Axos Invest offers both self-directed investing and a robo-advisor.

New to investing? Sick of high account minimums? Tired of paying trading, management, and rebalancing fees? Axos Invest could be the solution to all of your investing frustrations.

For several years, Axos Invest has operated as a low-cost robo-advisor option. But it has recently added support for Self-Directed Trading of thousands of stocks, ETFs, options, and mutual funds as well. That makes it more of a legitimate competitor to other full-service stock brokers.

Whether you're looking for AI-managed portfolios with low advisory fees or commission-free trades, Axos Invest has products designed to meet your needs. But with so many low-cost brokers and robo-advisors available today, does it have enough unique features to make it a serious contender? Let’s take a look.

Axos Invest Details | |

|---|---|

Product Name | Axos Invest |

Min Invesment | Self-Directed Trading: $0 Managed Portfolios: $500 |

Commissions | $0 $0 for Stock, Options, ETF Trades |

Annual Fee (For Managed Portfolios) | Under $500: $1 Over $500: 0.24% |

Account Type | Taxable, Roth IRA, Traditional IRA, SEP IRA |

Promotions | None |

Who Is Axos Invest?

After witnessing firsthand the often misaligned values of financial advisors and their clients, combined with high minimum investment amounts and unreasonable fees, the idea for Axos Invest was born.

The platform was originally founded by Herbert Moore and Vicki Zhou in 2013. It was previously called WiseBanyan before being acquired by Axos Financial in March 2019.

Despite its new ownership, Axos Invest still served solely as a robo-advisory service for another two years. But that changed at the end of June 2021 when it officially launched its Self-Directed Trading platform.

What Does It Offer?

Axos Invest has products and features that can suit both active traders and long-term investors. It also offers a variety of account types including individual, joint, Traditional IRA, Roth IRA, and SEP IRA.

Axos Invest's brokerage accounts also integrate well with its banking products. For example, if you have an Axos Bank Essential Checking account, you can access and start investing your direct deposit up to two days earlier. Here's what else you need to know about Axos Invest before you decide to open an account.

Commission-Free Self-Directed Trading

Axos Invest clients can now trade thousands of stocks, ETFs, and options commission-free. Unlike its Managed Portfolios product, there is no minimum investment required to open a Self-Directed Trading account.

With a basic account, you'll be charged $1.00 per contract for options trades which is a bit higher than the per contract fee at other leading brokers. You'll also pay a whopping $9.95 commission if you decide to trade one of the 10,000+ no-load mutual funds that Axos Invest offers.

Axos didn't announce support for fractional share investing at the launch of Self-Directed Trading. Hopefully that's a feature that will be added soon to the new platform.

Axos Elite

If you have a 25,000 minimum balance, you can sign up for an Axos Elite Self-Directed Trading account ($10/mo). Here are a few of the additional features and benefits that you get with Axos Elite:

- Margin trading: Rates start at 5.5% (as of January 2023).

- Lower-cost options trading: The per contract options fee drops to $0.80.

- Fully-paid lending: Get paid to lend out shares that you own.

- Research and data: Receive real-time stock quotes and get access to TipRanks research reports.

- Extended hours: Trade until 7 PM (EST).

Note that Axos Elite is a premium tier that carries a monthly subscription cost. As of writing, Axos Elite costs $10 per month.

Managed Portfolios

Axos Invest also offers portfolios of low-cost ETFs that are personalized to your risk tolerance and goals. The management of these portfolios is completely automated. You won't have access to human advisors. However, portfolio rebalancing and tax-loss harvesting are both included.

Accounts over $500 will be charged a 0.24% AUM (asset under management) advisory fee. If you have under $500, you'll be assessed a $1 per month charge. The amount you pay is based on how much you have in your account. For example, if you have a $1,000 balance, your annual fee will be $2.40.

Compared to other robo-advisors (like Betterment), this fee is slightly cheaper. On the other hand, if you're under $500, the $1 per month fee will be slightly higher. However, since Axos Invest has a $500 minimum investment to participate in its Managed Portfolios, the only way that you'd pay the higher AUM would be if your investments depreciated below $500.

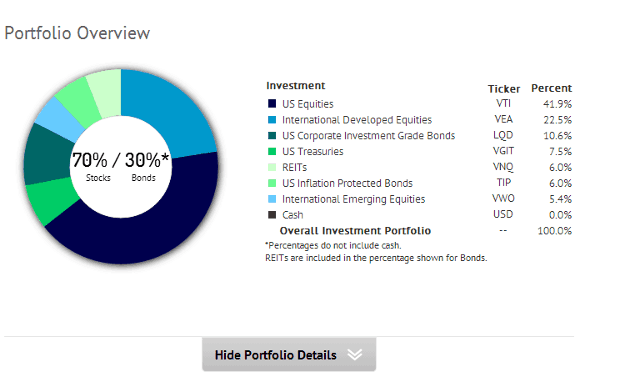

After answering the initial investing questions Axos Invest assigned me a risk score of 7.7. I felt that this was accurate. After my money was deposited I logged back in to my account to see how it was invested. Here’s exactly where my money went:

I was very impressed. It's exciting to see that $500 can be this well-diversified!

Are There Any Fees?

As previously mentioned, options trades come with a per contract fee of $0.80 to $1.00 (depending on whether you have a Basic or Elite Self-Directed Trading account). And mutual funds cost $9.95 per trade.

Managed Portfolios have a 0.24% AUM fee for accounts over $500 and $1 for account below $500. Axos Elite costs $10 per month. And if you decide to transfer your account to another broker (fully or partially), you'll pay a ACAT fee of $75.

How Does Axos Invest Compare?

With the launch of its Self-Directed Trading accounts, Axos Invest can now meet the needs of both active and passive investors. But it's not the only platform that offers free trading and robo-advisor portfolios with low fees. Here's a quick look at how Axos Invest compares:

Header | |||

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Min For Robo-Advisor Portfolios | $500 | $0 | $500 |

Fees For Robo-Advisor Portfolios | 0.24% (or $1) | 0.00% to 0.35% | 0.30% |

Banking? | |||

Cell |

How Do I Open An Account?

Regardless of the type of account that you're opening, it only takes about 10 minutes to get up and running with Axos Invest. But if you're opening a Managed Portfolios account, you’ll be prompted to answer several investing-related questions.

These are scenario-type questions in which you choose what you would do in the particular situation. Based on your answers Axos Invest will assign you a risk score from 1-10 with 1 having a low risk tolerance and 10 having a high risk tolerance.

Axos Invest will automatically invest your money for you into a diversified portfolio with an asset allocation that matches your risk score. But don’t worry - if you’re not comfortable with the risk score Axos Invest assigned you, you can change it.

Is It Safe And Secure?

Axos uses the same encryption technology on its investing platform that it uses to protect its banking customers. Brokerage assets are protected up to $500,000 ($250,000 for cash) by SIPC insurance. And if you also happen to bank with Axos, your deposits are insured up to $250,000 by the FDIC.

How Do I Contact Axos Invest?

Axos has multiple phone lines that are available to its banking customers. However, there is conspicuously no dedicated customer service number for Axos Invest clients.

If you're an existing customer who needs assistance, you can sign into your account and send a secure message. Or if you have a question regarding the account sign-up process, you can contact support@axosinvest.com.

Is It Worth It?

Opening an Axos Invest Self-Directed Trading account could be a good option for occasional traders. I say "occasional" traders because Axos doesn't provide as many advanced trading tools right out of the box.

You get a few more features if you upgrade to Axos Elite. But several brokers provide nearly all the options that you get with Axos Elite without charging the $10/mo fee. For now, active traders might want be better off choosing a different platform such as TD Ameritrade, Ally Invest, E*TRADE, or even Robinhood.

In my opinion, Axos Invest's Managed Portfolios are still its bread and butter. They're competitively priced, include goal-setting tools, and have IRA account options. I'd definitely recommend them to any investors who want robo-advisor services but don't need access to human advisors. Sign up for an Axos Invest account here >>>

Axos Invest FAQs

Let's answer a few of the most common questions that people ask about Axos Invest:

What happened to WiseBanyan?

WiseBanyan was acquired by Axos Financial in March 2019 and was rebranded as Axos Invest later that same year.

Does Axos Invest have a mobile app?

Yes, Managed Portfolios can be viewed and managed on its mobile app which is available on iOS and Android. However, the app doesn't currently support Self-Directed Trading.

How do I get my money out of Axos Invest?

You'll need to log into your account and send a secure message to the Axos team to begin the account closing process. If you'll need assistance with transferring your securities to another broker, you'll be charged a $75 ACAT fee.

Can new brokerage customers qualify for a bonus from Axos?

Maybe. Axos Invest often offers cash bonuses to new clients. Visit its website to see what promotions may be available.

Axos Invest Features

Account Types |

|

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

Mutual Funds | $9.95 |

Options Costs |

|

Self-Directed Trading Account Fee |

|

Managed Portfolios Advisory Fee |

|

Margin Rates | 5.5% (as of January 2023) |

Banking Services | Yes |

Fractional Shares | No |

Tax-Loss Harvesting | Yes |

Automatic Rebalancing | Yes |

Access To Human Advisors | No |

Customer Service Options | Secure message and email |

Customer Service Email | support@axosinvest.com |

Mobile App Availability | iOS and Android (currently only supports Managed Portfolios) |

Promotions | None |

Axos Invest Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Axos Invest is a low-cost robo-advisor and commission-free trading platform that offers a simple and easy-to-use investing experience.

Pros

- Stocks, ETFs, and options trade commission-free

- Low advisory fees

- Lots of account types

Cons

- Mutual fund trades aren’t free

- $500 minimum for Managed Portfolios

- Can’t self-trade fractional shares

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak