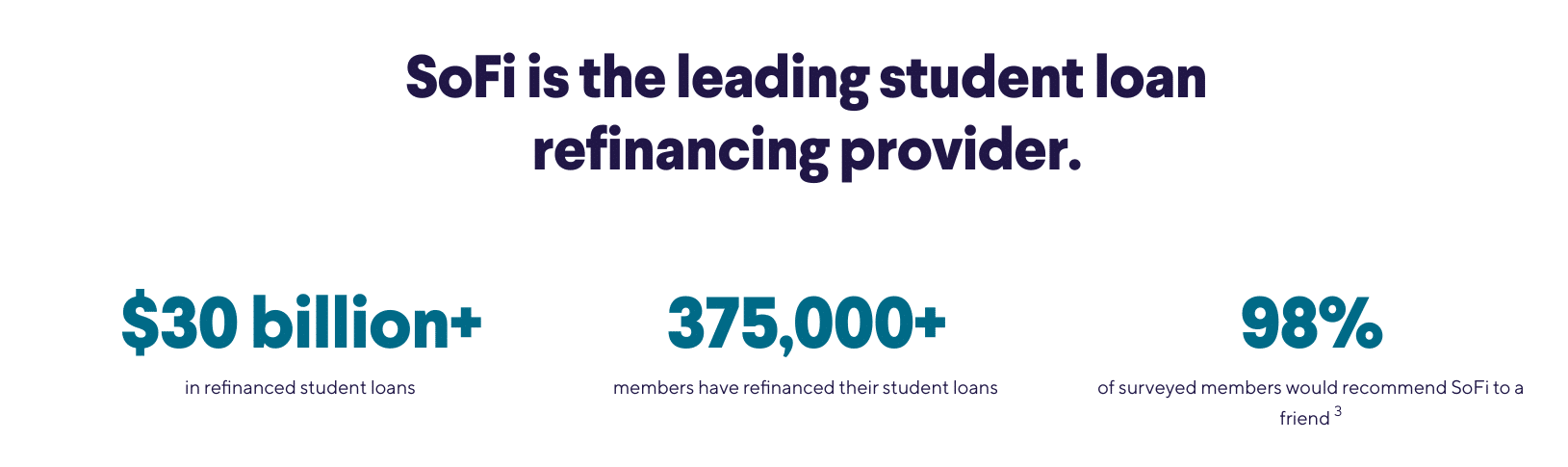

SoFi (short for Social Finance) started as a small company with just one product, student loan refinancing. Today, the company offers a variety of loans and financial services, including banking. But student loan refinancing is still its signature product. SoFi is also working to become a market leader in private student loans as well.

Over the years, it has grown into the largest and most well known student loan refinancing lender. I personally attribute them to making student loan refinancing as mainstream as it is today. However, SoFi is not without its growing pains. And it's hard to know if they're still the best with all the other competitors out there.

Note: We've been dissatisfied with them for several issues that we share throughout our review. So we don't recommend them. Basically, our opinion is that they are not the best in banking, in loans, or in investment, but your experience may differ and they could be the right choice for you.

Are the rates at SoFi still compelling? Are the borrower perks still unique? Do they still offer great student loan bonuses?

The answer is "sometimes" - and that's why SoFi always makes it into our list of the Best Places To Refinance Your Student Loans.

Even if you're leaning towards SoFi, you need to shop around for your student loan lender. We recommend doing this through Credible, a marketplace for student loan refinancing where you can receive and compare offers from multiple student loan refinancing lenders. Don't forget to take advantage of the $1,000 gift card bonus if you refinance with Credible.

This article explains what to expect if you take out a private student loan or refinance your existing loans with SoFi.

Quick Summary

- One of the most well-known student loan refinancing companies

- Very low rates for highly-qualified borrowers

- Variety of other financial products, including banking

SoFi Student Loan Refinancing

SoFi is a market leader in student loan refinancing. It become one of the first companies to really provide an online experience in this space and continues to be a great option. And student loan refinancing is still what they're most well known for.

One unique aspect of borrowing with SoFi is its emphasis on career growth. As a borrower, you will qualify for free career coaching and local networking events. These personalized services can help push you towards a higher income and faster debt repayment.

Rates And Terms

SoFi offers borrowing terms of 5,7,10, 15, or 20 years on fixed and variable rate loans. The minimum amount you can refinance is $5,000 ($10,000 in California).

Current SoFi rates are as follows.

Fixed:

- 4.99% - 9.99% APR (with AutoPay)

Variable:

- 6.24% - 9.99% APR (with AutoPay)

Remember, these rates do change. So please check their website for the latest rates.

SoFi consistently offers rates that are among the lowest in the country. Other than competitive interest rates, SoFi’s loan offerings aren’t particularly exceptional.

The only lender we've seen with sometimes better rates is Splash Financial.

SoFi Student Loan Refinancing Details | |

|---|---|

Product Name | SoFi Student Loan |

Min Loan Amount | $5,000 |

Max Loan Amount | None |

Variable APR | 6.24% - 9.99% APR |

Fixed APR | 4.99% - 9.99% APR |

Loan Terms | 5,7,10, 15, or 20 years |

Promotions | None |

Unique SoFi Repayment Programs

SoFi does offer some unique repayment programs that could benefit some. For example, they have a program for medical and dental residency candidates that offer $100/mo payments while in residency (for up to 4 years).

This can be a life saver to doctors and dentists who are still in training, and only earning $50,000 per year, but have $200,000+ in student loan debt.

Also, SoFi does allow for borrowers to refinance Parent PLUS Loans. Parent PLUS Loans are some of the most difficult Federal student loans to deal with, and refinancing is typically the best option if possible.

How Does SoFi Refinancing Compare?

SoFi is far from the only lender in the student loan refinancing space. While they were one of the first, many other lenders have emerged that are strong competition. However, SoFi is still consistently listed on our best places to refinance your student loans.

They have some of the best rates for highly qualified borrowers. Check out this quick comparison here:

Header |  |  | |

|---|---|---|---|

Rating | |||

Variable APR | 6.24% - 9.99% | 5.28% - 9.99% | 5.28% - 8.99% |

Fixed APR | 4.99% - 9.99% | 4.89% - 9.99% | 4.84% - 8.69% |

Bonus Offer | Up to $1,000 | Up to $500 | Up to $1,100 |

Cell | Cell |

You can also check out our full comparison of SoFi to Earnest here.

SoFi Private Student Loans

SoFi also offers private undergraduate and graduate student loans. These loans are extremely competitive with both rates and repayment terms.

They also offer parent loans to pay for college, which not many other lenders offer.

Rates And Terms

SoFi undergraduate and graduate private loans have some of the best rates and terms available to borrowers.

With SoFi, you can borrow up to 100% of the cost of attendance, with a minimum of $5,000 ($10,000 in California). Their loans also have no fees: no origination fees, no late fees, and no insufficient funds fees.

They offer 5, 7 10, and 15 year term loans.

They offer both variable rate and fixed rate loans. Current rates for undergraduates are follows:

Fixed:

- 4.49% to 13.08% APR (with autopay)

Variable:

- 4.99% to 13.07% APR (with autopay)

The graduate school loans offer similar top tier rates, with the same basic repayment plans and options:

Fixed:

- 5.25% to 13.60% APR (with autoPay)

Variable:

- 5.49% to 13.07% APR (with autoPay)

These rates are current as of March 2023.

SoFi Student Loan Details | |

|---|---|

Product Name | SoFi Private Student Loan |

Min Loan Amount | $5,000 |

Max Loan Amount | 100% Cost of Attendance |

APR | As low as 4.49% APR |

Rate Type | Variable and Fixed |

Loan Terms | 5, 10, or 15 years |

Promotions | None |

Loan Repayment Options

One of the highlights of SoFi's private student loan program is that they offer four repayment plan options - which can provide borrowers with a high level of flexibility.

They currently offer:

Immediate: This option requires immediate principal and interest payments on the loan. It's the highest monthly payment option, but the lowest overall cost option.

Partial: This option allows for a $25/mo payment while in school, then switches over to a standard payment after graduation.

Interest Only: This option has interest-only payments while in school, and then switches over to a standard payment after graduation.

Deferred: This option allows you to not pay anything while you're in school, and you begin full payments 6 months after graduation. This is most similar to a Federal loan.

SoFi also offers a 0.25% interest rate discount if you sign up to make automatic payments. This discount is reflected in their advertised loan rates.

How Do SoFi Private Loans Compare?

SoFi is a relative new-comer in the private student loan space. While their loans offer competitive pricing, they may not work for everyone. And while SoFi claims you may not need a cosigner, most borrowers will need to have one.

However, they are listed on our Best Private Loans page.

Check out this quick comparison here:

Header |  |  | |

|---|---|---|---|

Rating | |||

Minimum Loan | $5,000 | $1,000 | $3,000 |

APR Type | Variable and Fixed | Variable and Fixed | Variable and Fixed |

Cosigner | Not Required | Not Required | Not Required |

Cell | Cell |

What Borrower Protections Are Available?

When you refinance with any lender, you lose the protections offered by federal student loans. For example, people who refinance with SoFi cannot opt for an income-based repayment program. SoFi does have a forbearance program if you’ve become unemployed. The Unemployment Protection is offered in three month increments, and is capped at 12 months over the life of the loan. While generous, other lenders offer better forbearance programs.

SoFi also offer loan deferment for borrowers who return to graduate school, undergo disability rehabilitation, or serve on active military duty. It also offers a six month deferment to people who are in SoFi’s entrepreneurship program. During either deferment or forbearance interest continues to accrue on the loan.

SoFi's website doesn't list death and disability discharge as an option for borrowers, but we've confirmed with their compliance team that in cases of borrower death, the loan will be discharged - even if there is a cosigner. It will be listed on your promissory note.

However, there is no option for disability discharge at this time. Federal loans do offer this protection, and some private loans have started to as well. If you borrow with SoFi, consider a low cost life insurance policy or disability insurance policy.

Who Qualifies To Apply?

The number one criteria that SoFi considers when underwriting its loans is cash flow. If you have a high income, and relatively few debts, you’ll probably qualify to refinance with SoFi.

Additionally, SoFi considers your credit history and your current debt load. SoFi doesn’t use traditional credit scoring algorithms. But people with FICO credit scores in the 700 range or above tend to qualify.

We've found that SoFi was once one of the toughest places to qualify for refinancing. But over the last few years, they've loosened their lending standards a bit. However, if you have a lower credit score, you might be better off going with a company like Earnest.

In addition to meeting underwriting criteria, you must be a citizen or permanent resident of the United States with a degree from a four year university.

Are There Any Fees?

Neither of SoFi's student loan products really have any concerning fine print. They charge no fees - application, origination, or prepayment. And they even avoid charging late payment and insufficient funds fees.

How Do I Contact SoFi?

SoFi student loans are actually serviced by MOHELA. However, SoFi does have its own in-house customer service team. You can get in contact with them by live chat, phone at 855-456-7634, or by tweeting @SoFiSupport. Their customer service hours are Mon–Thurs 5 AM–7 PM (PT), Fri–Sun 5 AM–5 PM (PT).

Is It Safe And Secure?

SoFi's site is TLS 1.2 Encrypted and the company regularly submits to third-party audits which review its security protocols against standards such as SSAE18 SOC2 and PCI DSS. It also offers two-factor authentication to help users prevent unauthorized access to their accounts.

If you just have SoFi student loans, you won't need to worry about having any money on deposit with the company. However, it should be noted that SoFi Money cash accounts are protected up to $1.5 million with FDIC insurance.

Other SoFi Products

SoFi is really becoming a major financial player, creating complimentary loans products and accounts in the investing and banking spaces too. Here are a few examples:

Mortgages: We've tried to use SoFi Mortgage, and we weren't a fan. But you can check it out.

Personal loans: You should compare SoFi to other lenders just like you would with student loan refinancing. Check out Credible's Personal Loan Tool and see how SoFi compares for what you need.

Investing - SoFi Automated Investing is their investment management platform that is revolutionizing the robo-advisor space by offering 0% AUM fees. Read our SoFi Automated review here.

SoFi also has a traditional brokerage called SoFi Invest that seeks to compete with Robinhood. Read our SoFi Invest review here.

Cash Management - SoFi Money is a high interest checking account that has some of the top rates currently available to consumers. Read out full SoFi Money review here.

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is This For And Is It Worth It?

SoFi offers decent interest rates on shorter term loans (up to ten years). If you’ve got a great income, and a decent credit history, you’ll likely qualify for a loan from SoFi.

You can get a free rate estimate from SoFi (they won’t pull your credit until underwriting), so take a few minutes to get your rate. Then compare that rate with other lenders before deciding where to refinance.

However, we've found over the last few years that SoFi typically isn't the most competitive, and if you spend some time getting quotes from multiple lenders, you might be better served elsewhere.

SoFi Features

Min Loan Amount |

|

Max Loan Amount |

|

APR |

|

Autopay Discount | 0.25% |

Rate Type | Fixed or variable |

Loan Terms |

|

Origination Fees | None |

Prepayment Penalty | None |

In-School Payments |

|

Forbearance Period | Up to 12 months (issued in 3-month increments) |

Cosigners Allowed | Yes |

Cosigner Release | No |

Grace Period | 6 Months |

Eligible Schools | Title IV-accredited schools |

Customer Service Phone Number | 855-456-7634 |

Customer Service Hours | Mon–Thurs 5 AM–7 PM (PT) Fri–Sun 5 AM–5 PM (PT) |

Address For Sending Payments | MOHELA |

Promotions | None |

SoFi Student Loans

-

Rates And Fees

-

Application Process

-

Customer Service

-

Products and Services

Overall

Summary

SoFi offers student loan refinancing, private student loans, personal loans, mortgages, and even investing. In this review, we focus on SoFi’s student loan lending products: student loan refinancing and private student loans.

Pros

- Low rates and fees for student loan refinancing

- Some unique programs for medical school

- Parent PLUS Loan refinancing into the child’s name

Cons

- Not many flexible repayment plan options

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett