomed to automatically investing using a Robo-advisor or an automatic investment may appreciate how easy it is to set up an investment and invest a set amount each week or month.

1% Management Fee

For portfolios under $5,000, Concreit charges a $5 per month management fee. The company charges a 1% management fee for all investment portfolios over $5,000.

Option to Withdraw Investment Money App

Investors who don’t want money locked up for long periods can typically withdraw their principal investment after one year.

Withdrawals aren’t guaranteed but Concreit has historically been able to manage the requests by using cash on hand, income, or principal repayments. Concreit will typically be able to honor withdrawal requests within a few days of the request being made.

Those who withdraw sooner than one year will pay an early withdrawal worth 20% of the interest they earned.

Still, the option to liquidate funds is incredible since the underlying assets in the fund are so illiquid.

Are There Any Fees?

Most of Concreit’s investors will pay a 1% management fee based on the size of their portfolio. Investors with portfolios less than $5,000 will pay $5 per month.

When investors want to withdraw money, they pay a 0.1% withdrawal fee on all funds they take out of the fund.

If investors choose to pull out funds that have been invested less than a year, they’ll surrender 20% of the interest paid. For example, a 5% dividend yield would be reduced to 4%.

How Does Concreit Compare?

Non-traded REITs is not a new concept, and technology and various forms of legislation are making them more prevalent and accessible. Several companies including CrowdStreet and Fundrise offer REIT funds that are very similar to the REITs offered by Concreit. Also, their investment management fees are in line with fees charged by other non-traded REITs.

However, Concreit has a few standout features.

Header |  |  | |

|---|---|---|---|

Rating | |||

AUM Fees | 1.00% | 1.00% | 0.30% to 0.50% |

Min Investment | $1 | $500 | $1,000 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

To get started, download the Concreit app (iOS | Android) and create a profile.

The company doesn’t require a lengthy verification process, so once you have a profile you can start investing immediately.

To start investing:

- You must connect your bank accounts to the app.

- Then, deposit your first investment.

Concreit is open to U.S. citizens and residents over the age of 18.

Is It Safe And Secure?

Concreit focuses on their 5.5% dividend yield. This kind of yield isn’t to be confused with a high-yield bank account, where your money sits in an account and can be withdrawn at anytime without any penalties. While Concreit prioritizes withdrawals, it’s not immediately guaranteed. Concreit’s investors aren’t parking their money in an account, instead, they’re buying shares of a non-traded REIT, which can be viewed as a risky asset.

Aside from the investment risk, Concreit prioritizes your digital, personal information safely and security. Using an app to invest may present some level of risk of privacy or data loss. However, Concreit follows best practices to keep user information safe.

They don’t not share personal information with any third parties. Additionally, they use bank-level encryption to keep financial information safe and secure.

How Do I Contact Concreit?

According to their website, Concreit says they're a service-oriented company. The site has an easy-to-use chat service. To reach someone, customers can:

- Call: 206-607-6080

- Email: help@concreit.com.

Concreit is headquartered at 1201 3rd Ave. Suite 2200, Seattle, WA.

Is It Worth It?

Concreit’s historic performance combined with its low barriers to entry and superb technology makes it a great choice for investors seeking exposure to cash-flowing real estate.

Investors may be able to find higher returns or stronger cash flow by investing on their own or by choosing alternative REITs. However, Concreit’s focus on liquidity makes it a solid choice for investors who are earlier in their investment career.Concreit Features

Account Type | Individual |

Minimum Investment | $1 |

Management Fees | $5 monthly fee for investments under $5,000 1% for investments over $5,000 |

Investor Requirements | None |

Investment Type | Non-Traded Real Estate Investment Trust (REIT) |

Withdrawal Term |

|

Customer Service Email Address | help@concreit.com |

Customer Service Phone Number | 206-607-6080 |

Company Address | 1201 3rd Ave. Suite 2200, Seattle, WA |

Mobile App Availability | iOS and Android |

Promotions | None |

Concreit Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Risk Mitigation and Diversification

Overall

Summary

Concreit makes real estate investments more accessible to everyday folks who aren’t mega-wealthy by offering shares of non-traded REITs.

Pros

- Invest as little as $1

- Option to reinvest dividends and set up auto-investments

- It’s a passive form of investing in real estate

- Option to withdraw funds as needed

Cons

- Cannot pick and choose investments

- A $5 per month flat fee can be excessive on small portfolios

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington