Acorns in an automatic investing app that allows you to roundup and invest your spare change (and more).

If you’re anything like me, you probably remember your parents or grandparents filling up cups, jars, cup holders and desk drawers with leftover coins from daily cash spending. Once in a blue moon, you might have rolled these coins and deposited them at the bank. It was a surprisingly effective way to save hundreds or even thousands of dollars each year.

These days, most of us don’t use paper currency, so we rarely have “spare change.” Hoarding coins in jars for a rainy day fund simply isn’t a realistic option. Instead, our money is electronic digits on a screen. As a result, we simply spend our money without wondering what we should do with the “spare change.” However, many apps want to change that habit.

One of the first apps to come out with the spare change concept was Acorns. It’s an app that automates investing, rounds up your transactions, and can function as a starter financial wellness system. It automatically invests your money into a diversified portfolio that makes sense for you.

Since its initial release, Acorns has continued to innovate, and it’s raised the bar for micro-investing apps - and now banking as well! A few of the new feature releases make it reasonable to consider Acorns again. Should you create an Acorns account or is it an overblown app? This Acorns review explains the good and the bad.

Bonus: Right now, Acorns is offering a $20 bonus when you register an account and make your first $5 investment. Get stared here >>

Acorns Details | |

|---|---|

Product Name | Acorns |

Min Invesment | $0 |

Management Fees | $3/mo to $12/mo |

Account Type | Taxable, Traditional, Roth, SEP, UTMA/UGMA |

Promotions | $20 Bonus |

What Does Acorns Do?

Acorns is a micro-investing platform designed around the concept of modern portfolio theory. As an Acorns user, you’ll download the Acorns App and answer a few questions. The app will then recommend an efficient portfolio for you.

Diversified And Low-Cost Portfolios

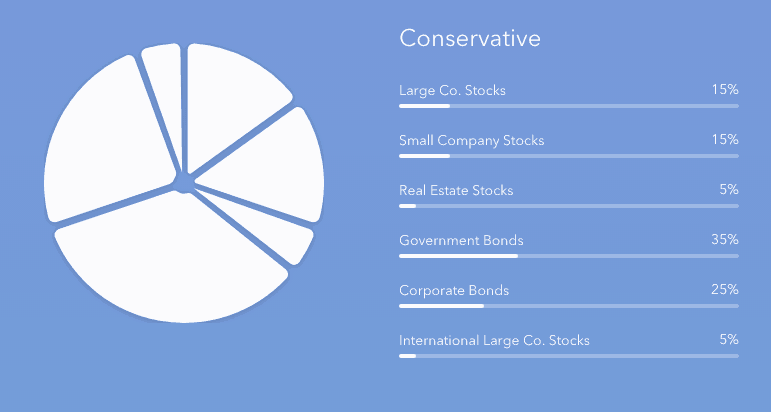

Acorns portfolios range from conservative (lots of bonds) to aggressive (all stocks and real estate).

All the portfolios contain exclusively low cost ETFs from Vanguard and BlackRock. From time to time, Acorns may swap out one ETF for another ETF that tracks the same index. These are the investments that Acorns is using today:

- Large Company - VOO

- Small Company - VB

- Medium Company Stocks - IJH

- Small Company Stocks - IJR

- International Company Stocks - IXUS

- Short Term Bonds - ISTB

- US Aggregate Bonds - AGG

- iShares ESG Aware MSCI USA ETF | ESGU

- iShares ESG Aware U.S. Aggregate Bond ETF | EAGG

- iShares ESG Aware MSCI EM ETF | ESGE

- iShares ESG Aware MSCI USA Small-Cap ETF | ESML

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB

- iShares ESG Aware MSCI EAFE ETF | ESGD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares MSCI USA ESG Select ETF | SUSA

- iShares U.S. Treasury Bond ETF | GOVT

- iShares MBS ETF | MBB

- iShares ESG Aware USD Corporate Bond ETF | SUSC

The expense ratios for the above funds range from 0.03% to 0.25%.

Round-Ups And Recurring Investments

Once you’ve chosen your portfolio, you’ll link your debit and credit cards to the Acorns platform. When you make a transaction, Acorns will “round up” the transaction to the nearest dollar. The round up (or spare change) gets deposited into a holding account.

If you spend $7.55, Acorns will deposit $0.45 into your holding account. When the account has at least $5, Acorns will automatically invest the proceeds into the market.

A new feature that Acorns recently released is “round-up multiplier.” Essentially you can double to 10X your roundups. For example, a $0.45 round-up could automatically become a $.90 round-up if you select a 2x multiplier. If you select a 10x multiplier it will become $4.50. The Round-Ups Multiplier can be adjusted through the app or website.

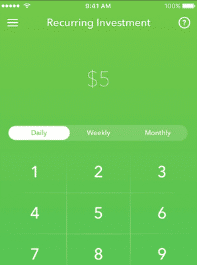

You can also set up recurring investments. For example, you could choose to invest $5 per day on the platform, or $200 per month if you prefer.

If your portfolio gets way out of line, Acorns will engage in rebalancing. In the non-tax advantaged accounts, the rebalancing may have tax implications for you. However, if you opt to set your money into an IRA (using Acorns Later), the rebalancing will not have immediate tax consequences.

Earn Partnerships

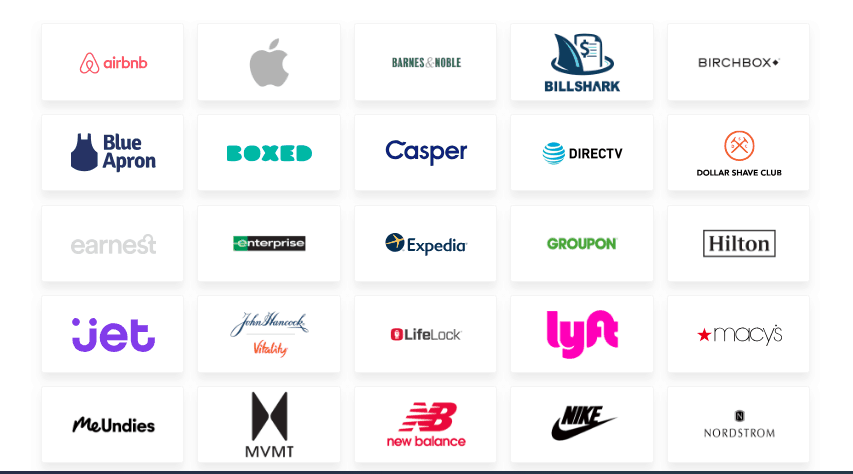

Acorns has also created referral relationships with a number of online retailers and brands. When you use the Acorns app or Chrome desktop browser to purchase from a select list of brands, the companies will deposit Earn bonus investments into your account.

Earn bonus investments range from 1-5% and up to 10% of the purchase price for most retailers. Retailers include Apple, Walmart.com, AirBnB, The Wall Street Journal and more. The Earn concept combines the micro-investing concept with the cashback site concept.

Acorns Early

Acorns Early is a UGMA/UTMA that allows you to save and invest for your child's benefit. The account is in your name, for the beneficiary of your child. This account/savings is NOT a 529 plan - and there are no tax benefits for saving in a UGMA account. However, savings is a good thing, so if this works for you, go for it.

Acorns Early is included in the Acorns Premium pricing level ($12 per month).

This is a very comparable service to Stash Investing. However, if you're looking to save for your children, we recommend using a tool like Backer.

Acorns Checking

Acorns Checking links your Acorns account to a checking account with a debit card that you can use to spend. It's a compelling checking account product - with no overdraft or minimum balance fees, free bank-to-bank transfers, and more. It also offers fee-free cash access at over 55,000 ATMs.

You'll earn 3% APY on your Acorns Checking account and 5% APY in an Acorns Emergency Fund, as long as you are registered in an Acorns $5 and above subscription tier.

Plus, you can earn up to 10% cash back when you use your debit card at certain Earn merchants (which we couldn't find which specific merchants you can earn at - although it appears to be similar to their existing Found Money partnerships).

However, the big drawback with Acorns Checking is that you must be on the $3/mo Acorns Personal plan (which includes a basic Acorns account and a retirement account). Compared to other free checking products (like Chime), this is a big drawback.

Other Features

Acorns Earn Chrome Extension- This was added to make it easier to find and redeem bonus investment offers while you browse your favorite brands.

Job Finder- In partnership with ZipRecruiter, Acorns recently added its Job Finder experience which make it easy to explore millions of full-time, part-time, and remote jobs to earn more money.

GoHenry- On the Acorns Premium plan, you can setup banking for kids with GoHenry.

How Much Does Acorns Cost?

Acorns recently added a Premium plan, so they now have three pricing levels:

- Bronze: $3 per month

- Silver: $6 per month

- Gold: $12 per month

Acorns Bronze - $3/mo

Acorns Bronze is the company's flagship product today. It allows you to put your spare change to work with Round-Ups. This is the product that Acorns started with, and is their bread and butter.

When you combine Found Money and all your round ups, most people will invest at least a few hundred dollars every year. Saving and investing the change can make a huge difference when you’re just getting started.

Acorns Bronze also includes "Later" (which is a retirement account) and "Banking." Honestly, combining banking and retirement savings at this level makes a lot of sense. And the pricing isn't terrible for what you get.

Acorns Silver - $6/mo

Acorns Silver combines everything from the Bronze plan, and adds Premium Education, Round-Ups, and the ability to set up recurring investment contributions. You also receive a 25% bonus on your Acorns Earn rewards.

At the Silver level, you also get a 1% IRA Match on new contributions to your Acorns Later IRA.

Acorns Gold - $12/mo

Gold is Acorns newest plan, and for $12/mo, it adds several features, including custom portfolios, giving you the option to pick individual stocks for your portfolio, live Q&A's with financial experts, a complimentary will service, $10,000 in life insurance, and a 50% match on your Acorns Earn rewards (up to $200 value).

Acorns Gold also includes Acorns Early which is their UGMA account that allows you to save for your children. You can also add multiple children at no additional cost.

The benefit of an UTMA/UGMA account is that it can be used for anything that benefits the child, so things like housing, technology, travel, etc. But we'd still rather see the saving going into a 529 plan rather than a taxable account, especially since this plan will set you back an extra $6 per month.

Every Acorns Gold subscription includes a free GoHenry account. GoHenry is an app that's designed to help parents teach their children about money. Kids and teens get access to a debit card with more than 45 customizable designs, and parents receive notifications so they can keep track of where and how their kids are spending money. For more details, check out our GoHenry review.

Finally, Acorns Gold has a 3% Acorns Later Match Bonus for new contributions.

Evaluating Acorns Fees

Aside from the management fee, Acorns does not charge transaction fees. That means you can deposit a lump sum (up to $20,000 per day) into your Acorns account and you can withdraw money at any time without transaction costs.

Are these prices worth the services that Acorns provides? Let’s say you save $50 through round-ups your first month. Then you pay a $3 maintenance fee. In that case, you’re paying a 6% management fee your first month. But as your portfolio grows, the ratio shrinks.

If you end up investing $1,000 your first year, you’ll pay $36 in management fees. That’s an effective 3.6% management fee which is again very high. Remember, Acorns isn’t offering tax-loss harvesting. And the ETFs they offer can be purchased for free from a traditional brokerage.

That said, Acorns newer features may make the platform worthwhile for more users. If you set up regular contributions, you could save $6,000 in an IRA or Roth IRA and even more in a SEP-IRA (depending on your income and the IRA contribution limits).

When you take into account that Acorns automatically rebalances for you, a $3 per month flat fee could actually be a great deal for larger accounts. For example, if you invested $25,000 with Acorns, your AUM costs would be less than 0.15%. And since you’d be inside a tax-advantaged account, tax-loss harvesting would be unnecessary.

But I suspect that most people with smaller accounts won’t earn enough in round-ups and Found money to offset the monthly cost. If you're concerned about the pricing, check out our list of places to invest for free.

How Does Acorns Compare?

Acorns is a popular robo-advisor investing app, but it's definitely not the only one. Here's a quick comparison of some of the other popular investing platforms.

Header | |||

|---|---|---|---|

Rating | |||

Management Fee | $3/mo to $12/mo | 0.25% to 0.40% | 0.25% |

Min Investment | $0 | $0 | $500 |

Advice Options | Auto | Auto and Human | Auto |

Banking | |||

Cell |

How Do I Contact Acorns?

Like other robo-advisor platforms, Acorns focuses more on automation than human support. Its Help Center doesn't even publish a customer service number or email address.

However, with a little digging we were able to find a support number: 855-739-2859. It should also be noted that Acorns does provide live chat support on its website and within the app.

Why Should You Trust Us?

I have been writing about and reviewing investment firms and brokerages since 2009, and have reviewed almost every US-based investment firm open to individual investors. I have seen this space evolve from high cost to low cost options, and have seen the amount of investment tools grow for individuals.

Furthermore, we have been polling our audience for years to find out which investment firms they trust and use, and that's how we put together our annual rankings of the best investment companies.

Finally, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is Acorns For And Is It Worth It?

Opening an Acorns Bronze account ($3/month) can make sense for people who need a little push to invest. The round-ups plus a modest $100-$200 monthly automatic deposit will get you well on your way towards saving for retirement.

If you haven’t started investing for retirement yet, I think the $3 per month option can be a good deal that will pay long term dividends for you (literally and figuratively). However, if you'd only be paying the fee to get access to the Acorns Checking account, I wouldn't do it. Most people can get a free checking account with similar benefits.

It's hard for us to see a reason to use the higher levels (for higher prices). While the IRA match is nice, you can get a similar match at Robinhood using their Gold subscription for just $5 per month.

The bottom line is that Acorns is expensive - relatively. If you're investing low amounts, the percentage is a big bite of your money. However, if you need the boost and automatic saving portions, then check it out.

Acorns FAQs

Let's answer a few of the most common questions that we see about Acorns.

Is it safe to invest with Acorns?

Yes, Acorns is an SIPC member which means that its customer's securities would be protected up to $500,000 ($250,000 limit for cash) if it were to fail as a brokerage firm.

Does Acorns offer a free plan?

No, the cheapest plan that Acorns offers is its Bronze plan which costs $3 per month.

Can you quit Acorns?

Yes, there are no lock-ups with any of Acorns investment options so you can close your account or cancel your subscription at any time.

Does Acorns offers any bonuses or incentives for new customers?

Yes, Acorns is currently offering a $20 cash bonus to customers who open new accounts.

Acorns Features

Account Types |

|

Minimum Investment | $0 |

Management Fees |

|

ETF Expense Ratios | 0.03% to 0.25% |

Socially Responsible Investments | Yes |

Access to Human Advisor | No |

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | No |

Customer Service Options | Live chat, phone, Help center |

Customer Service Phone Number | 855-739-2859 |

Web/Desktop Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | $20 cash bonus |

Acorns Review

-

Commissions and Fees

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Investing Options

-

Specialty Services

Overall

Summary

Acorns is an app-based investing service that allows you to round-up your purchases and automatically invest that amount. They have also added a suite of banking and saving for college options as well.

Pros

- Easily allows you to automatically invest for the future

- Banking options allow for better savings habits

- $20 bonus for opening an account

Cons

- The pricing structure is expensive for those with just a little bit of money

- The investment options are limited compared to other platforms

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves