Ally Invest has always been a good option for investors. But it never had anything incredibly compelling drawing people to the platform (except for great cash bonus offers).

However, that's changed over the past few years. Now Ally Invest not only offers commission-free investing but it also has one of the advanced trading platforms on the market.

We've decided to take a fresh look at both Ally Invest's Self-Directed Trading accounts as well as their Robo Portfolios. We've listed the platform's pros and cons of at the end of this review as well as any current promos that may be available. Keep reading to see our full Ally Invest review.

Ally Invest Details | |

|---|---|

Product Name | Ally Invest |

Min Invesment | $0 |

Commissions | $0 for stock, option, and ETF trades |

Account Type | Taxable, IRA, and more |

Promotions | None |

What Does Ally Invest Offer?

Ally Invest combines low-cost investing and trading with top-notch tools and features. Here are a few of its most notable features.

Low-Cost Trades

Ally Invest charges no commissions on stocks, ETFs, or options. It does charge a $0.50 per contract fee on options trades, but this a lower fee than many of its competitors charge. Ally Invest also offers a massive number of no-transaction-fee (NTF) mutual funds at over 11,000.

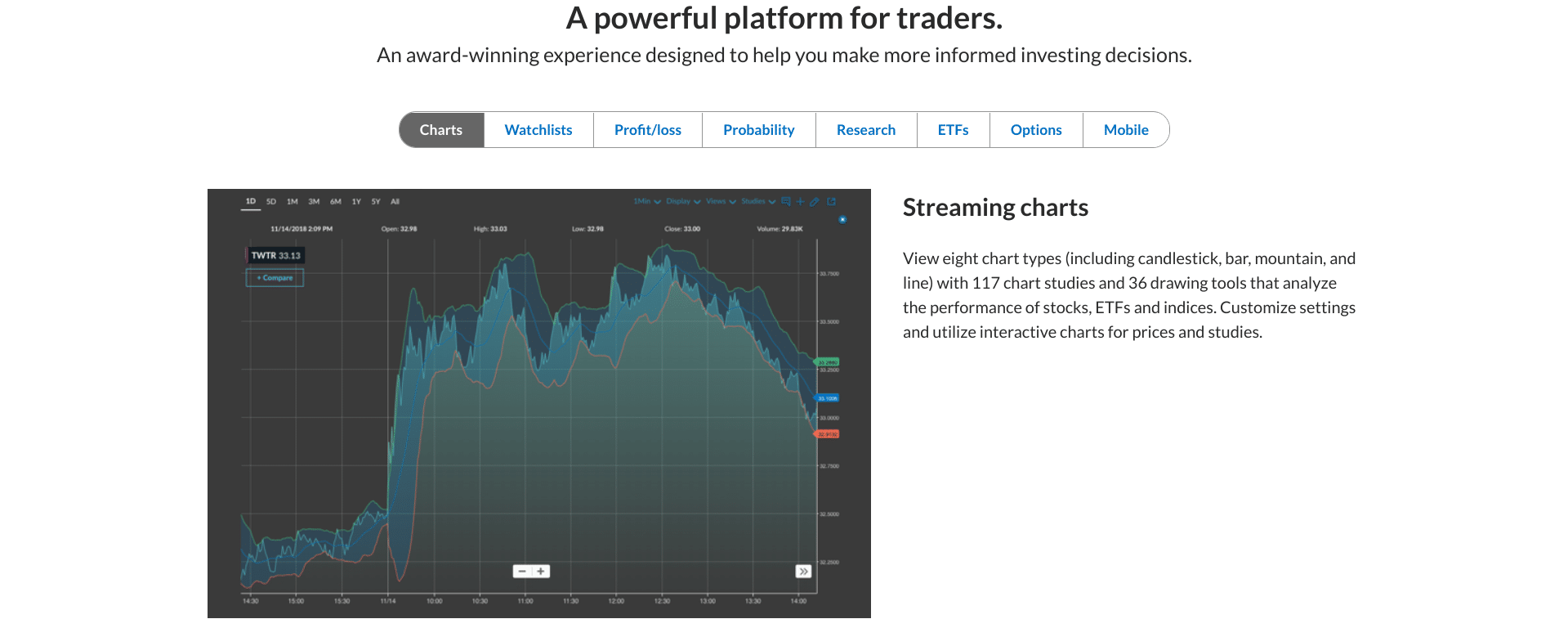

Advanced Tools

The Ally Invest Self-Directed Trading platform is one of the most professional that you'll find. It features 8 different chart types, 117 chart studies, and 36 drawing tools.

Other helpful tools for active traders include a profit/loss graph, probability calculator, and an intuitive options chain. About the only feature that it's currently missing is paper trading.

Robo Portfolios

If you're not interested in active trading, Ally Invest also offers robo-advisor service through its Robo Portfolios. Currently, Ally Invest offers four types of Robo Portfolios:

Each of these portfolios are made up of low-cost ETFs with a $100 investment minimum. And no matter which type that you choose, Ally Invest will provide automatic rebalancing over time.

Impressively, Ally Invest doesn't charge any advisory fees for its Cash-Enhanced Portfolio which has a 30% cash buffer. If that's too conservative for you, you can choose a fund with a lower cash balance, but you'll pay a 0.30% advisory fee.

Tax Management

One of the most difficult tasks for an investor is keeping track of the cost basis for security purchases. The Maxit Tax Manager tool helps investors match a sale lot (number of share sold and price, as of a certain date) with a specific purchase. It makes it easy to sell the right lots based on their cost basis. This feature is very useful.

Bond Laddering

In the Bonds section, Ally Invest offers a Build A Ladder tool. Laddering maturities refers to a portfolio of bonds that mature over time. By laddering maturities, you’ve able to invest dollars in new bonds over time. The ability to reinvest some of your portfolio reduces the impact of changes in interest rates on a bond portfolio. As rates move, you’re reinvesting some of your dollars at current rates. This is a great tool to reduce interest rate risk.

Options Chain

I also liked the choices available on the Options portion of the Trading platforms. Ally Invest provides tools to analyze and set up a variety of options trades. I thought the screen here were clear and straightforward. Ally also offers an Options Playbook educational resource that breaks down the trade setups, risks, rewards and more for 40 option strategies.

Alerts Center

One difficult task for an individual investor is staying informed. Technology provides an overwhelming amount of information. An investor needs specific, timely information on securities that they own.

The Ally Invest alert feature lets you set up alerts for specific securities, or for the broad market. If you own IBM common stock, for example, you can set up a variety of alerts for IBM. You many want any news regarding IBM, or an alert for a large movement in the stock’s price.

You can also set up alerts for the broader markets. For example, you may want to know the stocks with the largest percentage gains and losses on a particular exchange. Your alert can notify you of stocks with the largest trading volume for the day. These tools help you to make informed decisions.

Education

If you choose to invest on your own, you need tools to continually educate yourself. You’ll find an Education tab at the top of the home page. As expected, I found education topics listed by security type (stocks, bonds, mutual funds, etc.).

Are There Any Fees?

As previously discussed, Ally Invest doesn't charge any trade commissions on stock, ETFs, or options. However, options trades are charged a $0.50 per contract fee. Bonds cost $1 per bond (with a $10 minimum)

While there thousands of NTF mutual funds available on the Ally Invest platform, a few do still have a transaction fee of $9.95. Finally, stocks that have a per-share price less than $2 (OTC and Pink Sheet stocks) trade for $4.95 plus $0.01 per share.

There are no account fees with Ally Invest Self-Directed Trading accounts and there are no advisory fees for Robo Portfolios. However, there is a $50 ACAT outgoing fee that is charged if you decide to transfer your account to another brokerage firm.

If you want to compare their costs with other platforms, you can check out every online broker on our Online Stock Brokerage Comparison Tool.

How Does Ally Invest Compare?

Ally Invest is a popular option for those who want access to low-cost trading and investing. But there are a few other top brokers that offer similar features and pricing. Check out this quick comparison chart:

Header |  | ||

|---|---|---|---|

Rating | |||

Commissions | $0 | $0 | $0 |

Min Investment | $0 | $0 | $0 |

Banking | |||

Cell |

How Do I Open An Account?

I thought the process of opening an account with Ally Invest was relatively simple and straightforward. Note that the account application does ask for your Social Security number. However, Ally Invest has a lock icon next to that line on the application and they point out the IT security they use to protect your personal information.

The investing experience section of the application was a bit confusing. The app asks for your experience with stock, bonds and option trading. There is not a “no experience” choice for this section. Instead, the app has levels of experience, such as “less than $5,000 invested”, or “less than 10 trades per year.” I think a choice for no experience would have been helpful.

I received an email once my account application was submitted. My application was approved within 5 minutes and I received a second email which explained the choices I had to fund my account.

Is It Safe And Secure?

Yes, as a member of the SIPC, Ally Invest's brokerage customers are protected up to $500,000 against the company's failure. And Ally Invest provides additional securities coverage of up to $37.5 million. Banking customers also receive FDIC insurance for up to $250,000 in deposits.

When it comes to data security, Ally says that it uses advanced firewalls and Secure Socket Layering (SSL) Technology. It also offers two-factor authentication to help keep your account password secure.

How Do I Contact Ally Invest?

Ally Invest offers 24/7 support from its highly-rated customer service team. You can them by phone at 1-855-880-2559, email them at support@invest.ally.com, or chat live with a customer representative here.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have seen this space evolve from high cost to low cost options, and have seen the amount of investment tools grow for individuals.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Is It Worth It?

Overall, Ally Invest is very user-friendly. The ease of use, along with low costs, make Ally Invest attractive to investors. One of its biggest drawbacks is that it doesn't currently support fractional shares. It also doesn't offer tax-loss harvesting or access to human wealth managers. But other than those few minor disadvantages, Ally Invest offers a full brokerage package at market-leading prices.

If you're thinking about Ally Invest, sign up here and take advantage of the current promotions.

If you want to know about other brokers, check out our Online Broker Comparison Tool.

Ally Invest FAQs

Let's answer a few of the most common questions that we see about Ally Invest:

Is Ally Invest a good Roth IRA?

Yes, Ally Invest's Roth IRA has no account minimum and accounts holders can invest in free robo-advisor portfolios once their account balance reaches $100.

Can I day trade on Ally Invest?

While Ally Invest does not promote day trading on its site, its platform is well-equipped to support it due to its wide variety of technical analysis tools.

Does Ally Invest have socially responsible investments?

Yes, "social responsibility" is one of the themes that it offers for its Managed Portfolios. Its socially responsible portfolio only invests in companies that practice sustainability, energy efficiency, and other green initiatives.

Does Ally Invest offer any bonuses for new clients?

As of right now, there are no bonus offers available.

Ally Invest Features

Account Types |

|

Tradable Assets |

|

Account Minimum | $0 |

Stock Commissions | $0 |

ETF Commissions | $0 |

No-Transaction-Fee (NTF) Mutual Funds | 11,000+ |

Options Costs |

|

Basic Account Fee | $0 |

Managed Portfolios Advisory Fee |

|

Margin Rates | 3.25% to 7.75% (as of August 2021) |

Fractional Shares | No |

Banking Services | Yes |

Customer Service Number | 1-855-880-2559 |

Customer Service Email | support@invest.ally.com |

Customer Service Hours | 24/7 |

Web/Desktop Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | None |

Ally Invest Review

-

Commission and Fees

-

Customer Service

-

Ease of Use

-

Tools & Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Ally Invest offers online a great online trading platform that has low-cost commissions.

Pros

- Commission-free trades

- Managed Portfolios with fee-free option

- Advanced trading tools

- 24/7 customer service

Cons

- No fractional share investing

- Doesn’t perform tax-loss harvesting

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak