Credit Score

Definition

A credit score is a numerical expression representing an individual's creditworthiness, based on an analysis of their credit files.

Detailed Explanation

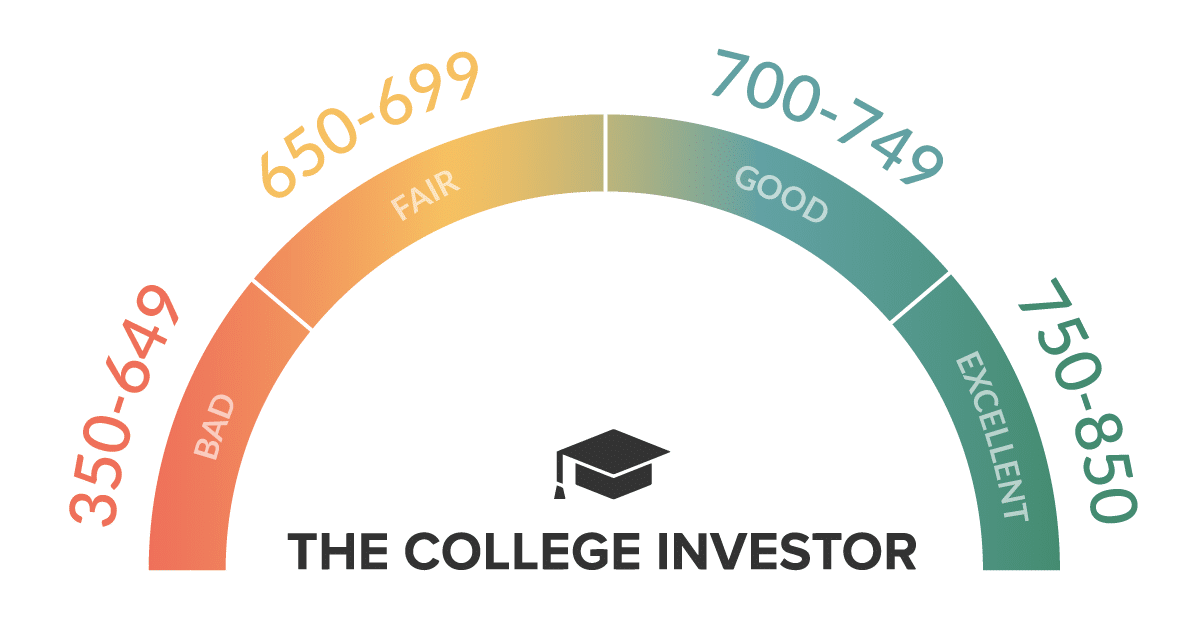

A credit score is a statistical number that evaluates a consumer's creditworthiness and is based on credit history. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner. Typically, credit scores range from 300 to 850, with higher scores indicating less credit risk.

Credit scores are calculated using information from your credit reports, which include details of your credit history such as:

- number and types of credit accounts you have

- length of time each account has been open

- amounts owed

- amount of available credit used

- payment history

- new credit inquiries

The exact formula for calculating a credit score is a closely guarded secret, but it generally includes factors like payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

The most popular credit scores are FICO scores, created by the Fair Isaac Corporation. FICO scores are used by many lenders, and they're often considered the industry standard. Another common type of credit score is the VantageScore, which was developed by the three major credit bureaus: Experian, TransUnion, and Equifax.

Credit scores play a key role in a lender's decision to offer credit. For example, a high credit score may result in a borrower receiving a lower interest rate on a loan.

Example

Imagine a borrower, Sarah, who has a credit score of 780. This high score indicates to lenders that Sarah has a strong history of managing her credit well and making payments on time. As a result, when Sarah applies for a mortgage, she is likely to receive favorable terms, such as a lower interest rate.

Key Articles Related To Credit Score

Related Terms

Credit Report: The process of paying off a debt over time through regular payments.

Credit History: Credit history is a record of an individual's or entity's past borrowing and repayment activity, including loans, credit cards, and other forms of credit.

Credit Bureau: A credit bureau is an organization that collects and maintains individual credit information, providing this information to lenders and consumers to assist in making informed financial decisions.

Frequently Asked Questions

What is a good credit score?

According to Experian, a good credit score is between 670 and 739. Very good ranges from 740 to 799, and excellent is anything above 800.

How can I improve my credit score?

The best thing you can do to improve your credit score by making payments on time, as payment history is 35% of your credit score. Making payments will also reduce the amount you owe which will help as amounts owed are 30% of your score.

How often does my credit score change?

Your credit score can change whenever new information is added to your credit report, which can be as frequently as every month.

Does checking my credit score lower it?

No, checking your own credit score is considered a soft inquiry and does not affect your score.

Editor: Ashley Barnett