The first data is now available for how student loan borrowers are doing with student loan repayments restarting.

The U.S. Government Accountability Office (GAO) has published preliminary observations on borrower repayment after the end of the payment pause and interest waiver. Additional historical data was obtained from the Federal Student Loan Portfolio section of the FSA Data Center.

Although the number of borrowers who are current on their federal student loans is greater now than before the pandemic, the percentage of borrowers in repayment who are current is lower. This is partly because the 12-month on-ramp temporarily suppressed repayment activity by nearly 10 million borrowers and partly because more borrowers have been added to the federal student loan portfolio since the start of the pandemic.

In addition, more borrowers qualify for a zero payment under the SAVE repayment plan than under the REPAYE plan, because the discretionary income threshold increased from 150% to 225% of the poverty. Borrowers with a calculated payment of zero count as current on their loans.

Let's dive into the data and see how borrowers are responding to the restart of student loan payments.

History Of The Student Loan Payment Pause And Interest Waiver

Section 3513 of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) [3/27/2020, P.L. 116-136] authorized a payment pause and interest waiver on federal student loans. The payment pause was retroactive to March 13, 2020 and expired on September 30, 2020.

The payment pause and interest waiver was extended a total of eight times, two times by President Trump and six times by President Biden. President Trump extended the payment pause through December 31, 2020 and January 31, 2021. President Biden extended the payment pause through September 30, 2021, January 31, 2022, May 1, 2022, August 31, 2022, December 31, 2022 and September 30, 2023.

The January 31, 2022 and December 31, 2022 extensions were identified as the “final” extensions, but were followed by additional extensions.

Further extensions were blocked by the Fiscal Responsibility Act of 2023 [6/3/2023, P.L. 118-5], which scheduled the restart of repayment for 60 days after June 30, 2023. Interest began accruing on September 1, 2023 and repayment restarted in October 2023.

The payment pause lasted more than three-and-a-half years, a total of 1,297 days (42 months and 18 days). More than $208 billion in interest was waived during the payment pause.

Student Loan On-Ramp Period

The U.S. Department of Education was concerned about the challenges of restarting repayment after so many years of non-payment, so they implemented a 12-month “on-ramp” to protect borrowers from negative credit reporting if they failed to make payments.

Normally, federal student loan borrowers are reported as delinquent to the three credit bureaus when they are more than 90 days past-due.

During the 12-month on-ramp, however, the U.S. Department of Education implemented retroactive administrative forbearances when borrowers were 90 days past due. Interest continued to accrue during these forbearances, but about 6.7 million delinquent borrowers were shielded from negative credit reporting.

Fresh Start Initiative

The U.S. Department of Education also implemented the Fresh Start Initiative, which restores defaulted borrowers to a current status without requiring them to rehabilitate the loans by consolidating them or making a number of on-time voluntary payments. Technically, the payment pause counted as though the borrowers had made the on-time payments required by loan rehabilitation.

The Fresh Start Initiative removed the default from the borrower’s credit history. It also suspended enforced collection methods for defaulted federal student loan debt, such as wage garnishment and Treasury offset of income tax refunds and Social Security disability and retirement benefit payments.

7.8 million borrowers were in default prior to pandemic. After implementation of the Fresh Start Initiative, 6.0 million borrowers are in default.

Current Status Of Federal Student Loans

The following tables show the status of outstanding federal education loan debt as of January 2024. It's important to note that while student loan repayments resumed in October 2023, loan servicer issues did leave borrowers in administrative forbearance for months.

Loan Status (Jan 2024) | Borrowers | Dollars |

|---|---|---|

Current | 17.8m (53%) | $706B |

Past Due | 9.7m (29%) | $290B |

Deferment or Forbearance | 5.8m (17%) | $254B |

Totals | 33.2m | $1.25T |

For borrowers who were current on their student loans, here's what their payments looked like.

Specifically, 14% of all Federal student loan borrowers, or 4.5 million people, had loan payments equal to $0 per month. This also represents 30% of all Federal student loan dollars. The large increase in $0/mo payments is also the cause of an 80X rise in the cost of the student loan program.

Payment Amount | Borrowers | Dollars |

|---|---|---|

Payment Greater Than $0 | 13.3m (40%) | $494B |

$0 IDR Payment | 4.5m (14%) | $212B |

Past-due borrowers included borrowers who were one or more days late. Six million borrowers, or 60% of the past-due borrowers, were 91-120 days past due. These borrowers represented most of the 6.7 million borrowers ($186 billion) in the on-ramp who were shielded from negative credit reporting. The breakdown of past-due borrowers were as follows:

- 1 - 30 Days Late: 2.4 million (24%)

- 31 - 60 Days Late: 0.8 million (8%)

- 61 - 90 Days Late: 0.8 million (8%)

- 91 - 120 Days Late: 6.0 million (60%)

Student Loan Repayment Plan Choices

This table shows the distribution of borrowers among repayment plans.

Repayment Plan (Jan 2024) | Borrowers | Dollars |

|---|---|---|

Non-IDR Plan | 20m (61%) | $549B |

SAVE | 7.3m (22%) | $397B |

Other IDR Plan | 5.5m (17%) | $304B |

Totals | 32.8m | $1.25T |

For borrowers in the SAVE repayment plan, here's what the payments look like:

SAVE Payment Amount | Borrowers | Dollars |

|---|---|---|

Payment Greater Than $0 | 2.6m (42%) | $180B |

$0 Payment | 3.6m (58%) | $153B |

For borrowers in other IDR repayment plans, here's what the payments look like:

Other IDR Payment Amount | Borrowers | Dollars |

|---|---|---|

Payment Greater Than $0 | 3.3m (77%) | $195B |

$0 Payment | 1.0m (23%) | $62B |

Note that only 6.2 million (85%) of the borrowers and $333 billion of the dollars (84%) in the SAVE repayment plan had a scheduled payment as of January 31, 2024, including a zero payment. Likewise, 4.3 million of the borrowers (78%) and $257 billion of the dollars (85%) in other IDR plans had a scheduled payment.

Overall, 44% of borrowers and 36% of dollars in IDR plans, including the SAVE repayment plan, had a zero monthly payment.

⚠︎ SAVE Student Loan Repayment Plan Lawsuits

Two lawsuits were filed to block implementation of the SAVE repayment plan. One succeeded in getting a preliminary injunction, pending appeal. As a result, the U.S. Department of Education placed the 8 million borrowers in the SAVE repayment plan in an interest-free forbearance on July 19, 2024.

- 11 Republican states filed a lawsuit in the U.S. District Court for the District of Kansas on March 28, 2024, seeking to block implementation of the SAVE repayment plan. The Kansas court issued a ruling on June 24, 2024, blocking the parts of the final rule that had not yet gone into effect. On June 30, 2024, the U.S. Court of Appeals for the 10th Circuit issued a stay of the Kansas court ruling pending appeal.

- 7 Republican states filed a lawsuit in the U.S. District Court for the Eastern District of Missouri on April 9, 2024, opposing the SAVE repayment plan. The Missouri court issued a ruling on June 24, 2024, blocking the forgiveness part of the rule. After the 10th Circuit appeals court decision, the plaintiffs appealed the Missouri ruling to the U.S. Court of Appeals for the 8th Circuit, seeking to block the entire rule. On July 18, 2024, the U.S. Court of Appeals for the 8th Circuit issued a stay blocking implementation of the SAVE repayment plan. The 8th Circuit subsequently replaced the stay with a preliminary injunction on August 9, 2024. The U.S. Department of Justice filed an emergency application to the U.S. Supreme Court on August 13, 2024, asking the court to vacate the 8th Circuit’s injunction after the 8th Circuit refused to clarify whether its ruling applied only to the SAVE repayment plan and not all income-driven repayment plans.

- The U.S. Supreme Court denied the request to vacate the injunction on August 28, 2024.

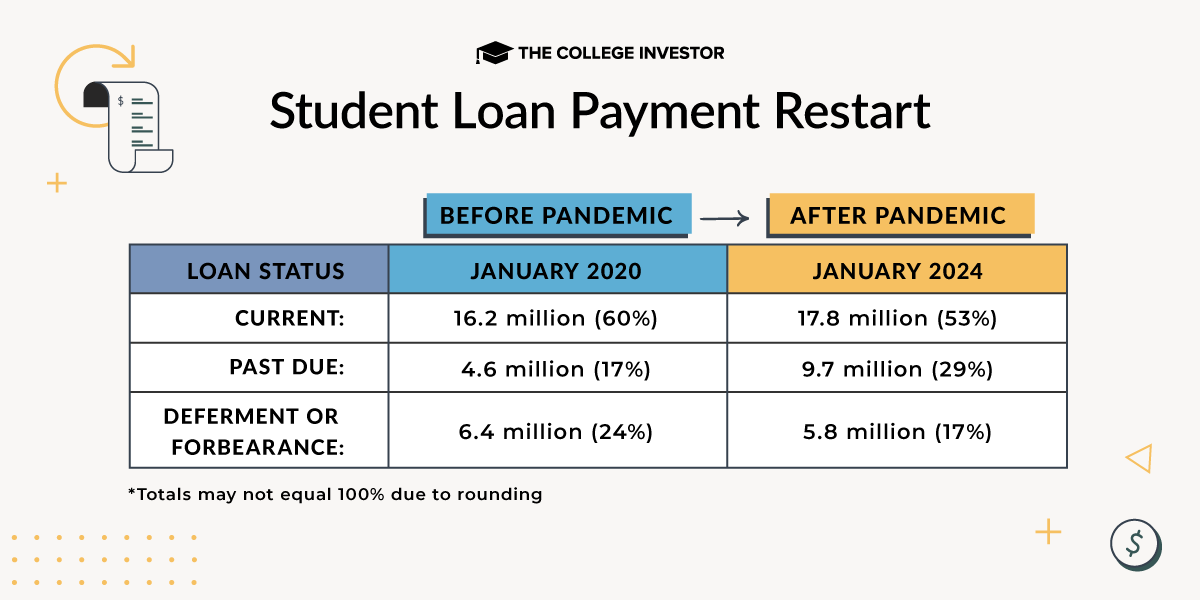

Status Of Federal Student Loans Compared To Pre-Pandemic

The following tables show the status of outstanding federal education loan debt before and after the pandemic. This compare the repayment status of Federal student loans in January 2020 (from before the pandemic) to January 2024.

Although the number of borrowers who are current increased, the percentage decreased, in part because the number of borrowers in repayment increased by more than 5 million. The number of borrowers in repayment includes borrowers who are current, past due, in deferment and in forbearance.

The number of borrowers who are past due doubled, in part due to the on-ramp.

The distribution of borrowers by loan status is likely to change significantly after the on-ramp expires on September 30, 2024. Some of these borrowers will start repaying their student loans and some will obtain a deferment or forbearance, with the rest remaining in a past-due status.

This repayment behavior is better than expected despite the prolonged period of the payment pause.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Robert Farrington