If you're looking for passive income ideas, you may think the whole concept is a myth - there's no way that you can earn money by doing nothing. It's why passive income is highly sought after, yet often misunderstood.

The truth is, passive income streams require an upfront investment and a lot of nurturing in the beginning. After some time and hard work these income streams start to build and are able to maintain themselves, bringing you consistent revenue without much effort on your part.

Speaking from personal experience, adding passive income streams to your portfolio can help you increase your earnings and accelerate your financial goals in tremendous ways. For example, starting a savings account and earning interest, or investing in dividend paying stocks can all start adding income to your life without having to work! Your money is working for you!

For example, you can use passive income streams to help you get out of debt or achieve financial independence sooner.

Let's get to the passive income ideas!

What is Passive Income?

Passive income is unearned income derived from investments. This investment is typically a monetary investment, but it could also include an upfront time investment.

Passive income is different than active income: your job. The goal is to not have to work directly for the money you earn. Read our full guide to What Is Passive Income?

What It Takes To Earn Passive Income

Before we get into the passive income ideas I think it’s a good idea to first clear up a couple of misconceptions. Although the word “passive” makes it sound like you have to do nothing to bring in the income this just isn’t true. All passive income streams will require at least one of the following two elements:

1) An upfront monetary investment, or

2) An upfront time investment

You can’t earn residual income without being willing to provide at least one of these two. Because it's important to remember what passive income is NOT. Passive income is not your job, it's not freelancing, or working online. Passive income is doing something once, then earning rewards from it into the future.

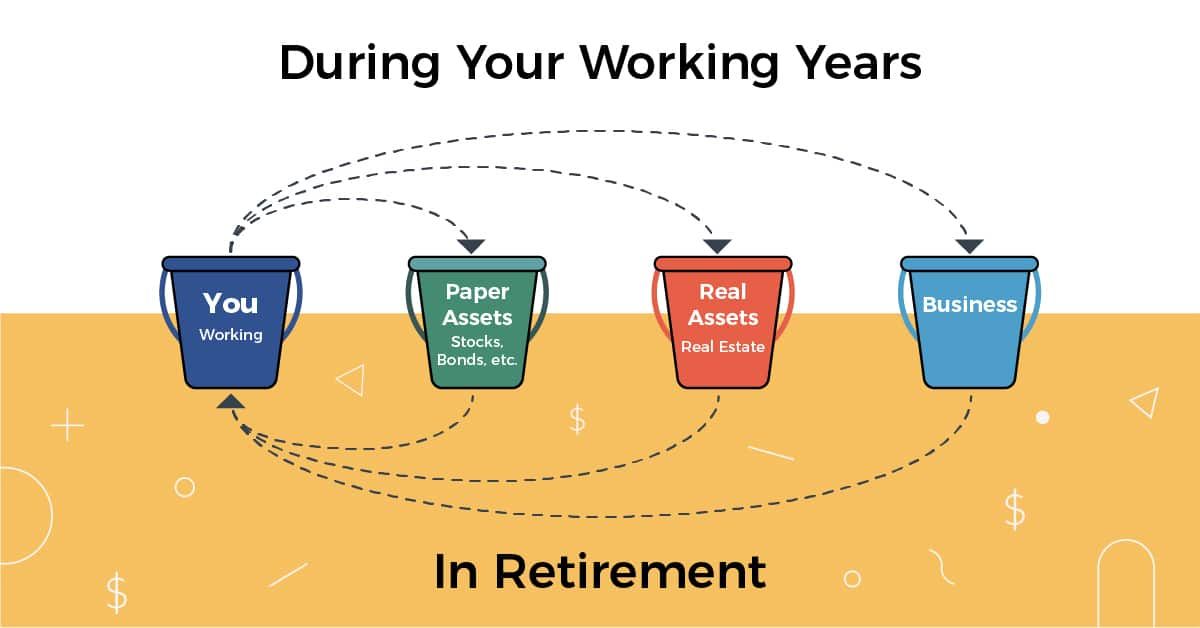

Here's a good example of how I view passive income and how it fits into your portfolio of assets:

Today, I have a big list of passive income ideas you can try regardless of the category you fall in.

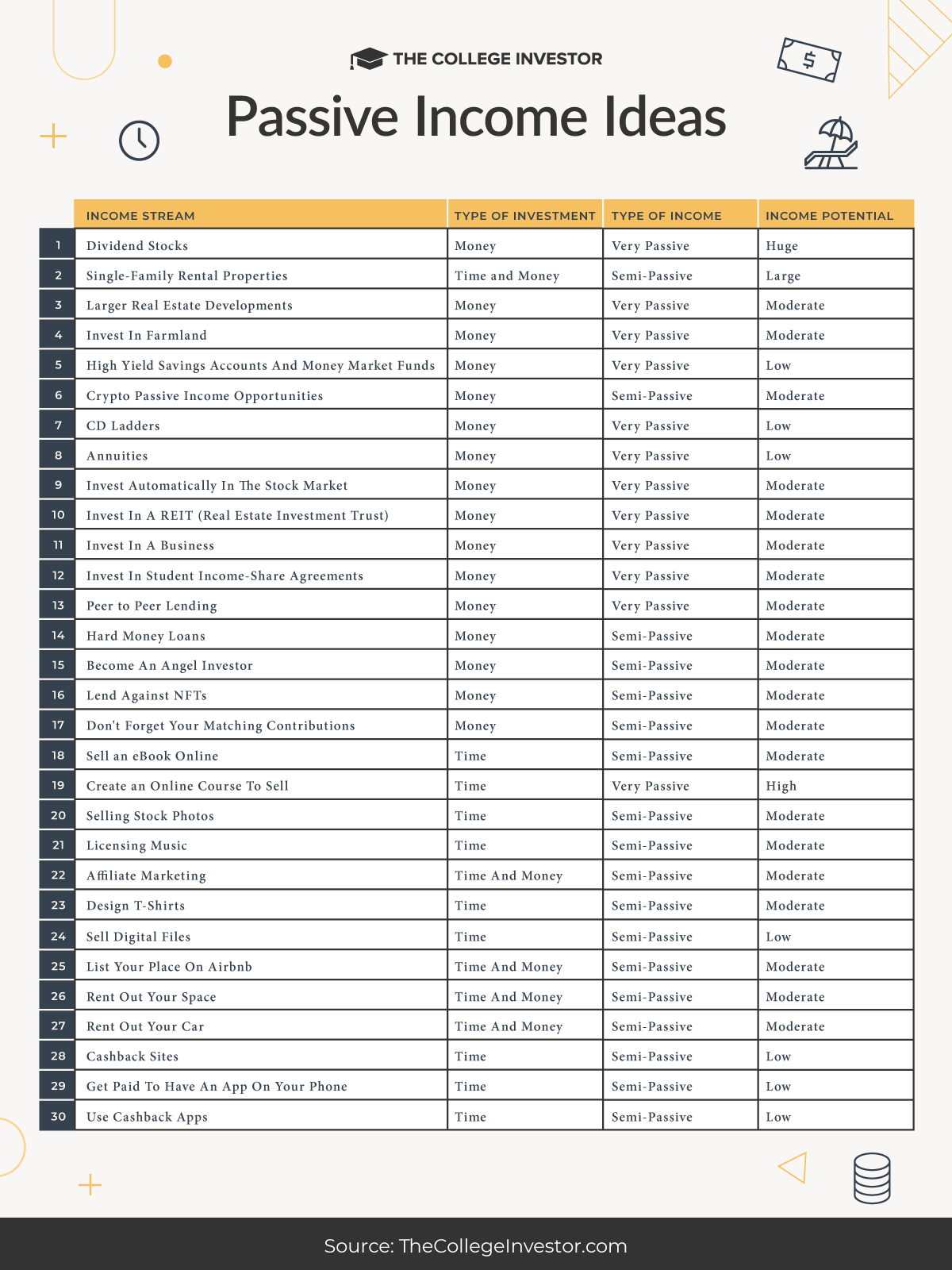

Check out this list of passive income ideas here:

Passive Income Ideas Requiring an Upfront Monetary Investment

These types of passive income require you to invest money up front to generate the passive income later. Don't be alarmed though - you can start with as little as $5 with some of these ideas, so it's achievable for everyone. For most people creating a passive income strategy, putting a little money in investments or savings is the best place to start.

1. Dividend Stocks

Are Dividend Stocks Worth It?

Investment income is my favorite type of passive income.

Dividend stocks are tried and true way to earn passive income. You will have to do plenty of research to find good stocks and invest a significant amount of money to receive large dividend checks. However, if you consistently invest money into dividend stocks you can amass a nice residual income over time.

For any of these investment opportunities, make sure you open an account at the best online brokerage, and get rewards while doing it.

One of our favorite places to invest is Charles Schwab. You might not have heard of Schwab, but it's a FREE investing platform that allows you to build a portfolio, and invest in it for free.

Since the platform is commission-free, you can invest in dividend stocks with no trading costs. That's amazing. Want to reinvest your dividends? That's free too! This is why Schwab was voted one of the best brokerage firms of 2024.

Read our full experience with Charles Schwab here.

How To Choose The Right Dividend Stocks

- Look for companies with a history of consistent dividend payments

- Research dividend yield and payout ratios

- Diversify your portfolio to minimize risk

If you're uncertain about choosing individual stocks, look for high dividend paying ETFs or mutual funds.

2. Single-Family Rental Properties

Are Single Family

Rentals Worth It?

A cash flowing rental property is a fantastic way to bring in a monthly income. To make this truly passive you can outsource the running of the properties to a management company.

However, the internet has made investing in rental properties easier than ever before. There are a lot of ways you can invest in rental properties depending on what your goals and interests are. You can be a limited partner in large residential or commercial properties, or you can buy homes and be a landlord - all online!

Invest In Single Family Homes

If you're looking for a more traditional path to real estate investment, check out Arrived Homes. This company allows you to buy cash-flow positive single family rentals - online! You can sign up and start searching properties today. Check out Arrived here.

The great thing about using a platform versus doing it yourself is that the income is even more passive. Check out our full experience with Arrived here.

Tips For Successful Rental Property Investing

- Choose properties in high-demand areas

- Ensure positive cash flow

- Consider using a property management company

3. Larger Real Estate Developments

Is Real Estate Investing

Worth It?

Do you not want to be a landlord, but still want real estate exposure and income? Then consider being a limited partner in a large development. With these options, you can invest in multi-family or commercial properties. You get the income and tax treatment just like regular real estate ownership, but you don't do any of the work!

Our favorite platform for this is RealtyMogul because you get the flexibility to invest as little as $1,000, but can also participate in REITs and private placements – typically not offered to the public. Investors can fund real estate loans to gain passive income or buy an equity share in a property for potential appreciation. Their platform is open to both accredited and non-accredited investors.

Read our full experience using RealtyMogul here.

Benefits of Crowdfunded Real Estate

- Access to real estate investments with lower capital requirements

- Diversification across multiple properties

- Professional management of investments

For Accredited Investors

One of my favorite ways to get started with rental properties is through EquityMultiple. Similar to LendingClub, you can start investing in real estate for as little as $5,000 at platforms like EquityMultiple.

This platform has a nice mix of smaller residential to mixed use residential and commercial properties. Read our full EquityMultiple review here.

4. Invest In Farmland

Is Farmland Investing

Worth It?

Farmland isn't sexy, but it has a lot going for it when it comes to real estate investing. It's slow, steady, pays consistent rent, and everyone needs to eat. Plus, compared to other types of real estate its much less volatile. There's two major companies that allow you to invest in farmland. FarmTogether and AcreTrader.

We recently did a behind the scenes review of our own AcreTrader investment, and you can watch the AcreTrader review video on YouTube.

Check out our reviews and get started:

Benefits of Leasing Farmland

- Steady rental income

- Land appreciation potential

- Minimal management responsibilities

5. High Yield Savings Accounts And Money Market Funds

Are Savings Accounts

Worth It?

If you don't want to think much about your money, but want it to work for you, a basic place to put it is in a high yield savings account or money market fund.

The difference is in the account type and where it's located. Typically, high yield savings accounts are located at banks, and are FDIC insured. Money market funds can be located at both banks and investment companies, and are only sometimes FDIC insured.

Interest rates have been rising, so putting more money into a savings account can generate a safe passive income stream.

American First Credit Union currently offers a solid yield at 5.18% APY with just a $100 minimum to open! Check out American First here >>

Characteristics of High-Yield Savings Accounts

- Federally insured up to FDIC Limits

- Accessible and liquid

- Low-risk investment

If you want the most up to date rates on high yield savings accounts and money markets, check out these lists that we update the rates daily on:

6. Crypto Passive Income Opportunities

Is Crypto Worth It?

Over the last several years, crypto savings accounts have become very popular - simply because they provide the opportunity for higher rates of return on your money. It's important to note that these aren't really "savings accounts". These are investment and lending accounts that allow you to earn a high yield on your crypto "easily". But they're not without risk!

Some popular options are Uphold and Nexo (only available outside the United States). You can earn upwards of 25% APY on your crypto at these companies, but there are risks. Check out our full guide to Crypto Savings Accounts here.

You can also look at staking your crypto, lending your crypto, and even buying NFTs. There are a lot of opportunities to earn passive income with crypto - we put together a full guide here: How To Make Passive Income With Crypto.

Popular Cryptocurrencies for Staking

- Ethereum

- Cardano (ADA)

- Polkadot (DOT)

7. CD Ladders

Are CDs Worth It?

Building a CD Ladder requires buying CDs (certificates of deposits) from banks in certain increments so that you can earn a higher return on your money. CDs are offered by banks and since they are a low risk investment they also yield a low return. This is a good option for the risk averse to build passive income streams.

For example, what you do if you want a five-year CD ladder is you do the following. Look how the rates rise over different time periods (these are estimated):

- 1 Year CD - 4.00%

- 2 Year CD - 4.250%

- 3 Year CD - 4.50%

- 4 Year CD - 5.00%

- 5 Year CD - 5.25%

If building a CD Ladder sounds complicated, you can also stick to a traditional high yield savings account or money market fund. While the returns aren't as amazing as other things on this list, it's better than nothing, and it's truly passive income!

We recommend building a CD Ladder at CIT Bank because they have one of the best CD products available. High rates and even a penalty-free CD option (which currently earns 3.50% APY). Check out CIT Bank here.

You can also look at CD alternatives like Save. Save is a hybrid product that potentially allows you to earn way above market returns, but keeps your principal safe in an FDIC-insured bank account. Check out Save here >>

Check out these great deals on the best high yield CDs on our full list of the best CD rates that get updated daily.

Benefits of CD Ladders

- Higher interest rates compared to savings accounts (usually)

- Regular access to funds

- Reduced risk of interest rate fluctuations since you've locked in a rate

8. Annuities

Are Annuities Worth It?

Annuities are an insurance product that you pay for but can then provide you passive income for life in the form of monthly payments. The terms with annuities vary and are not always a great deal so it’s best to talk to a trusted financial advisor if you’re interested in purchasing an annuity.

These investments aren't for everyone - they can come with high fees, and not be worth it. But if you have zero risk tolerance for loss, and are looking for a passive income stream, this could be a good potential idea for you your portfolio.

Check out Blueprint Income for a marketplace for personal annuities.

Types of Annuities

- Fixed annuities

- Variable annuities

- Indexed annuities

9. Invest Automatically In The Stock Market

Are Robo-Advisors Worth It?

If you're not interested in picking dividend paying stocks (and I can understand that), there are still ways to invest passively in the stock market. You can automatically invest in various ways through what's called a robo-advisor.

A robo-advisor is just like what it sounds like - a robotic financial advisor. You spend about 10 minutes answering a few questions and setting up your account, and the system will take it from there.

The most popular robo-advisor is Wealthfront - which you can setup to automatically invest in and they will handle the rest for you. What's great about Wealthfront is that they charge one of the lowest fees in the robo-advisor industry, and they make it really easy to invest automatically.

Plus, Wealthfront was recently named one of our top picks for the Best Robo-Advisors For 2023. They offer a great service plus you can get advice from a real human, which is awesome. Read our full experience with Wealthfront here.

Sign up for Wealthfront here and get started investing for a passive income!

10. Invest In A REIT (Real Estate Investment Trust)

Are REITs Worth It?

If you're concerned about investing directly in real estate, or maybe you're not yet an accredited investor, that's okay. You can still take advantage of real estate in your investments through REITs - Real Estate Investment Trusts.

These are investment vehicles that hold property within them - and you as the owner get to benefit from the gains, refinances, sale, income (or loss) on the property.

Our favorite platform to invest in a REIT is Fundrise¹. They only have a $500 minimum to get started and offer a variety of options we love as well!

Check out our full experience and review of Fundrise here.

11. Invest In A Business

Are Business Loans Worth It?

Another way to generate passive income is to invest and be a silent partner in a business. This is very risky, but with risk comes the potential for high returns. For example, several years ago both Lyft and Uber were looking for private investors to invest in their companies. Today, they are worth billions - but you as an investor would only reap that benefit if they go public via an IPO, or get acquired. So, it's risky.

But there are ways to reduce your risk. For example, you can invest small amounts in many companies through lending them money in small bonds.

There are now tools available where you can loan money to a business and get paid a solid return for doing it!

Small Business Loans

Percent is a company that allow you to lend money to businesses in various ways. They are a marketplace for lending, and they offer commercial loans, receivable loans, and more. You must be an accredited investor, but if you're looking for more risk and reward, it could be an option. Read our full experience and Percent review here.

12. Invest In Student Income-Share Agreements

Are ISAs Worth It?

An Income-Share Agreement (ISA) is an alternative to student loans. By using an ISA, a student’s tuition is paid for in exchange for a percentage of their future income.

Who is funding these ISAs? Private investors and universities fund them. Investors basically take a bet on a student’s future.

You see these most commonly at coding academies and trade schools, but they are growing in popularity.

Edly is a company that allows you to invest in ISAs. They have two options - one you can invest directly in a note, and the other in a fund that they use for future notes. Depending on timing, there might not be any open notes available in to invest.

You must be an accredited investor to invest, and there is a $10,000 minimum. However, they are targeting 8-14% returns, which is awesome. Read our full Edly experience and review here.

13. Peer to Peer Lending

Is Peer-To Peer Lending

Worth It?

P2P lending is the practice of loaning money to borrowers who typically don’t qualify for traditional loans. As the lender you have the ability to choose the borrowers and are able to spread your investment amount out to mitigate your risk.

Right now, Lenme is one of the last peer to peer lending platforms out there. But these loans are going to be used for personal reasons, so keep that in mind. Check out our full Lenme review here.

What's great about this is that you simply lend your money, and you get paid back principal and interest on that loan.

The median return on cash flow is 3% - which is better than some savings accounts you're going to find today. Check out other CD alternatives.

14. Hard Money Loans

Is Hard Money Lending

Worth It?

Similar to other types of peer to peer lending, hard money loans focus on a specific niche - real estate loans. These loans are typically used for fix and flip projects, or short term bridge loans.

Right now, Groundfloor is one of the oldest platforms in the space that has been creating a marketplace for hard money loans.

However, realize it's not without risk. According to Groundfloor, there was been a 1% loss ratio since they started with their marketplace.

If you're interested, you can get started on Groundfloor for as little as $10. See our full Groundfloor review here.

15. Become An Angel Investor

Is Angel Investing

Worth It?

Have you ever watched the show Shark Tank, where the five investors listen to pitches from small companies and then make offers to invest? That's called angel investing - and for many investors, it doesn't look like the show Shark Tank at all!

Instead, most companies pitch their ideas online via email introductions, zoom meetings, and small presentations. And there are even some websites that "syndicate" deals together - where a bunch of people get to together to invest in a startup. And you can be a part of that too!

You have to remember that this is extremely high risk, high reward - but it's totally passive investing. Most startups do fail, and if the company you invest in fails, you could lose all your investment.

If you're looking to become an angel investor, check out AngelList or Propel(x). AngelList probably has the highest amount of deal flow available, while Propel(x) focuses on niche deals.

Tips for Investing in a Business

- Choose a business with growth potential

- Assess the management team's competence

- Understand the exit potential and strategy

16. Lend Against NFTs

Is NFT Lending

Worth It?

If you're into the NFT-space, there is a really interesting way that you can make passive income by simply lending to others with NFTs as collateral. What this means in practice is that you create a smart contract with someone who owns an NFT, you agree on an amount to lend to them, a repayment period, and you both digitally sign this contract.

Remember that most NFT lending is done via Ethereum, so you provide the funds in ETH, and they repay you in ETH. If the borrower doesn't repay you in time (or at all), the smart contract will transfer you ownership of the collateral NFT.

Check out this list of platforms where you can do NFT lending.

17. Don't Forget Your Matching Contributions

Is 401k Matching

Worth It?

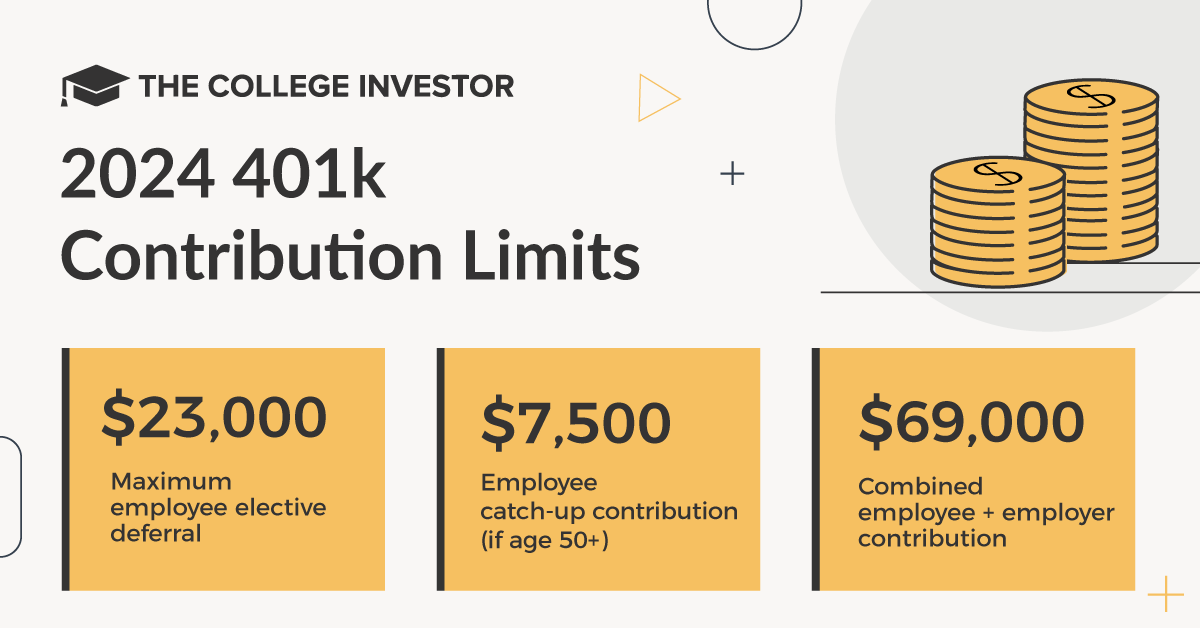

This is one of my favorite passive income ideas, because it's so easy, yet so many people fail at it. It's simple - take advantage of matching contributions for your 401k or HSA.

That's literally free money for simply contributing to your own retirement accounts. By not taking advantage of the match, you're leaving free money on the table.

All you have to do is ensure that you're contributing enough to your 401k or HSA so that you get the full matching contribution. For your HSA, your employer also might require you to take action - like taking a health assessment or getting a physical. But all that free money can add up!

Note: If you have old 401k from past jobs laying around, you should roll them over and make sure they're invested correctly. Services like Beagle and Capitalize can help.

Passive Income Ideas Requiring an Upfront Time Investment

The next section of passive income ideas require a time investment. Instead of using money, you need to put in sweat equity to make these happen. This is related to a side hustle. Our guide to the best side hustles can help you find ideas that require a time investment - which can then springboard you into a passive income stream.

Almost all of these ideas require starting a personal blog or website. But the great thing about that is that it's incredibly cheap to do. We recommend using Bluehost to get started. You get a free domain name and hosting starts at just $2.95 per month - a deal that you won't find many other places online! You can afford that to start building a passive income stream.

18. Sell an eBook Online

Are eBooks Worth It?

Self Publishing is mainstream today. When you purchase an eBook off of Amazon there’s a pretty good chance you’re buying a self-published book. Self-publishing is also ridiculously easy. I tried this a few years ago and couldn’t believe how simple the process was.

To self-publish a book you’ll first need to write and edit it, create a cover, and then upload to a program such as Amazon’s Kindle Direct Publishing. Don’t expect instant success though. There will need to be a lot of upfront marketing before you can turn this into a passive income stream.

A similar option is to create printables that you can sell online. Printables aren't as in-depth as a full eBook, so they are easier to create and you can still earn a passive income on your sales! Learn how to create online items to sell on Fiverr and Etsy in your first day of this online course that teaches you what to do: The E-Printables Selling Course.

Tips for Successful eBook Publishing

- Identify a profitable niche or topic

- Create engaging, well-written content

- Promote your book through various channels

19. Create an Online Course To Sell

Are Online Courses Worth It?

Udemy is an online platform that lets its user take video courses on a wide array of subjects. Instead of being a consumer on Udemy you can instead be a producer, create your own video course, and allow users to purchase it. This is a fantastic option if you are highly knowledgeable in a specific subject matter. This can also be a great way to turn traditional tutoring into a passive income stream!

Similar to Udemy, you can start a YouTube channel where you teach high demand subjects, and you can monetize via ads. You do the work up-front to create the videos, and then you enjoy the passive income steams from the ads for years to come!

Check out Udemy here to get started >>

Tips for Creating a Successful Online Course

- Identify a high-demand subject

- Create engaging and informative content

- Market your course effectively

20. Selling Stock Photos

Is Selling Stock Photos

Worth It?

Do you ever wonder where your favorite websites, blogs, and sometimes even magazines get their photos? These are normally bought from stock photo websites. If you enjoy photography you can submit your photos to stock photo sites and receive a commission every time someone purchases one of them.

One of the biggest marketplaces to sell stock photos is DepositPhotos. You can upload your photos are earn money whenever someone uses them.

In fact, check out this awesome story of one of our scholarship contestants who turned photography into a stock photo business.

21. Licensing Music

Is Licensing Music

Worth It?

Just like stock photos you can license and earn a royalty off of your music when someone chooses to use it. Music is often licensed for YouTube Videos, commercials, and more.

With the amount of YouTube videos and podcasts that are being created, there is more demand than ever for music - and people are willing to pay for it.

The key way to do it is to get your music in a library that people can search. Check out this guide on how to license your music.

If you already have a license and want to sell it for cash, or if you're looking to buy music licenses to earn income, check out Royalty Exchange. This platform connects artists with those looking to build a royalty revenue steam.

Popular Stock Audio Platforms

- AudioJungle

- Pond5

- PremiumBeat

22. Affiliate Marketing

Is Affiliate Marketing

Worth It?

Affiliate marketing is the practice of partnering with a company (becoming their affiliate) to receive a commission on a product. This method of generating income works the best for those with blogs and websites. Even then, it takes a long time to build up before it becomes passive.

Larry Ludwig is a 25 year expert on marketing and he built (and retired early) by creating websites that earned passive income with affiliate marketing. We're known Larry for a long time and definitely knows what he's talking about.

If you want to get started with affiliate marketing check out this course on affiliate marketing and how to become a full time blogger.

How to Succeed in Affiliate Marketing

- Choose a niche with a strong audience

- Promote products relevant to your audience

- Build trust and credibility through quality content

23. Design T-Shirts

Is Selling T-Shirts

Worth It?

Sites like Cafe Press allow users to custom design items like T-shirts. If your design becomes popular and makes sales you’ll be able to earn royalties. Plus, the passive income stream of this is that you can setup print on demand services so that you don't have to have any inventory and orders simply get fulfilled when customers order them.

Even Amazon has gotten into this business of print on demand. Amazon has a new service called Amazon Merch, where you simply upload your designs and Amazon takes care of the rest (making it, packing it, and shipping it).

Popular Merchandise Platforms

- Teespring

- Redbubble

- Zazzle

24. Sell Digital Files

Is Selling Digital Files

Worth It?

I’ve been into home décor lately and I had to turn to Etsy to find exactly what I wanted. I ended up purchasing digital files of the artwork I wanted printed out! The seller had made a bunch of wall art, digitized, and listed it on Etsy for instant download. There are other popular digital files on Etsy as well such as monthly planners. If you’re into graphic design this could be an amazing passive income idea for you.

Adrian Brambilia is an online marketer that has developed a huge amount of passive income streams over the last few years. If this is something you're curious about, check out this course by Adrian Brambila that can help you get started.

In fact, we sell digital files too. I re-used my first resumes and cover letters as a digital product so that other college graduates could get a head start. Check out my professional resume templates here.

Popular Places To Sell Digital Files

- Etsy

- Teachers Helping Teachers

- Gumroad

Semi-Passive Small Business Ideas

I call these semi-passive income because they are more like a business, less like the ideas above. They all also require a small combination of time and money investment. But once you invest, you can earn more income and typically do so passively.

However, these all do require some ongoing time investment, so they aren't 100% passive like having a savings account.

25. List Your Place On Airbnb

Is Listing On Airbnb

Worth It?

If you have a house, apartment, spare room, or even backyard, consider listing your property on AirBNB and start earning money when you get your place booked. Sign up your place today.

AirBNB is great because you can earn money on a space you already own. It does require a little work up front to prep your place, list it, and clean up after guests, but it's pretty passive otherwise.

26. Rent Out Your Space

Is Renting Your Property

Worth It?

Maybe you don't have a room to spare, or a whole other house (who can afford it)? But maybe you have space that you can rent for people needing storage. That's where Neighbor comes in.

With Neighbor, you can rent space you're not using to others to store their stuff. Some common things that people rent are driveway space or parking space for car or RV storage, garage storage space, and business storage space.

Check out the Neighbor app here and start earning passive income from renting out random space you have. You can also check out our review and experience with Neighbor.

Tips for Renting Out Storage Space

- Ensure a secure and clean storage environment

- Set a competitive rental rate

- Advertise your space on local platforms

27. Rent Out Your Car

Is Renting Your Car

Worth It?

Similar to listing your place for rent, you can also list your car for rent. This can be truly passive because once you list your car, it can earn you income when you're not using it!

Our favorite partner to rent your car is Turo. Turo allows you to put your car out for rent, and when people rent it, Turo handles the rest!

The cool thing with Turo is that, depending on your location and what kind of car you have, you can make a decent passive income!

Check out Turo here and get started earning passive income with your car! Check out our list of other ways to make money with your car as well (most of the others aren't passive though).

Popular Car-Sharing Platforms

- Turo

- Getaround

- HyreCar

Easy Passive Income Ideas

Last on the list I wanted to point out a couple of easy passive income ideas. These require no money and no upfront work. While the earnings are menial you still can’t beat easy passive income!

28. Cashback Sites

Are Cashback Sites

Worth It?

Just like cashback rewards cards you should opt to use a cashback site when shopping online. If you don’t you’re giving up free money that requires little to no work! We just compared the two most popular sites - Rakuten versus TopCashBack.

All you have to do is login to these sites before you make a purchase, click the link, and you'll earn the percentage cash-back the site offers.

If you want to know which sites are offering the highest cashback, check out Cashback Monitor - a free comparison site that finds you the best cashback deals out there.

29. Get Paid To Have An App On Your Phone

Are Phone Apps

Worth It?

What if you could install an app on your phone, and get paid for it? Yes, this app tracks what you're doing and it sells your data - but what's more passive than that?

If you don't want to do anything out of the norm, check out Neilson Digital. You simply download the app and do what you normally do. The app runs in the background and you are entered to win rewards. Simple, easy way to get money for nothing! Download the app here.

Mobile Expression is a similar app for iPad. You can earn rewards for installing it and leaving it on your device for at least 90 days. And boom! You get paid!

Popular Market Research Platforms

30. Use Cashback Apps

Are Receipt Apps

Worth It?

Beyond credit cards and websites, there are also cashback apps that can help you get passive income from the shopping you're already doing.

Dosh, for example, works with 10,000 retailers and all you have to do is download the app and shop. Read our Dosh review here to learn more.

Honey is a browser extension that will find coupon codes and other discounts for any item you're buying. Read our full Honey review here.

How to Get Started

While it can be tempting to want to pick five passive income ideas to get started with I’d really encourage you to pick one in the beginning. You need time and the ability to focus to really a grow a passive income stream. Master one thing before moving on to the other.

It’s going to take a substantial amount of time or money in the beginning but I promise earning passive income is everything it’s cracked up to be! Pick an idea, make a plan, and dedicate yourself until that income stream comes to fruition.

Who Is This For?

Passive income is more than a sexy phrase you hear social media personalities talking about. Passive income is the key to building wealth over the long term. And there are a variety of ways to go about building passive income streams, depending on what your financial and "life" situation is.

Although passive income can take time to build, over time, the income streams you develop can end up sustaining all your income - allowing you to retire comfortably. And the earlier you start, the easier it is. But it takes momentum and consistency over time.

All of the passive income ideas we're talking about require either an up-front investment of time, or an up-front investment of money. And depending on where you're at in life, it might take more of one or other - or a combination. These ideas are designed to spark your desire to start building wealth!

Why Trust Us?

I've been a personal finance enthusiast for my entire adult life, and journalist for over a decade. I started writing about my path to building wealth in 2009, which involved a lot of the ideas I cover here - from savings, to investing, real estate, and more. I've reported on bank accounts, investment accounts, real estate investing, and more over the last decade. All of these areas are key to building passive income - which I why I created the first version of this article in 2015.

For this guide, I've crafted a list of what I believe are the best ideas to get started and grow wealth, based on my experience, the learnings we've seen from our readers and communities, and the broader knowledge our entire team has around personal finance - including the products and services available to consumers. And we continue to update it as new options or services to make it easier are developed.

Furthermore, rates and terms you see in this article are checked by our compliance team every weekday, so we can provide the most accurate information possible.

Frequently Asked Questions About Generating Passive Income

How do I generate passive income?

Passive income is the idea that you deploy time and/or money and receive income with no further work. You have to do something to generate passive income up front, but then you can rely on that income into the future.

What are some examples of passive income?

Investing is a great example of a passive income stream. You invest money in a company stock, and you receive a dividend payment and appreciation on the investment. Another popular example is real estate. You buy a property, and you enjoy the rent as passive income.

Does passive income really work?

Yes! Passive income is how the rich continue to build wealth. When you don’t have money, you can leverage your time and effort to create income streams that will grow into the future. As you accumulate money, you can deploy that money (and even combine it with your time) to generate more and more passive income.

Where can I invest to have passive income?

If you want to invest to generate passive income, dividend stocks and mutual funds are great ways to do it. You can also invest in debt instruments, like bonds. If you want a safer approach, you can invest in a money market account or CD to get a risk-free return on your money.

What are the most popular passive income ideas?

There are lots of popular passive income ideas. The most popular include investing in the stock market, owning real estate, investing in a business, and even simply keeping your money in a high yield savings account. All of these approaches generate passive income, but they do require up front capital.

Does passive income really require “no work”?

This is a myth. Passive income always requires something up front: time or money. However, the idea that it becomes passive after you do the work is what’s alluring about it. For example, you spend 6 months writing a book, and you can enjoy the royalty income from your book for the rest of your life without any further work. That’s not to say that doing more work won’t boost your income, but there is an element that requires nothing more to earn.

How do taxes on passive income work?

The Internal Revenue Service (IRS) classifies passive income as "unearned income", and how it's taxed varies based on the type. For example, ordinary dividends and interest are taxed at your ordinary income rate, but qualified dividends are taxed at long-term capital gains rates. Income streams like rental income or real estate investment trusts may be taxed in a variety of ways, including ordinary income, capital gains, and more. But with rental property, you get a lot of tax benefits with depreciation and other deductions. You should consult a tax professional if you have questions.

What are some of your favorite passive income ideas?

¹ The information contained herein neither constitutes an offer for nor a solicitation of interest in any securities offering; however, if an indication of interest is provided, it may be withdrawn or revoked, without obligation or commitment of any kind prior to being accepted following the qualification or effectiveness of the applicable offering document, and any offer, solicitation or sale of any securities will be made only by means of an offering circular, private placement memorandum, or prospectus. No money or other consideration is hereby being solicited, and will not be accepted without such potential investor having been provided the applicable offering document. Joining the Fundrise Platform neither constitutes an indication of interest in any offering nor involves any obligation or commitment of any kind.

The publicly filed offering circulars of the issuers sponsored by Rise Companies Corp., not all of which may be currently qualified by the Securities and Exchange Commission, may be found at www.fundrise.com/oc.

The College Investor receives cash compensation from Wealthfront Advisers LLC (“Wealthfront Advisers”) for each new client that applies for a Wealthfront Automated Investing Account through our links. This may create an incentive that results in a material conflict of interest. The College Investor is not a Wealthfront Advisers client. More information is available via our links to Wealthfront Advisers.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Danny Cieniewicz, CFP®, CCFC