Tastytrade is a low-cost trading platform that allows you to trade stocks, options, and more.

There’s a plethora of commission-free online brokers out there. But if you’re an active trader who frequently trades options, you need a platform that has the investing tools you need while still being low-fee.

That’s where tastytrade, a newer player in the online brokerage place, could come in handy.

This low-commission broker lets you trade options, futures, stocks and ETFs, and even cryptocurrency. If you’re looking for an affordable way to trade options and futures and in-depth trading tools, tastytrade could be the right brokerage for you.

tastytrade Details | |

|---|---|

Product Name | tastytrade |

Products | Stocks, ETFs, Options, Futures, Cryptocurrency |

Min Deposit | $0 |

Fees | $0 for Stocks and ETFs, Fees for Options, Futures, Crypto |

Promotions | Earn Up To $5,000* |

What Is tastytrade?

Tastytrade is an online brokerage based in Chicago, Illinois that began in 2017. This retail broker states it provides “professional-grade, world-class technology to retail traders at industry-leading prices.”

Despite being a younger company, the team behind tastytrade is anything but green. In fact, tastytrade's co-founders Scott Sheridan and Tom Sosnoff were previous co-founders of thinkorswim, a trading platform that focuses on options and futures trading.

Considering the team’s background, it’s no surprise that tastytrade also focuses on derivatives trading, equity options, futures, and futures options.

What Does It Offer?

Tastytrade is different from your average online broker that focuses on commission-free stock and ETF investing.

Tastytrade still lets you invest in stocks and ETFs without paying fees. But the company really caters to active traders who primarily deal in options and futures, so it’s not for passive investors.

But if you want robust research tools and affordability for options and future trading, tastytrade certainly has some enticing features to try out.

Different Account Types

One common drawback of newer online brokerages is a lack of account types. However, tastytrade doesn’t suffer from this problem, and you can open a variety of investing accounts to suit your needs.

Tastytrade account types include:

Individual Accounts: Open a margin trading or cash account. Note that you must maintain a minimum balance of $2,000 to access margin trading.

Retirement Accounts: Tastytrade includes Traditional, Roth, and SEP IRAs.

Entity Accounts: Open a corporate account for a C-Corp, S-Corp, LLC, or Partnership. You can also open trust accounts.

Joint Accounts: Tastytrade lets you open a tenants in common account or a “with rights of survivorship” (WROS) account.

One advantage of tastytrade is that it also offers individual cash and margin accounts plus joint accounts to international customers. Currently, tastytrade supports traders in dozens of countries alongside the United States and is continuing its international expansion.

According to tastytrade, approval for domestic accounts typically takes one to three business days. International accounts take up to five to seven business days for approval. Overall, tastytrade offers a healthy range of account types and is continuing to expand its international availability.

Multiple Investing Options

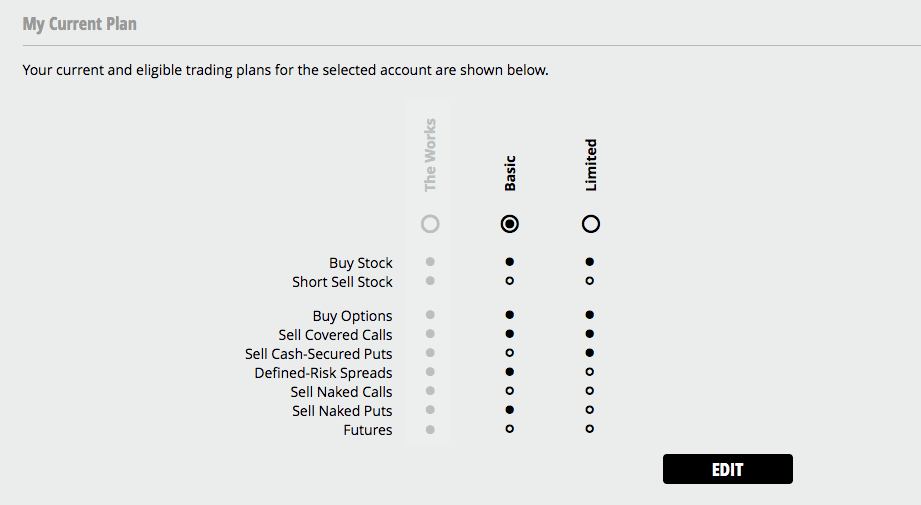

When you sign up for tastytrade, you complete a brief investor profile that outlines your investing experience, goals, and financial situation. You then get a trading level based on your investor profile that determines which trading features you have access to.

For example, if you’re a beginner investor, you might have a “Limited” trading level, which restricts short selling, futures, and selling naked calls and puts.

However, tastytrade lets you upgrade your account to unlock more features. And upgrading just depends on how you self-report on your investor profile, so you don’t have to pay more to get more features.

The most robust trading plan on tastytrade is The Works. This individual margin account supports trading for:

- Covered and uncovered options

- Covered and uncovered options spreads

- Futures

- Options on futures

- Stocks and ETFs

As for actually placing trades, you use tastytrade's mobile app, desktop portal, or web application. Investors have several order types as well, including:

- Limit

- Stop Limit

- Market

- Stop Market

- Bracket and Conditional Orders

- Good until canceled and good until date orders

Overall, tastytrade gives you way more investing options than sticking with a robo-advisor or simpler investing apps like Robinhood.

Cryptocurrency Trading

If you want to add cryptocurrency to your portfolio, you’re in luck. Tastytrade now lets customers invest in crypto after enabling this feature in their accounts, similarly to upgrading their account plan.

You enable crypto trading for your account under the “Trading Preferences” tab. Enabling crypto trades creates a crypto wallet with Zero Hash, tastytrade's crypto custodian.

From there, you place crypto trades similarly to stock and futures orders. Order types include dollar amount, market, and limit, and there’s a $1 trading minimum on crypto orders.

Currently, tastytrade supports the following cryptocurrencies, including:

Note that crypto trading is only available for an individual cash or margin account. Tastytrade is expanding trading to account types like IRAs and joint accounts, but for now, companies like Bitcoin IRA are a better choice for IRA crypto investing.

Additionally, if you want more coin support and options like crypto staking to earn passive income, crypto exchanges like Coinbase or Gemini are better than tastytrade.

Trading Tools And Charts

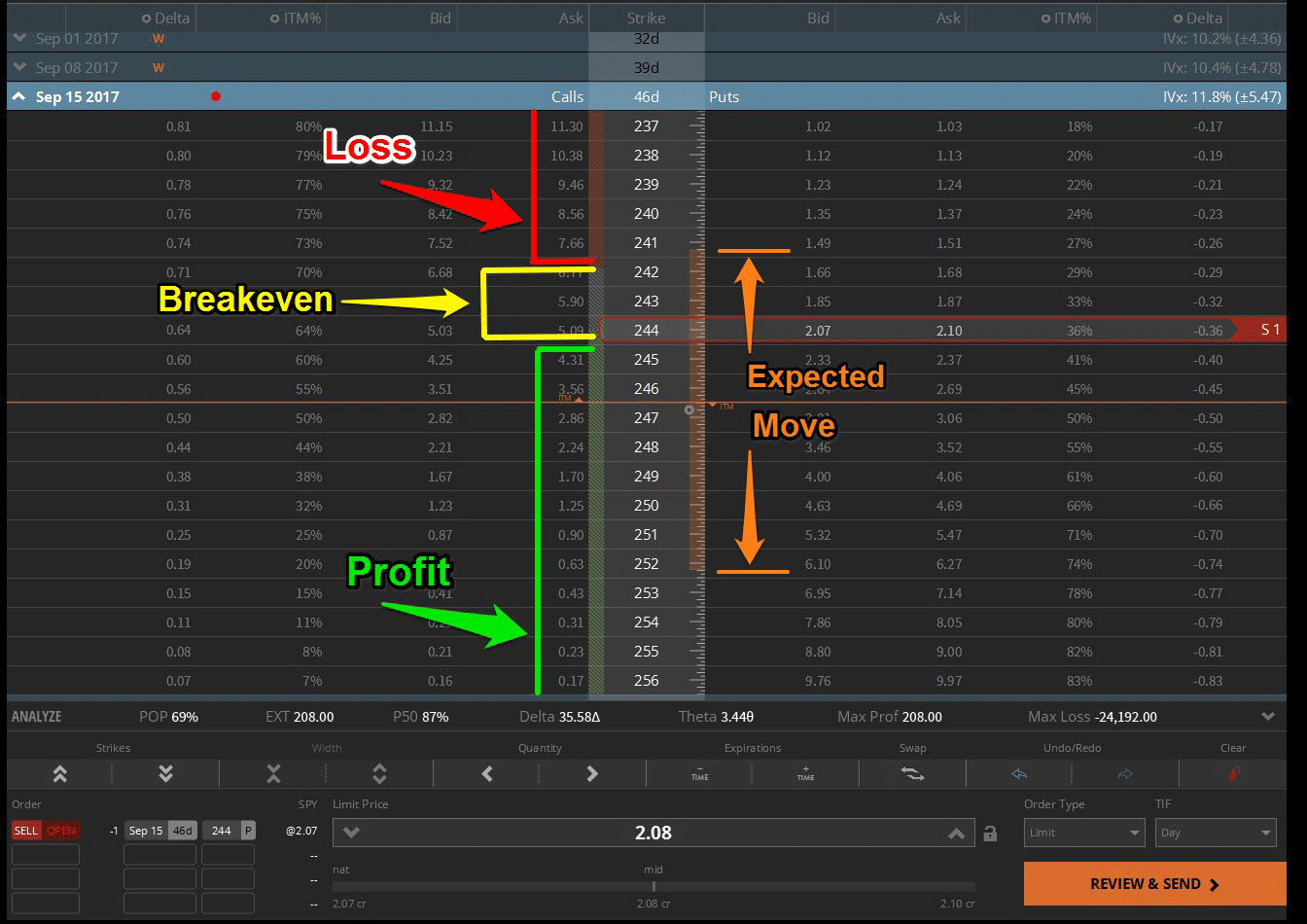

Tastytrade lets you trade through its mobile app, web version, or desktop app. But if you’re an active trader and want the most trading tools possible, downloading the free desktop app is your best option.

Tastytrade also shines for options traders. Some useful trading tools you get include:

- Curve Analysis: Set up trades using a table view or curve view to visualize profit, breakeven, and loss areas.

- Trading Strategies: Utilize trading strategies like iron butterfly options and iron condor.

- Quick Order Adjustments: Quickly adjust unfilled orders with a single click and cancel, replace, duplicate, or invert them.

- Percent Of Profit: Tastytrade lets you lock in winners at various profit targets so you can place options trades and choose when the order closes automatically so you don’t have to stare at your account all day.

Technical Indicators: Create your own watchlists and use charting tools with indicators like delta, gamma, theta, vega, and implied volatility.

For complete beginners, this can be overwhelming, especially if you’re using its desktop application. This is because of the amount of data you get and number of technical indicators you can use for options trading.

However, tastytrade desktop version is for high-volume traders who need incredibly fast quotes, order execution, and as much data as possible.

The web-based version is slightly toned-down, but you still get most of the charting and visualization tools you get with the desktop app. And if you prefer trading on the go or want to watch your options and futures trade while away from your computer, the mobile app has you covered.

Education Modules

Tastytrade caters to experienced traders who want to actively trade options and futures. But this doesn’t mean you have to be a professional investor to try out the platform.

Additional educational content can be found on tastylive – a separate, but affiliated company of tastytrade. tastylive programming has been in existence since 2011.

tastytrade, which originally launched as tastyworks in 2017, rebranded in 2023.

Also, you can subscribe to the following free newsletters from tastylive:

- Cherry Picks: Get weekly quantitative research reports for breaking news on earnings, trading opportunities, and market movers.

- Cherry Bomb: Get daily pre-market ideas from Tom Sosnoff and Tom Preston.

tastylive offers free modules to learn about options strategies, portfolio management, futures and options for beginners, implied volatility, and dozens of other topics.

Are There Any Fees?

Creating a tastytrade account and downloading the desktop or mobile app is free. But tastytrade charges various fees depending on what you’re trading:

Tastytrade Pricing and Fees | ||

|---|---|---|

Cell | Opening Commission | Closing Commission |

Options On Stocks & ETFs ($10 Max Per Leg) | $1 per Contract | $0 |

Options On Futures | $2.50 per Contract | $0 |

Options On Micro-Futures | $1.50 per Contract | $0 |

Stocks and ETFs | $0 | $0 |

Futures | $1.25 per Contract | $1.25 per Contract |

Micro-Futures | $0.85 per Contract | $0.85 per Contract |

Smalls Futures | $0.25 per Contract | $0.25 per Contract |

Smalls Options Futures | $0.50 per Contract | $0 |

Cryptocurrency | 1% of Purchase ($10 Max) | 1% of Sale ($10 Max) |

Having capped commissions really makes a difference for larger trades. For example, making 20 puts/calls on a single leg costs $10 in opening commissions on tastytrade, not $20. Similarly, it doesn’t matter if you’re buying $1,000 of Bitcoin or $5,000; you just pay $10 in opening fees.

Tastytrade also has potential banking fees you should note:

- ACH Deposits and Withdrawals: Free

- Outgoing Domestic Wire: $25

- Outgoing Foreign Wire: $45

- Domestic Check: $5

- Foreign Check: $10

- Returned Check/Wire/ACH Recall: $30

- IRA Closing Fees: $60

Finally, tastytrade has different margin rates depending on your debit balance. For example, a balance of $0 to $24,999 results in an 8% rate, but you can get as low as 5% for having $1,000,000+ in your balance.

You can view a complete list of tastytrade trading fees, bank fees, and margin rates on its website.

How Does tastytrade Compare?

Tastytrade provides a wealth of trading tools and data to help futures and options traders. And, the platform still lets you invest in stocks, ETFs, and cryptocurrencies.

However, if you want more features for stock and ETF investing, like stock screeners and more market news, tastytrade isn’t the best brokerage. In this case, alternatives like Interactive Brokers and Charles Schwab are worth considering.

Header | |||

|---|---|---|---|

Rating | |||

Stocks & ETFs | Commission-Free | Commission-Free | Commission-Free |

Per-Contract Options Fee | $0.50 - $2.50 | $0.65 | $0.65 |

Fractional Shares | No | Yes | Yes |

Cryptocurrency | Yes | No | Yes |

Cell |

tastytrade Promotions

Tastytrade currently offers a great account opening bonus of up to $5,000*, depending on how much you deposit.

Here is the current tiered bonus structure:

Deposit Amount | Bonus Amount |

|---|---|

$5,000 - $24,999 | $100 |

$25,000 - $99,999 | $500 |

$100,000 - $249,999 | $2,000 |

$250,000 - $499,999 | $3,000 |

$500,000 - $999,999 | $4,000 |

$1,000,000+ | $5,000 |

How Do I Open An Account?

Opening a tastytrade account is free. There aren’t account minimums either, but you need $2,000 or more to unlock margin trading. Go here to open an account >>

You open an account by providing your email and picking a username. From there, you choose your country of residence and the type of account you’re opening.

Tastytrade also requires several pieces of personal information to finish opening an account, including your:

- Name

- Address

- Citizen status

- Date of birth

- Employment information

- Phone number

- Social security number

Finally, tastytrade also runs a soft credit check through Equifax, but this doesn’t impact your credit score. If you have a credit freeze, you can submit a government-issued ID and a copy of your social security card, W2, or SSA Benefits Statements instead.

Is It Safe And Secure?

Tastytrade states it encrypts as much data as possible and that it uses industry-standard encryption protocols to keep your personal information secure. It also works with security consultants to audit and improve its security.

Furthermore, tastytrade is a member of the Securities Investor Protection Corporation (SIPC). This can cover customer claims up to $500,000 and up to $250,000 for cash claims.

Tastytrade also has an insurance policy that provides protection for securities and cash up to an aggregate of $600 million. In other words, you get both SIPC protection and additional coverage to supplement SIPC protection.

Finally, you can improve your own account security by enabling features like two-factor authentication via SMS or an authenticator app.

How Do I Contact tastytrade?

Tastytrade uses a chat support system on its website to provide customer service.

To contact tastytrade, you type your question or problem into the live chat box. The website then provides links to relevant help desk articles you can review to potentially answer your problem. If you still need assistance, tastytrade connects you to its customer support team for live chat support instead.

You can also contact tastytrade support at support@tastyworks.com or by calling 888-247-1963.

Why Should You Trust Me?

I have been researching and reviewing investing services and brokerage firms since 2017, and I have a huge passion for investing. I've been involved in the investing and cryptocurrency space heavily since 2020, covering many of the competitors and similar services to tastytrade.

Furthermore, our editor Robert Farrington has been researching and reviewing brokerages since 2015, and has extensive investing experience since starting The College Investor in 2009.

Who Is This For And Is It Worth It?

If you want to actively trade options and futures and enjoy low trading fees, tastytrade is worth using. The range of trading tools you get that are geared towards options trading is also a massive perk. Plus, you still get commission-free stock and ETF trading and decent crypto support.

Tastytrade falls a bit short if you want to invest in equity securities like mutual funds or fixed-income investments like bonds. In this case, using online brokers like Charles Schwab (thinkorswim) is a better choice. And if you’re looking for fractional shares and simple stock and ETF trading, investing apps like Robinhood are better options.

But the bottom line is that tastytrade is one of the best ways to trade options and futures. And, you can always visit tastytrade’s Learn Center to learn the ropes if you’re brand new to this type of investing.

tastytrade Features

Account Types | Individual, Joint, Traditional IRA, Roth IRA, SEP IRA, Corporate, and Trust accounts |

Minimum Deposit | $0 |

Minimum Balance Requirement | $0 |

Commission-Free Stock and ETF | Yes |

Cryptocurrency Investing | Yes |

Fractional Shares | Yes |

Maintenance Fees | No |

ESG Options | No |

Customer Service Number | 888-247-1963 |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | Earn Up To $5,000* |

* Cash bonus amount varies by deposit amount which must be maintained in your account for 12 months. Offer not valid for existing clients who have funded or previously funded an account. Offer expires 12/31/2024. Click here or visit info.tastytrade.com/tasty-offer for full terms, conditions, and restrictions.

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with The College Investor (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

tastytrade was previously known as tastyworks, Inc.

Tastytrade Review

-

Commission & Fees

-

Ease of Use

-

Investment Options

-

Customer Service

-

Tools and Resources

-

Specialty Services

Overall

Summary

Tastytrade is a low-cost stock and options investing platform that has great tools for active options and futures traders.

Pros

- Capped commission structure

- Variety of tools for options traders

- Variety of educational resources for beginner and experienced traders

Cons

- Limited stock screening features and tools for non-options trading

- Limited cryptocurrency support

Tom Blake is a personal finance writer with a passion for making money online, cryptocurrency and NFTs, investing, and the gig economy.

Editor: Robert Farrington Reviewed by: Colin Graves