529 Plan And Saving For College Statistics

Here are the key 529 college savings plan statistics to know, including how much families have saved for college, where families are saving for college, the 529 plan rules by state, and more.

We strive to keep this information updated regularly based on the latest data from the College Savings Plan Network, private surveys and research, and more.

This data is accurate as of July 2024.

Key 529 Plan Statistics

Here are the key 529 college savings plan statistics as of the end of 2023:

- Total Amount Saved In 529 Plans: $471 Billion

- Number Of 529 Plans Opened: 16.4 Million

- Average 529 Plan Balance: $28,681

- Number Of Children (0-17) In The United States: 74.6 Million

Other key facts:

- 49 out of 50 states offer 529 plans for their residents

- If you contributed the maximum allowed to all state 529 plans, you could save $23.3 million per beneficiary

529 College Savings Plan Facts

Here are some of the key facts around 529 college savings plans, including which states have expanded their 529 plan rules to conform with the SECURE Act and the SECURE Act 2.0.

- Tax Credits: 5 states offer tax credits for their residents to make contributions to a 529 plan. These states include Indiana, Minnesota, Oregon, Utah, and Vermont.

- Tax Deductions: 29 states offer tax deductions for their residents.

- Tax-Parity: Some states offer a tax deduction for contributions to ANY 529 plan nationwide. These states are Arizona, Arkansas, Kansas, Minnesota,Missouri, Montana, and Pennsylvania.

- Conforming With Federal Tax Law For K-12 Education: Most states follow the rules for K-12 education being allowed, with 39 states following Federal law.

- Conforming With Federal Tax Law For Student Loan Debt: Only 28 states have changed their plans to allow up to $10,000 to be used for student loan debt.

- Allows The 529 To Roth IRA Conversion: 33 states have officially allowed the 529 plan to Roth IRA conversion.

The value of 529 plans has been growing steadily over the last decade, but it hasn't been a perfectly straight line. Here is the total 529 plan balance by year:

Total 529 Plan Balance By Year | |

|---|---|

Year | Total Assets |

2023 | $471.1 Billion |

2022 | $411.2 Billion |

2021 | $480.3 Billion |

2020 | $425.2 Billion |

2019 | $371.5 Billion |

2018 | $311.2 Billion |

2017 | $319.1 Billion |

2016 | $275.1 Billion |

2015 | $253.2 Billion |

2014 | $247.9 Billion |

2013 | $227.1 Billion |

2012 | $190.7 Billion |

2011 | $164.9 Billion |

2010 | $157.4 Billion |

Who's Managing The 529 Plan Assets?

529 Plans are interesting vehicles. They are individually governed by their own states, who in turn outsource the management of the 529 plan to an investment firm. When you see major brokerages like Fidelity or Vanguard offering a 529 plan, they are actually offering a state's 529 plan which they manage. For example, Vanguard runs the Nevada 529 plan, while Fidelity offers several state plans.

However, it's a niche industry, and 90% of 529 plan assets are managed by 10 firms:

- Ascensus

- American Funds

- Fidelity

- TIAA

- US Bank (formerly Union Bank)

- Utah my529

- T. Rowe Price

- BNY Sumday

- American Century

- Ohio Direct

Which Brokerage Uses Which Plan?

Since all 529 plans are state-based, when you open a 529 plan at Vanguard or Fidelity, you're actually using a specific state's plan on the backend. For example, Vanguard uses the Nevada plan.

Here's which state plans the major brokerages use:

- Capital Group - Virginia

- Charles Schwab - Kansas

- Fidelity - Arizona, Connecticut, Delaware, Massachusetts, New Hampshire (main national plan)

- Franklin Templeton - New Jersey

- Goldman Sachs - Arizona

- Morgan Stanley - North Carolina

- Putnam - Nevada

- State Farm - Nebraska

- The Hartford - West Virginia

- T. Rowe Price - Alaska

- USAA - Nevada

- Vanguard - Nevada

- Wealthfront - Nevada

Related Reports: How Much Should You Have In A 529 Plan By Age

How Families Save For College

Beyond 529 plans, there are a variety of ways that families can save for college. These include specific accounts like a 529 college savings plan or Coverdell Education Savings plan, but also other accounts, such as a basic savings account or even a Roth IRA to save for college.

There are also Prepaid College Tuition Plans (such as Florida Prepaid), and the Private 529 Plan, designed to work with private colleges nationwide.

Beyond the 529 plan data, the numbers of plans and types are much less clear because only 529 plans and Coverdells are exclusively used to pay for college.

Average Amount Of Money Saved For College By Age Group

Here is the average amount of money families have saved for college by age group and account type:

Age | 529 Plan | Coverdell ESA | Prepaid College Plan |

|---|---|---|---|

0 - 6 | $9,196 | $506 | $1,656 |

7 - 12 | $14,787 | $6,018 | $3,415 |

13 - 17 | $24,618 | $6,578 | $7,354 |

18 and older | $25,596 | $9,490 | $26,450 |

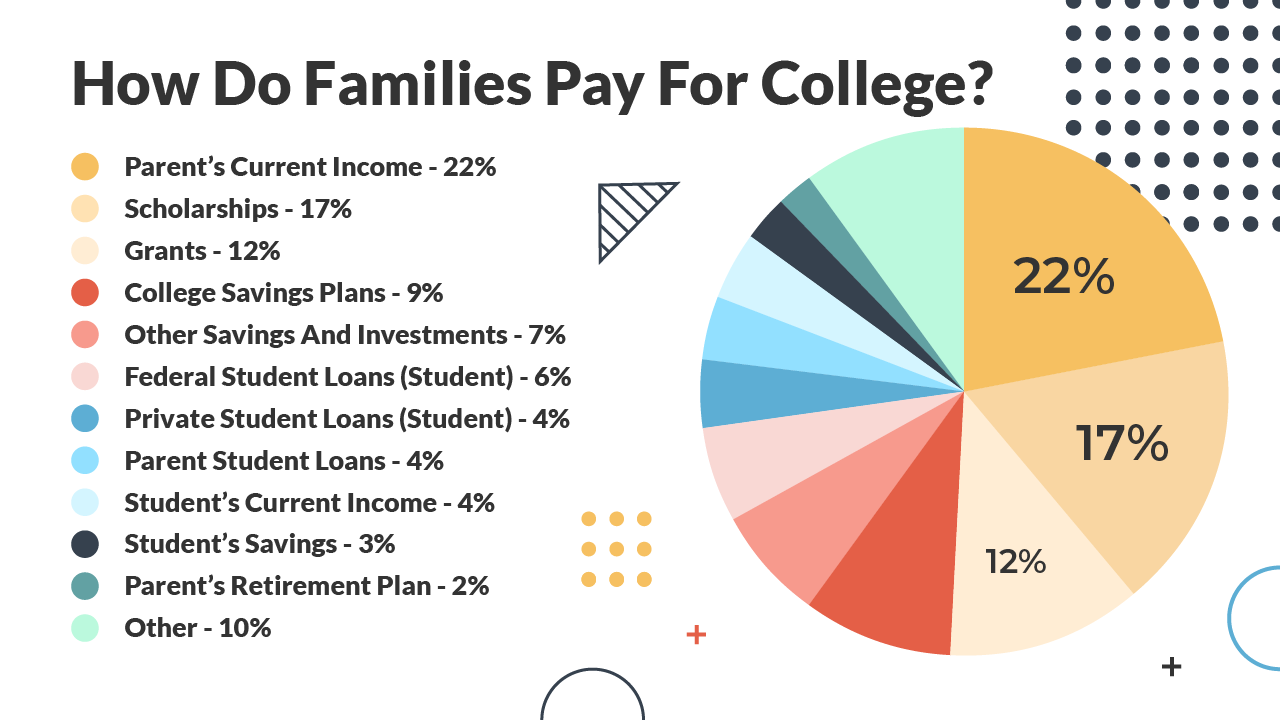

Where Families Find The Money To Pay For College

Paying for college is a "pie" with many slices. Most families don't simply draw funds from a bank account and pay the tuition bill. They are putting together small amounts of money from various places to pay for college.

Here's the average percentage of the total cost of attendance paid by each source:

Geographic Breakdown

Here is the geographic breakdown of 529 plans by state:

5 Largest 529 Plans By Assets

- Virginia CollegeAmerica - $85.7 Billion

- New York 529 College Savings Program - $38.6 Billion

- Nevada The Vanguard 529 Plan - $32.6 Billion*

- Utah My529 - $21.9 Billion

- New Hampshire UNIQUE College Investing Plan - $19.4 Billion

* The Nevada Vanguard Plan is offered nationwide through Vanguard

Find your state below or check out our 529 plan guide by state to learn more about each state plan:

Related Reports: Best 529 Plans Based On Performance

529 ABLE Plan Statistics

ABLE Plans (which stands from Achieving a Better Life Experience) are specially designed tax-advantaged savings and investment accounts that allow Americans with disabilities to save without impacting their means-tested federal benefits.

46 states and Washington D.C. offer ABLE plans, but Americans in all 50 states can join a state plan.

Key 529 ABLE Facts

Here is a breakdown of some key 529 ABLE Facts:

- Total 529ABLE Accounts: 150,600

- Total ABLE Dollars Saved: $1.5 Billion

- Average ABLE Account Balance: $9,954