Historically, investing in real estate required access to cash, and a lot of it. Today, creative financing and partnerships can help typical investors own property with as little as $10,000. But that barrier is still quite high, especially if you’re just getting started. Real estate crowdfunding has done a lot to bring down the barrier even further.

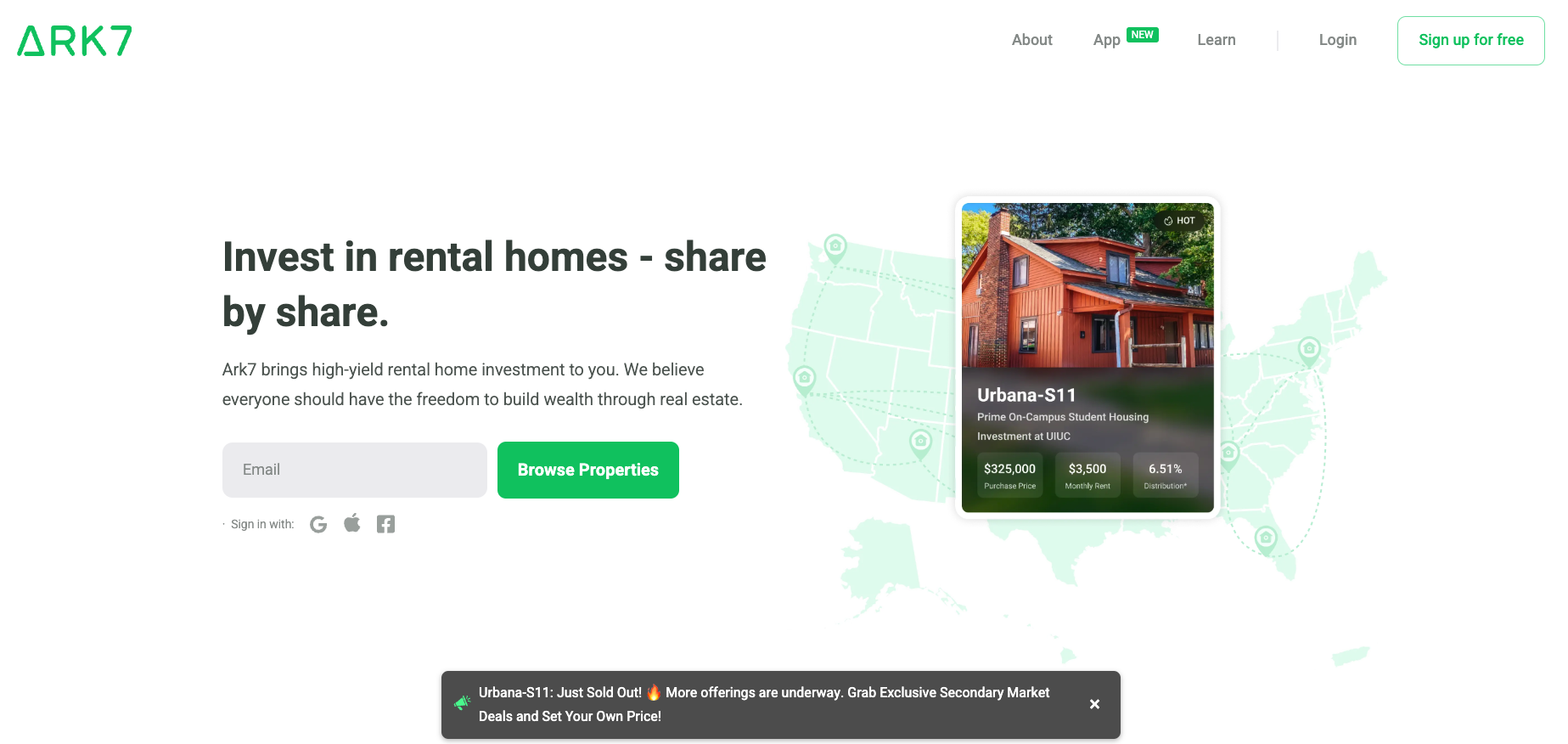

Today, sites like Ark7 make it possible to buy a fractional share of residential real estate (including townhomes, single-family homes, and small multifamily homes) for as little as $20 per share. If you want to gain exposure to real estate, but you don’t want the hassle of property management, Ark7 may be the right platform for you.

We explain how it works, what to expect, and how Ark7 is different from so many other real estate sites.

Quick Summary

- Fractional real estate investing app focused on residential real estate throughout the United States.

- Property management fees and repair costs are deducted from rental income before Ark7 distributes monthly dividends to investors.

- Potential returns range from 4%-7% on most investments on the site.

Ark7 Details | |

|---|---|

Product | Fractional Real Estate Investing App |

Accounts | Taxable, IRA |

Min. Investment | $20 |

AUM Fees | 0% |

Promotions | New Investor Only: Earn $50 Ark7 Bonus Credits when you invest $1,000 in property shares |

What Is Ark7?

Ark7 is a relatively small fractional real estate investing company that’s focused on driving down investment costs and giving investors access to residential real estate across the United States. With $16 million in properties funded, the company currently distributes more than $60,000 in dividends each month to shareholders. While those numbers seem big, Ark7 is not a huge crowdfunding site yet.

Despite the small size, Ark7 has some outsized advantages, which include a prominent secondary market (where you may be able to sell shares) and access to small-scale residential real estate like single-family homes and townhomes.

What Does It Offer?

Ark7 is a fractional real estate investing company and app that allows you to buy shares of residential real estate for as little as $20. The company focuses on building sustainable cash flow for all investments it offers as well as appreciation to give an exit opportunity.

Buy Shares of Residential Real Estate for as Little as $20

Ark7 allows you to buy shares of residential real estate for as little as $20. Depending on the investment, the initial cost of shares may be much higher than $20, but the low price of a single share makes it possible to own shares of half a dozen or more properties over about a year.

No Monthly Investment Fees

Ark7 will not charge a monthly investment management fee. There is a property management fee (ranging from 8% to 15%), but that is deducted before the dividends are distributed. Ark7 also charges a one-time 3% sourcing fee, and they disclose this on the property listing.

While Ark7 is still a relatively small player in the real estate crowdfunding space, it is refreshing to see a company that is doing away with bogus investment fees and making money through real value-added services like property management.

No Property Management Hassles

Rental income is typically considered passive income, but landlords who manage their own properties know that passive doesn’t necessarily mean hands-off. Simply staying on top of vacancies and maintenance requests from tenants can take several hours each month.

Ark7 removes those hassles by managing all the investments on the site. You’ll pay a competitive property management fee to Ark7, but you’ll never be expected to fix a leaky toilet, find new tenants for a property, or evict a slow-paying tenant. Real estate crowdfunding through Ark7 is truly hands-off investing, so the income you earn is passive income.

Even filing taxes is easier with a crowdfunding site like Ark7. Previously, investors received a 1099-DIV or a K-1, but starting in 2023, investors will only receive a 1099-DIV to make tax filing easier.

Geographically Diverse Investments

Ark7 invests in high-cost-of-living areas, and low cost of living areas, on the coasts and in the heartland. It invests in volatile markets and markets with slow and steady growth. When you buy into the platform, you’ll buy shares of a single investment, but over a year or two you can build diverse real estate holdings with fractional investments all over the United States.

Limited Liquidity

After holding an investment for a minimum period (usually a year or more), an investor can try to sell their shares through Ark7’s secondary market. Depending on your selling price, the performance of the asset, and other factors, the shares may sell quickly or not at all. You shouldn’t go into an Ark7 investment expecting to sell shares anytime soon.

Are There Any Fees?

Ark7 charges an upfront finders fee of 3% when you buy shares through the platform. This one-time fee covers the technology and investment fees for the entire duration of your investment.

You will also pay a property management fee ranging from 8%-15% per property, but that is deducted before the dividends are distributed. This may seem steep, but property management is expensive. Landlords typically expect to pay a property management fee of 10% of the monthly rent to manage a property, and the property management company may not even manage tenant turnover or other aspects of renting the property.

How Does Ark7 Compare?

Ark7 is a real estate fractional investment app with extremely low investment minimums. In many ways, it is similar to Fundrise. The main difference between the two sites is that Ark7 has more of a focus on individual and small multifamily residential real estate offerings whereas Fundrise offers a blend of large multifamily and commercial offerings.

Historically, many fractional investment sites boasted returns ranging from 8-12% annually. Ark7 advertises monthly cash distributions that are a more modest 4-7% annualized cash return with appreciation only coming in when you choose to sell your shares.

Ark7 has a decent secondary market given the size of the platform, but it’s unknown what you may be able to sell for in the secondary market.

Header |  |  | |

|---|---|---|---|

Rating | |||

AUM Fees | None | 1.00% | 0.30% - 0.50% |

Min. Investment | $20 | $10 | $1000 |

Open to Non-Accredited Investors? | |||

Cell |

How Do I Open An Ark7 Account?

You can sign in to browse Ark7 properties simply by connecting your email or social media account to the app or site. To start investing, you must be 18 years old, have a Social Security Number (or Individual Taxpayer ID Number), have a US address, have a US bank account, and an email address and phone number (for multi-factor authentication). Ark7 doesn’t require you to be an accredited investor, but you must be a legal investor in the United States to invest through Ark7.

Is It Safe And Secure?

Ark7’s commitment to privacy and security is incredibly strong. It does not sell or transfer any of your personal information unless doing so is required to complete a transaction. Ark7 clearly discloses all of its third-party arrangements which include a site for processing payments and a site for hosting the company’s secondary market. But information isn’t shared with these partners unless it is required to serve the customers.

No app or website is perfectly safe, but Ark7 has all the technical and business processes in place to protect user information as best as possible.

When it comes to investments, Ark7 has a strong, but limited track record. It advertises target cash-flow rates which makes the expected return easy to understand. However, any given investment may lose money in a given month or over time.

How Do I Contact Ark7?

Ark7 is located at 1 Ferry Building, Ste 201, San Francisco, CA 94111. You can contact customer service by emailing support@ark7.com. You can also schedule a video call using the company’s scheduling service.

Who Is It For And Is It Worth It?

Ark7 offers a low-cost method to start your first real estate investment. It provides diversity, including access to townhomes, single-family homes, and small multi-family investment properties that can be difficult to find on other real estate crowdfunding sites. While Ark7 doesn’t offer trusts with broad diversification, investment minimums on the site are very low, and most people can achieve geographic and investment-style diversification with just a few thousand dollars.

Ark7 won’t be your most lucrative real estate investment, especially compared to house-hacking or other self-managed investments. With a small secondary market, it may be difficult to liquidate shares. But Ark7 offers an easy way to diversify into residential real estate, which is remarkably difficult to do outside of fractional real estate investing sites. If you want to push the easy button on real estate investing, Ark7 may be the right platform to make that happen.

Ark7 Features

Account Types | Taxable and IRA |

Minimum Investment | $20 |

AUM Fees | None |

Annual Property Management Fees | 8%-15% |

Investor Requirements |

|

Secondary Market | Yes |

Fractional Shares | Yes |

Company Address | 1 Ferry Building, Ste 201, San Francisco, CA 94111 |

Customer Service Email | support@ark7.com |

Customer Service Hours | 8 AM - 8 PM PST, Monday - Friday |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | New Investor Only: Earn $50 Ark7 Bonus Credits when you invest $1,000 in property shares |

Ark7 Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Diversification and Risk Management

Overall

Summary

Ark7 is a small, fractional real estate investment platform offering residential real estate investing with low investment minimums and a secondary market to sell real estate shares.

Pros

- Very low investment minimums (ranging from $20 to $100 for a single share)

- Gives you access to residential real estate investments in many fast-growing cities.

- Access to a secondary market to sell real estate shares.

Cons

- Management fees can be fairly high 8-15% compared to hiring a property manager.

- No automatic way to reinvest money at this time.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington